“One of the best ways to jumpstart your savings is by starting with the help of your tax refund.”

If you’re planning to buy a home this year, saving for a down payment is one of the most important steps in the process. One of the best ways to jumpstart your savings is by starting with the help of your tax refund.

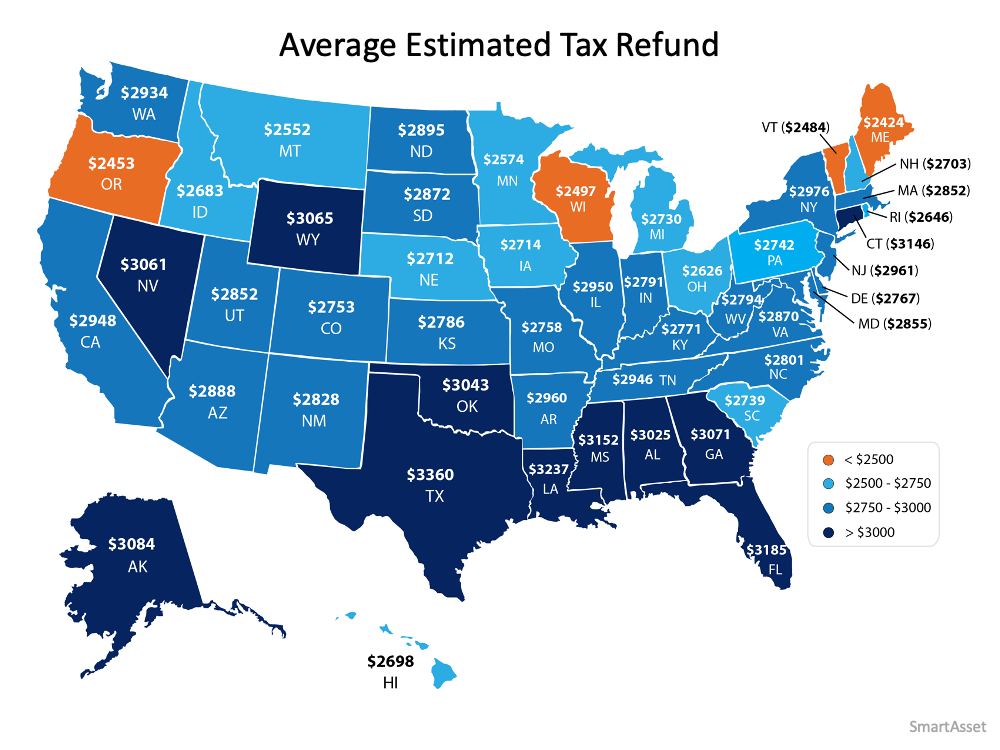

Using data from the Internal Revenue Service (IRS), it’s estimated that Americans can expect an average refund of $2,925 when filing their taxes this year. The map below shows the average anticipated tax refund by state: Thanks to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. In addition, Veterans Affairs Loans allow many veterans to put 0% down. You may have heard the common myth that you need to put 20% down when you buy a home, but thankfully for most homebuyers, a 20% down payment isn’t actually required. It’s important to work with your real estate professional and your lender to understand all of your options.

Thanks to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. In addition, Veterans Affairs Loans allow many veterans to put 0% down. You may have heard the common myth that you need to put 20% down when you buy a home, but thankfully for most homebuyers, a 20% down payment isn’t actually required. It’s important to work with your real estate professional and your lender to understand all of your options.

How can your tax refund help?

