“Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.”

The link between financial security and homeownership is especially important today as inflation rises. But many people may not realize just how much owning a home contributes to your overall net worth. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), says:

“Homeownership is rewarding in so many ways and can serve as a vital component in achieving financial stability.”

Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.

Owning a Home Is a Building Block for Financial Success

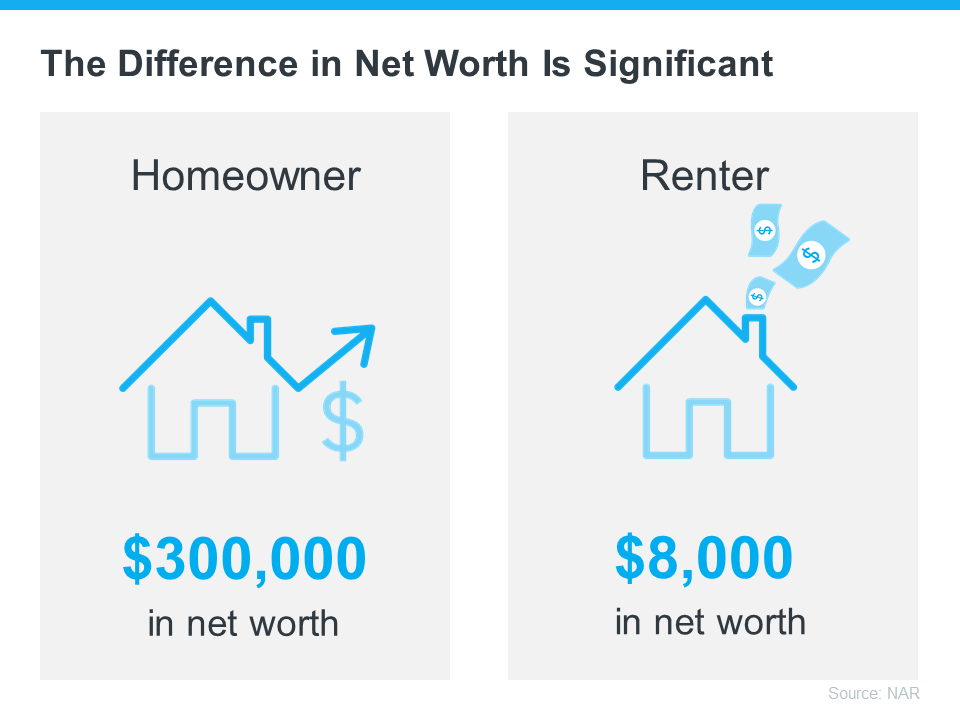

A recent NAR report details several homeownership trends and statistics, including the difference in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renter (see visual below):

The results from this report show that owning a home is a key piece to the puzzle when building your overall net worth.

Equity Gains Can Substantially Boost a Homeowner’s Net Worth

The net worth gap between owners and renters exists in large part because homeowners build equity. As a homeowner, your equity grows as your home appreciates in value and you make your mortgage payments each month.

In other words, when you own your home, you have the benefit of your mortgage payment acting as a contribution to a forced savings account. And when you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month.

To sum it up, NAR says it simply:

“Homeownership has always been an important way to build wealth.”

Bottom Line

The gap between a homeowner’s net worth and a renter’s shows how truly foundational homeownership is to wealth-building. If you’re ready to start on your journey to homeownership, let’s connect today.

To view original article, visit Keeping Current Matters.

What’s Ahead for Home Prices in 2023

The decision to purchase a home is best made when you do it knowing all the facts and have an expert on your side. Call today to speak to one of our expert real estate agents.

What Buyer Activity Tells Us About the Housing Market

January’s home showings are a positive sign that buyers are getting back out there.

An Expert Gives You Clarity in Today’s Housing Market

The right agent can help you understand what’s happening at the national and local levels.

Leverage Your Equity When You Sell Your House

Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash.

4 Tips for Making Your Best Offer on a Home

When putting together an offer, your trusted real estate advisor will help you think through what levers to pull.

Could a Multigenerational Home Be the Right Fit for You?

Multi-generational home buying is a way for families to often buy a home that may have been previously out of reach.