“One of the best ways to jumpstart your savings is by starting with the help of your tax refund.”

If you’re planning to buy a home this year, saving for a down payment is one of the most important steps in the process. One of the best ways to jumpstart your savings is by starting with the help of your tax refund.

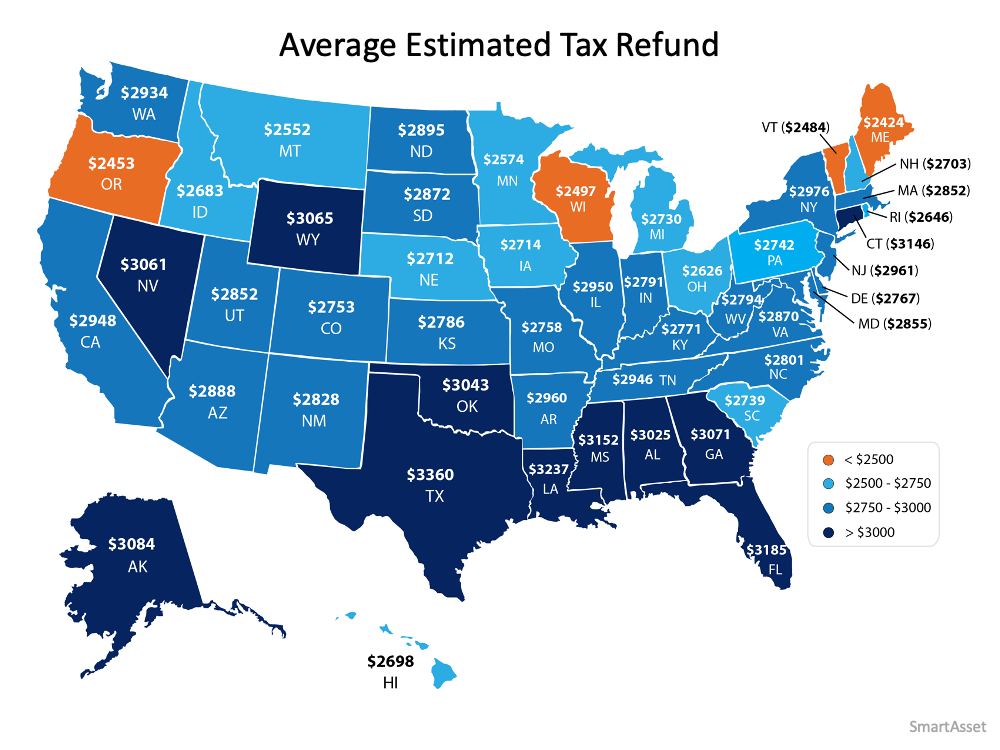

Using data from the Internal Revenue Service (IRS), it’s estimated that Americans can expect an average refund of $2,925 when filing their taxes this year. The map below shows the average anticipated tax refund by state: Thanks to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. In addition, Veterans Affairs Loans allow many veterans to put 0% down. You may have heard the common myth that you need to put 20% down when you buy a home, but thankfully for most homebuyers, a 20% down payment isn’t actually required. It’s important to work with your real estate professional and your lender to understand all of your options.

Thanks to programs from the Federal Housing Authority, Freddie Mac, and Fannie Mae, many first-time buyers can purchase a home with as little as 3% down. In addition, Veterans Affairs Loans allow many veterans to put 0% down. You may have heard the common myth that you need to put 20% down when you buy a home, but thankfully for most homebuyers, a 20% down payment isn’t actually required. It’s important to work with your real estate professional and your lender to understand all of your options.

How can your tax refund help?

