“Here’s what you should know about today’s home prices.”

The recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here’s what you should know about today’s home prices.

Local price trends still vary by market. But looking at national data, Nataliya Polkovnichenko, Ph.D., Supervisory Economist at the Federal Housing Finance Agency (FHFA), explains:

“U.S. house prices were largely unchanged in the last four months and remained near the peak levels reached over the summer of 2022. While higher mortgage rates have suppressed demand, low inventories of homes for sale have helped maintain relatively flat house prices.”

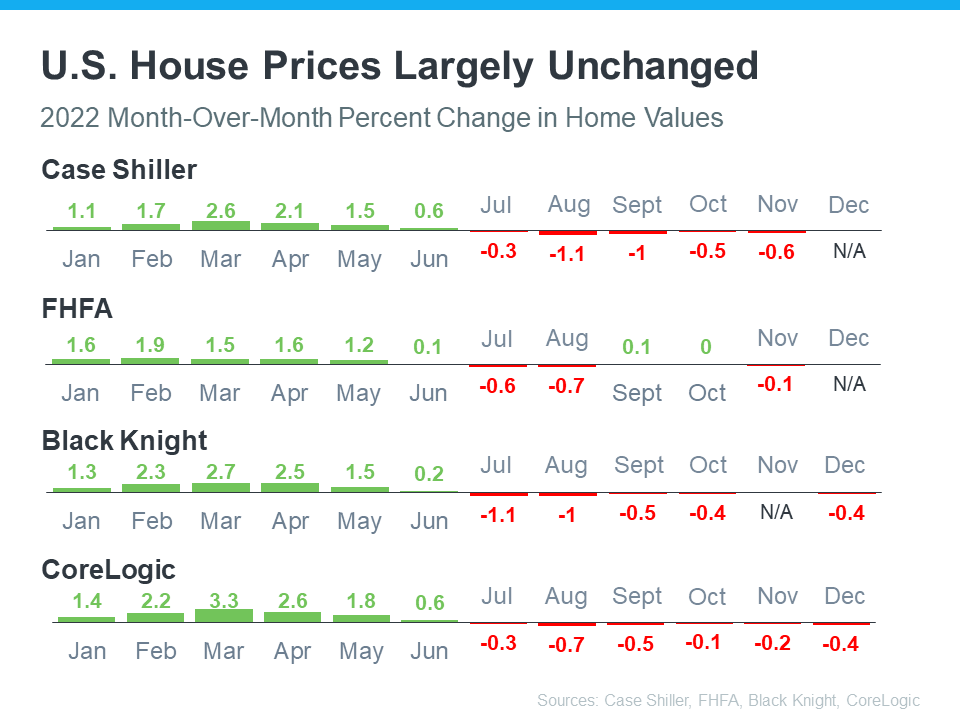

Month-over-month home price changes can be seen in the chart below. The data also shows that price depreciation peaked around August. Since then, any depreciation has been even milder. In other words, today’s home prices aren’t in a freefall.

What Does This Mean for You?

If you currently own your house, you may be concerned about even the smallest decline in prices. But keep in mind how much home values grew over the last few years. Compared to that growth, any declines we’re seeing nationally are likely to be minimal. Selma Hepp, Chief Economist at CoreLogic, shares:

“. . . while prices continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak.”

It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the home prices in your area if you’re planning to make a move this spring.

Bottom Line

To understand what’s going on with home prices in our market and how they could impact your goals, let’s connect today.

To view original article, visit Keeping Current Matters.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.

Should I Move with Today’s Mortgage Rates?

While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

Keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Don’t Let Your Student Loans Delay Your Homeownership Plans

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time.

The Best Week To List Your House Is Almost Here

The third week of April brings the best combination of housing market factors for sellers.