“Here’s what you should know about today’s home prices.”

The recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here’s what you should know about today’s home prices.

Local price trends still vary by market. But looking at national data, Nataliya Polkovnichenko, Ph.D., Supervisory Economist at the Federal Housing Finance Agency (FHFA), explains:

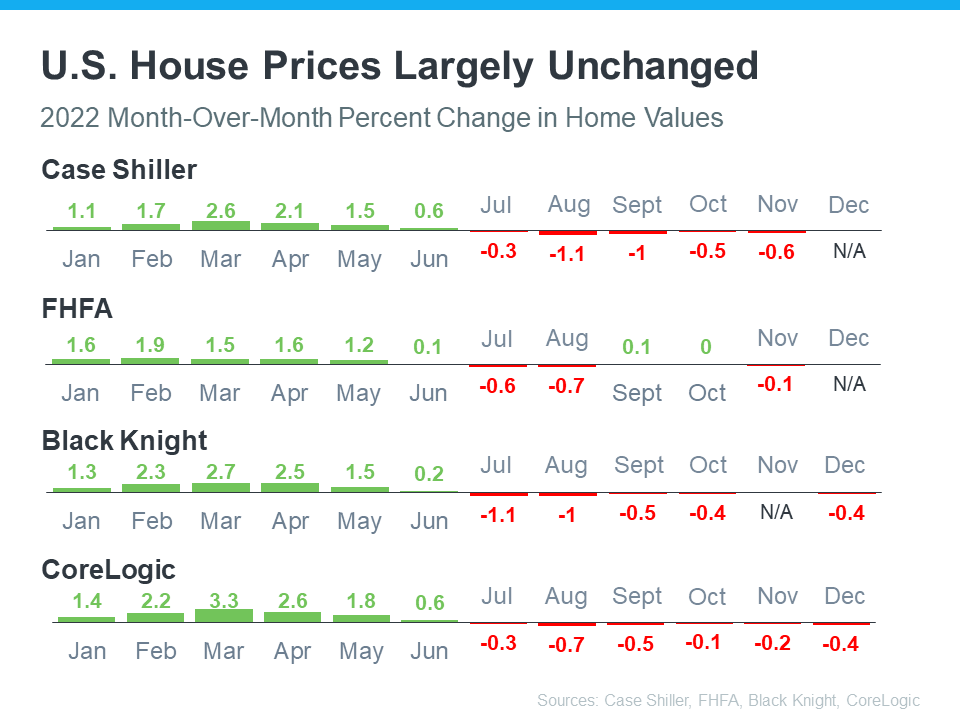

“U.S. house prices were largely unchanged in the last four months and remained near the peak levels reached over the summer of 2022. While higher mortgage rates have suppressed demand, low inventories of homes for sale have helped maintain relatively flat house prices.”

Month-over-month home price changes can be seen in the chart below. The data also shows that price depreciation peaked around August. Since then, any depreciation has been even milder. In other words, today’s home prices aren’t in a freefall.

What Does This Mean for You?

If you currently own your house, you may be concerned about even the smallest decline in prices. But keep in mind how much home values grew over the last few years. Compared to that growth, any declines we’re seeing nationally are likely to be minimal. Selma Hepp, Chief Economist at CoreLogic, shares:

“. . . while prices continued to fall from November, the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak.”

It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the home prices in your area if you’re planning to make a move this spring.

Bottom Line

To understand what’s going on with home prices in our market and how they could impact your goals, let’s connect today.

To view original article, visit Keeping Current Matters.

Expert Housing Market Forecasts for the Second Half of the Year

Housing supply is increasing, but there are still more buyers than there are homes for sale, maintaining the upward pressure on home prices.

The Drop in Mortgage Rates Brings Good News for Homebuyers

A decrease in mortgage rates means an increase in your purchasing power.

Is Homeownership Still the American Dream?

Your home is your stake in the community and a strong financial investment, something you can be proud of.

If You’re Selling Your House This Summer, Hiring a Pro Is Critical

Today’s market is at a turning point, making it more essential than ever to work with a real estate professional.

Two Reasons Why Today’s Housing Market Isn’t a Bubble

Today, there’s still a shortage of inventory, which is causing ongoing home price appreciation.

The Average Homeowner Gained $64K in Equity over the Past Year

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home.