“One of the best ways to jumpstart your savings is by starting with the help of your tax refund.”

If you’re planning to buy a home this year, saving for a down payment is one of the most important steps in the process. One of the best ways to jumpstart your savings is by starting with the help of your tax refund.

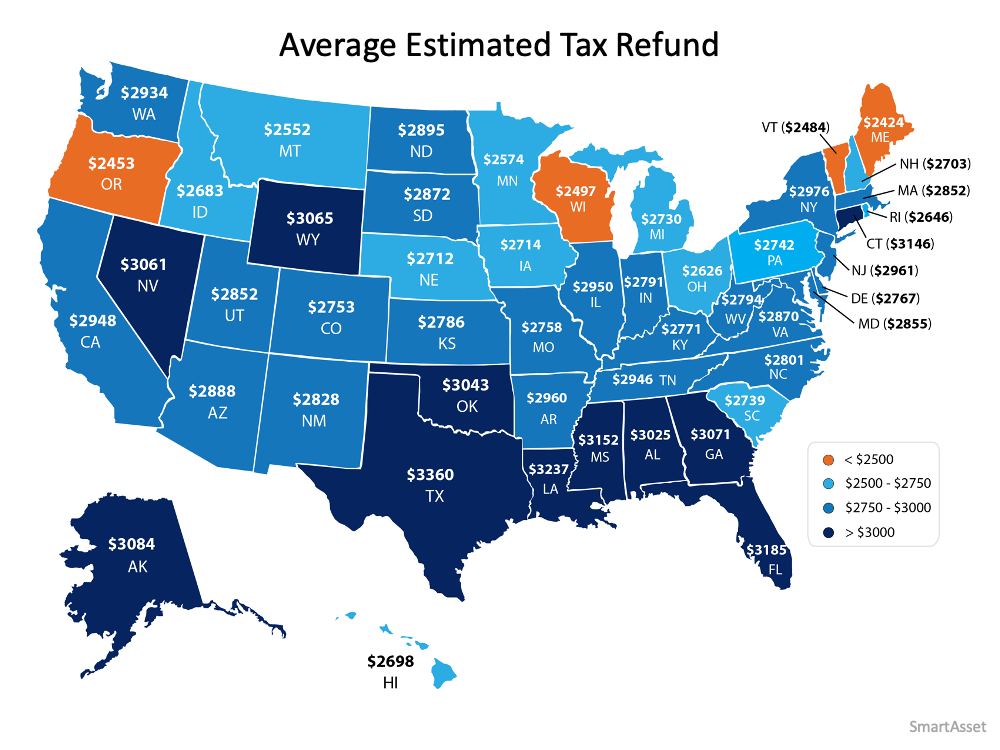

Using data from the Internal Revenue Service (IRS), it’s estimated that Americans can expect an average refund of $2,925 when filing their taxes this year. The map below shows the average anticipated tax refund by state: Thanks to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. In addition, Veterans Affairs Loans allow many veterans to put 0% down. You may have heard the common myth that you need to put 20% down when you buy a home, but thankfully for most homebuyers, a 20% down payment isn’t actually required. It’s important to work with your real estate professional and your lender to understand all of your options.

Thanks to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. In addition, Veterans Affairs Loans allow many veterans to put 0% down. You may have heard the common myth that you need to put 20% down when you buy a home, but thankfully for most homebuyers, a 20% down payment isn’t actually required. It’s important to work with your real estate professional and your lender to understand all of your options.

How can your tax refund help?

