“Unless specified by your loan type or lender, it’s typically not required to put 20% down.”

If you’re getting ready to buy your first home, you’re likely focused on saving up for everything that purchase involves. One cost that’s likely top of mind is your down payment. But don’t let a common misconception about how much you need to save make the process harder than it could be.

Understand 20% Isn’t Always the Typical Down Payment

Freddie Mac explains:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

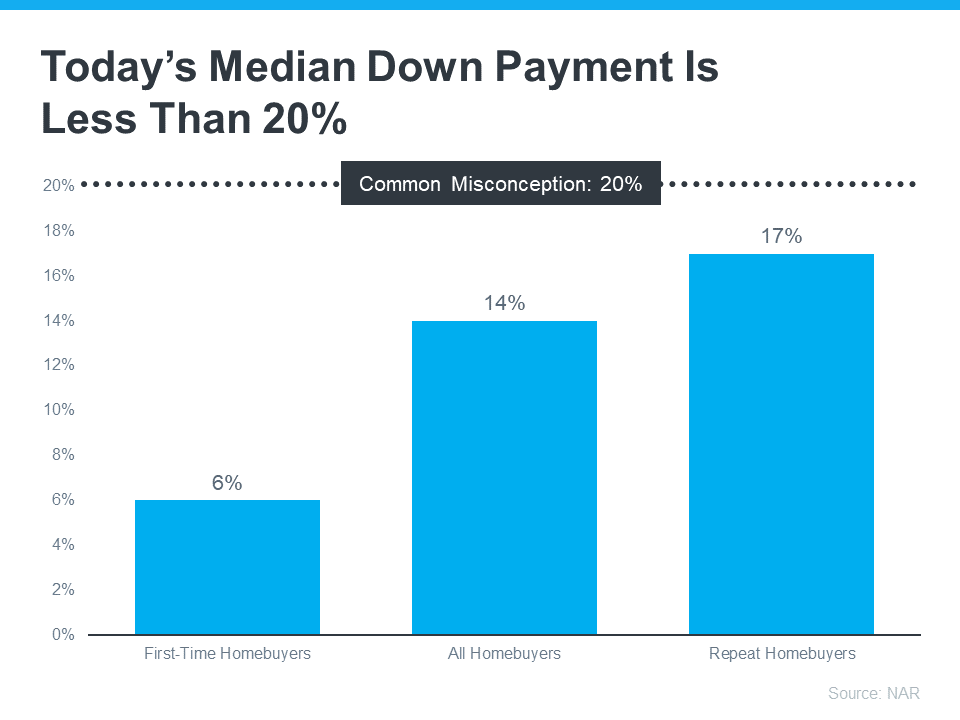

Unless specified by your loan type or lender, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize. According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, the median down payment today is only 14%. And it’s even lower for first-time homebuyers at just 6% (see graph below):

Learn About Options That Can Help You Toward Your Goal

If saving for a down payment still feels like a challenge, know that there’s help available. A real estate professional and trusted lender can show you options that could help you get closer to your down payment goal. According to latest Homeownership Program Index from Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments.

Plus there are even loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants.

To understand your options, be sure to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like Down Payment Resource. Then, partner with a trusted lender to learn what you qualify for on your homebuying journey.

Bottom Line

Remember, a 20% down payment isn’t always required. If you want to purchase a home this year, let’s connect. You’ll also want to make sure you have a trusted lender so you can explore your down payment options.

To view original article, visit Keeping Current Matters.

Why Home Sales Bounce Back After Presidential Elections

As has been the case before, once the election uncertainty passes, buyers and sellers will return to the market.

Why Your House Will Shine in Today’s Market

If you’re thinking about selling, the shortage of homes for sale means your house is likely to get some serious attention from buyers.

How Long Will It Take to Sell Your House?

If you’re looking for ways to make your move happen as quickly as possible, partnering with a great local agent is the key.

Planning To Sell Your House in 2025? Start Prepping Now

By starting your prep work early, you’ll give yourself plenty of time to get your house market-ready by the end of the year.

What To Expect from Mortgage Rates and Home Prices in 2025

With home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers.

Why Did More People Decide To Sell Their Homes Recently?

As rates came down at the end of the summer, more people jumped into the market and decided to make their move.