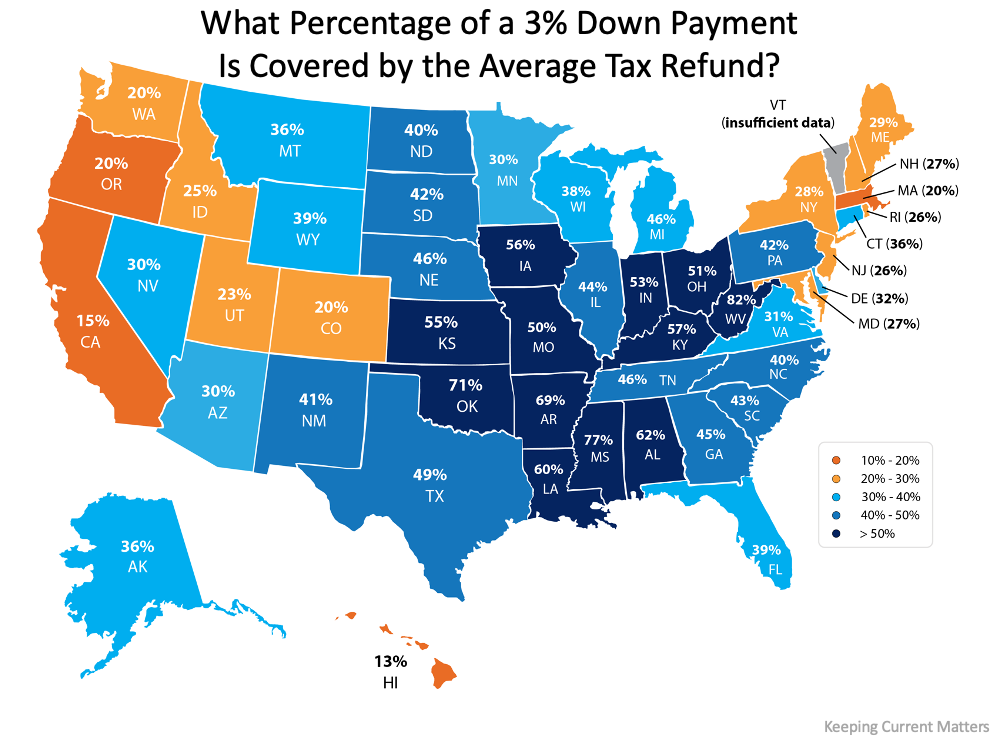

If you’re a first-time buyer, your tax refund may cover more of a down payment than you realize.

If you take into account the median home sale price by state, the map below shows the percentage of a 3% down payment that’s covered by the average anticipated tax refund: The darker the blue, the closer your tax refund gets you to homeownership when you qualify for one of the low down payment programs. Maybe this is the year to plan ahead and put your tax refund toward the down payment on a home.

The darker the blue, the closer your tax refund gets you to homeownership when you qualify for one of the low down payment programs. Maybe this is the year to plan ahead and put your tax refund toward the down payment on a home.

Not enough money from your tax return?

A recent paper from the National Bureau of Economic Research found that, of the households that received a stimulus check last year, “One third report that they primarily saved the stimulus money.” If you had the opportunity to save your Economic Impact Payments, you may consider putting that money toward your down payment or closing costs as well. Your trusted real estate professional can also advise you on the down payment assistance programs available in your area.

Bottom Line

Saving for a down payment can seem like a daunting task, but it doesn’t have to be. This year, your tax refund and your stimulus savings could add up big when it comes to reaching your homeownership goals.

To view original article, visit Keeping Current Matters.

Millennials: Is It Time to Buy a Bigger Home?

Growing equity can be the driver you’re looking for to fund your next move, especially if what you need in a home is changing right now.

3 Ways You’ll Win When You Buy a Home This Year

There are so many great reasons to purchase a home, and over the past year, we’ve realized more of them than we ever thought possible.

Reasons to Hire a Real Estate Professional [INFOGRAPHIC]

The right agent can explain current market conditions and break down exactly what they mean for you.

The Luxury Market Is Attracting Buyers in 2021

It appears that some higher-priced markets may have more homes to choose from than those at lower price points.

3 Reasons We’re Definitely Not in a Housing Bubble

Housing supply is at a historic low. Demand is real. Homeowners have enough equity to be able to weather a dip in home values.

6 Foundational Benefits of Homeownership Today

As we think about the future and what we want to achieve beyond 2021, it’s a great time to look at the benefits of owning a home.

![Reasons to Hire a Real Estate Professional [INFOGRAPHIC]](https://brookhampton.com/wp-content/uploads/2021/02/20210108-MEM-1046x1665-1-400x250.png)