Bubble Alert! Is it Getting Too Easy to Get a Mortgage?

There is little doubt that it is easier to get a home mortgage today than it was last year. The Mortgage Credit Availability Index (MCAI), published by the Mortgage Bankers Association, shows that mortgage credit has become more available in each of the last several years. In fact, in June the last year:

-

More buyers are putting less than 20% down to purchase a home

-

The average credit score on closed mortgages is lower

-

More low-down-payment programs have been introduced

This has some people worrying that we are returning to the lax lending standards which led to the boom and bust that real estate experienced ten years ago. Let’s alleviate some of that concern.

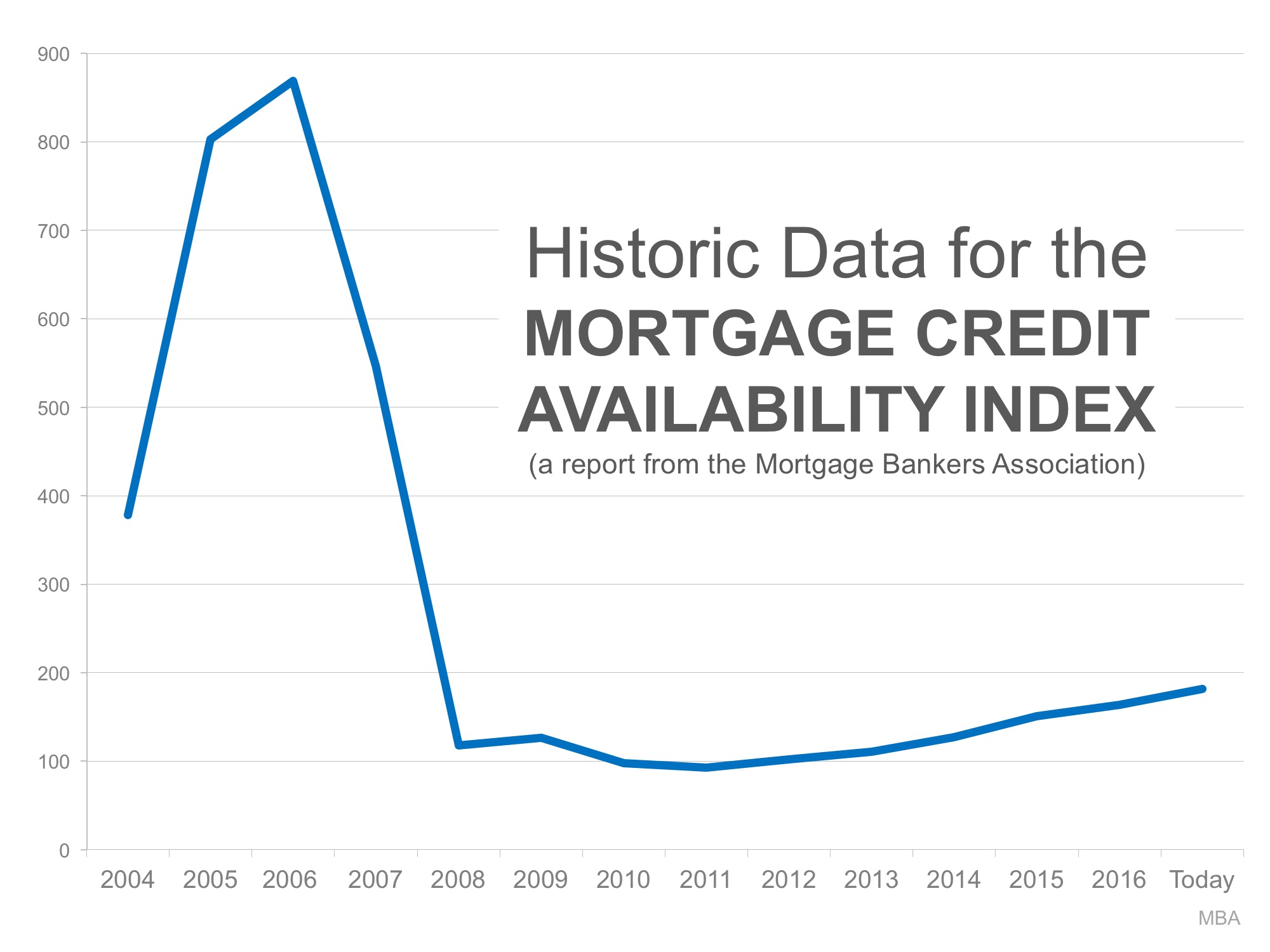

The graph below shows the MCAI going back to the boom years of 2004-2005. The higher the graph line, the easier it was to get a mortgage.