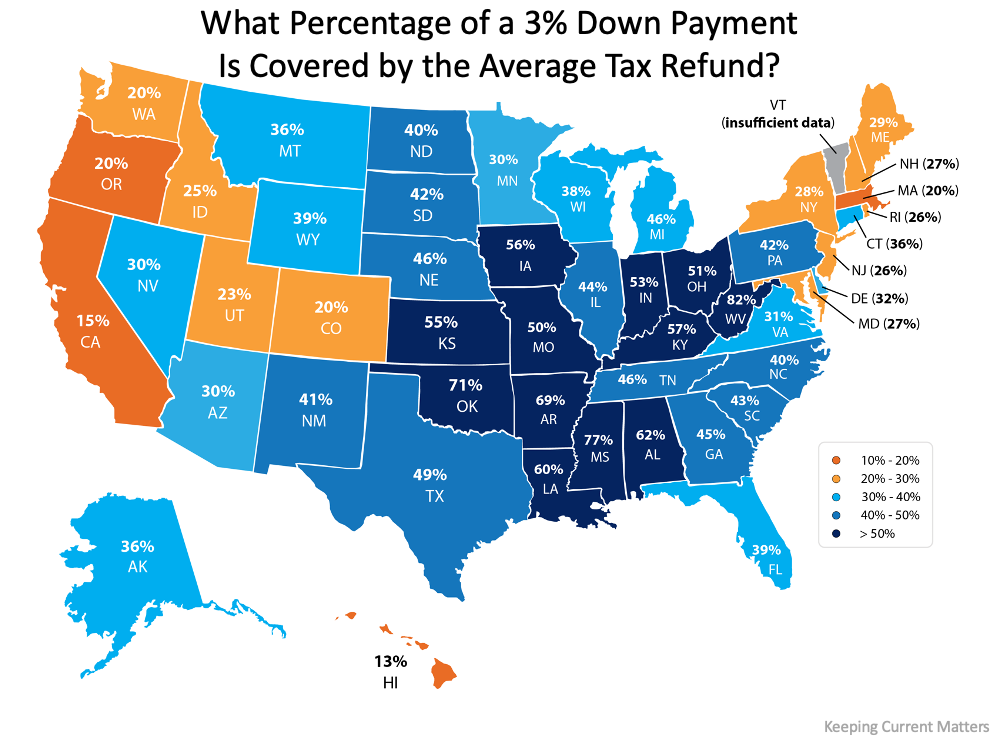

If you’re a first-time buyer, your tax refund may cover more of a down payment than you realize.

If you take into account the median home sale price by state, the map below shows the percentage of a 3% down payment that’s covered by the average anticipated tax refund: The darker the blue, the closer your tax refund gets you to homeownership when you qualify for one of the low down payment programs. Maybe this is the year to plan ahead and put your tax refund toward the down payment on a home.

The darker the blue, the closer your tax refund gets you to homeownership when you qualify for one of the low down payment programs. Maybe this is the year to plan ahead and put your tax refund toward the down payment on a home.

Not enough money from your tax return?

A recent paper from the National Bureau of Economic Research found that, of the households that received a stimulus check last year, “One third report that they primarily saved the stimulus money.” If you had the opportunity to save your Economic Impact Payments, you may consider putting that money toward your down payment or closing costs as well. Your trusted real estate professional can also advise you on the down payment assistance programs available in your area.

Bottom Line

Saving for a down payment can seem like a daunting task, but it doesn’t have to be. This year, your tax refund and your stimulus savings could add up big when it comes to reaching your homeownership goals.

To view original article, visit Keeping Current Matters.

Sellers Have an Opportunity with Today’s Home Prices

If you’re thinking about selling your house, you have a great opportunity to capitalize on today’s home price appreciation.

Work With a Real Estate Professional if You Want the Best Advice

An expert real estate advisor is knowledgeable about market trends and the ins and outs of the homebuying and selling process.

Why Rising Mortgage Rates Push Buyers off the Fence

If you’re on the fence about whether to buy now or wait for a better deal, buying sooner rather than later might be wise.

Are There More Homes Coming to the Market?

Recent data shows more sellers are listing their houses this season, which may give you more options for your home search.

Will Home Prices Fall This Year? Here’s What Experts Say.

Experts say the housing market isn’t set up for a price decline due to that ongoing imbalance between supply and demand.

How Today’s Mortgage Rates Impact Your Home Purchase

If you’re planning to buy a home, it’s critical to understand the relationship between mortgage rates and your purchasing power.