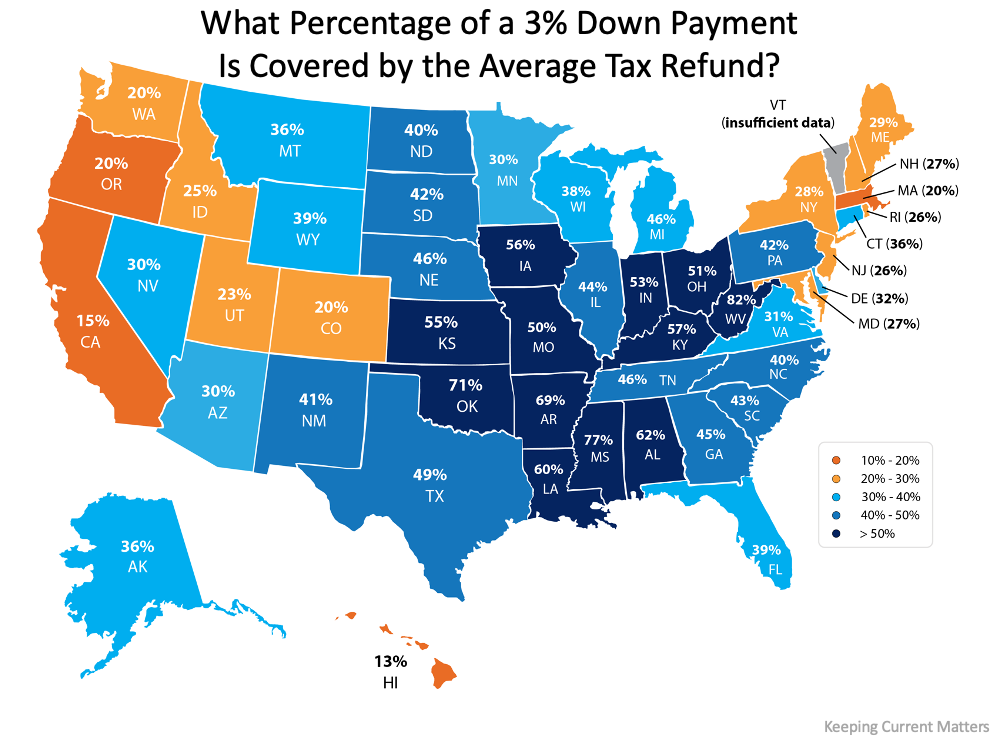

If you’re a first-time buyer, your tax refund may cover more of a down payment than you realize.

If you take into account the median home sale price by state, the map below shows the percentage of a 3% down payment that’s covered by the average anticipated tax refund: The darker the blue, the closer your tax refund gets you to homeownership when you qualify for one of the low down payment programs. Maybe this is the year to plan ahead and put your tax refund toward the down payment on a home.

The darker the blue, the closer your tax refund gets you to homeownership when you qualify for one of the low down payment programs. Maybe this is the year to plan ahead and put your tax refund toward the down payment on a home.

Not enough money from your tax return?

A recent paper from the National Bureau of Economic Research found that, of the households that received a stimulus check last year, “One third report that they primarily saved the stimulus money.” If you had the opportunity to save your Economic Impact Payments, you may consider putting that money toward your down payment or closing costs as well. Your trusted real estate professional can also advise you on the down payment assistance programs available in your area.

Bottom Line

Saving for a down payment can seem like a daunting task, but it doesn’t have to be. This year, your tax refund and your stimulus savings could add up big when it comes to reaching your homeownership goals.

To view original article, visit Keeping Current Matters.

What To Expect from Mortgage Rates and Home Prices in 2025

With home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers.

Why Did More People Decide To Sell Their Homes Recently?

As rates came down at the end of the summer, more people jumped into the market and decided to make their move.

Why an Agent Is Essential When Buying a Newly Built Home

By working with a knowledgeable real estate agent, you can feel confident when buying a newly built home today.

Why Now’s Not the Time To Take Your House Off the Market

By keeping your home on the market, you increase the chances of attracting people who are truly ready to make a purchase.

Now’s the Time to Upgrade to Your Dream Home

A recent survey reveals the top motivator for today’s homebuyers is the desire for more space or an upgraded home.

This Is the Sweet Spot Homebuyers Have Been Waiting For

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible.