Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

To view original article, visit Keeping Current Matters.

Should We Be Showing Homes Right Now?

The Coronavirus pandemic has changed the world. With all that we are hearing , should we be showing homes right now?

Economic Slowdown: What the Experts Are Saying

More and more economists are predicting a recession is imminent as the result of the pullback in the economy caused by COVID-19.

Three Reasons Why This Is Not a Housing Crisis

In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data.

5 Simple Graphs Proving This Is NOT Like the Last Time

There are many reasons indicating this real estate market is nothing like 2008. Take a look at 5 graphs that show the dramatic differences.

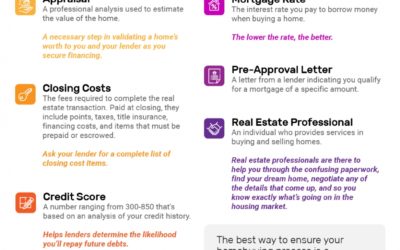

Buying a Home: Do You Know the Lingo?

To point you in the right direction, here’s a list of some of the most common language you’ll hear throughout the home buying process.

Yes, You Can Still Afford a Home

Since wages have increased and mortgage rates have dropped to historically low levels, this is a great time to buy your first home or move up to the home of your dreams.

Confidence is the Key to Success for Young Home Buyers

For those in younger generations who aspire to buy, here are three things to consider sooner rather than later…

Equity Gain Growing in Nearly Every State

Today, the number of homeowners that currently have significant equity in their homes is growing. This year may be your year to sell!

New Homes Coming to the Housing Market This Year

New inventory means more options. More inventory means more competition. What does all this mean to you?

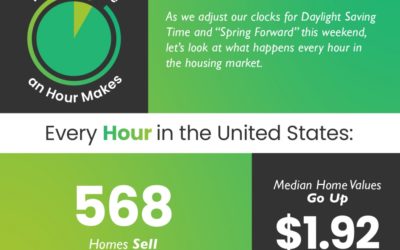

The Difference an Hour Makes

Don’t forget to set your clocks forward this Sunday, March 8 at 2:00 AM EST in observance of Daylight Saving Time, unless you’re a resident of Arizona or Hawaii!