“Many first-time buyers still believe they need a 20% down payment to buy a home in today’s market.”

According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market:

“More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.”

When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think they’ll have to wait several years (in some markets) to come up with the necessary funds to buy their dream homes. The report continues to say,

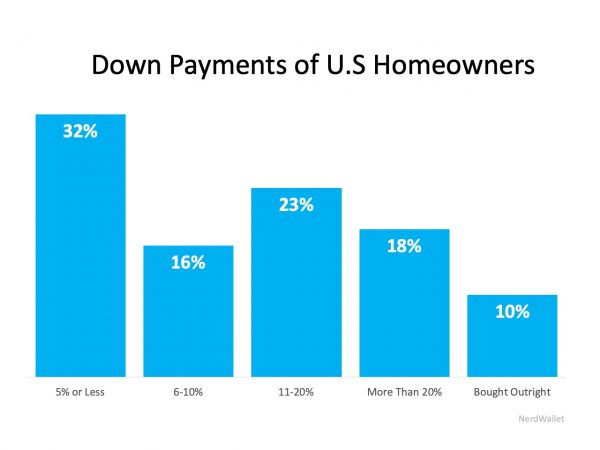

“The truth: 32% of current U.S. homeowners put 5% or less down on their home, according to census data.” (as shown below):

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

Bottom Line

Don’t let a lack of understanding keep you and your family out of the housing market. Let’s get together to discuss your options today.

To view original article, visit Keeping Current Matters.

What Homebuyers Need To Know About Credit Scores

Your credit score is one of the most important factors lenders consider when you apply for a mortgage.

Why the Median Home Price Is Meaningless in Today’s Market

Using the median home price as a gauge of what’s happening with home values isn’t worthwhile right now.

Saving for a Down Payment? Here’s What You Need To Know.

One of the biggest misconceptions among housing consumers is what the typical down payment is.

Why Buying or Selling a Home Helps the Economy and Your Community

If you’re thinking about buying or selling a house, it’s important to know that it doesn’t just affect your life, but also your community.

Your Needs Matter More Than Today’s Mortgage Rates

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed.

Are Home Prices Going Up or Down? That Depends…

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year.