As you can see, lending standards were much more lenient from 2004 to 2007. Though it has gradually become easier to get a mortgage since 2011, we are nowhere near the lenient standards during the boom.

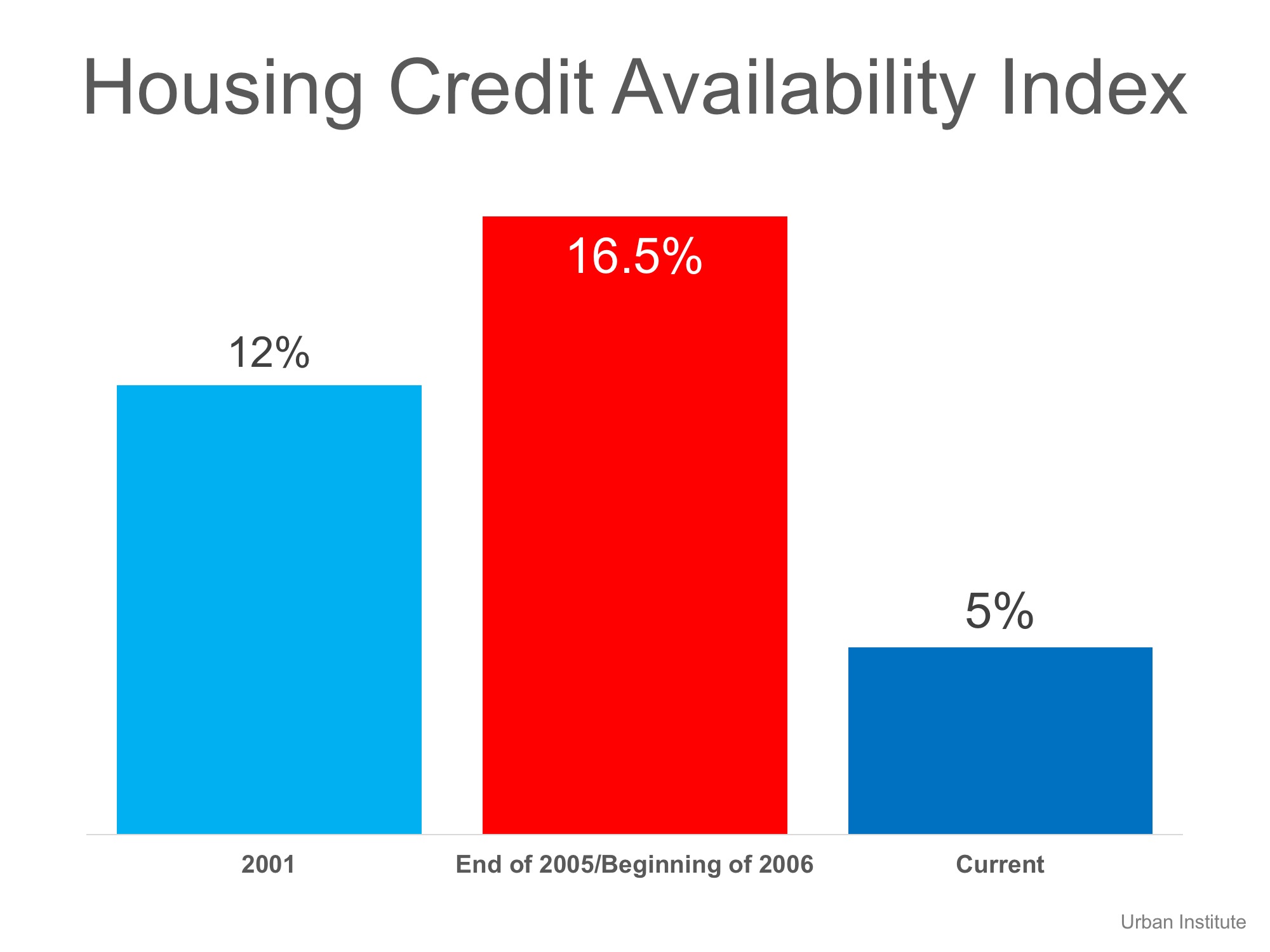

The Urban Institute also publishes a Home Credit Availability Index (HCAI). According to the institute, the HCAI:

“Measures the percentage of home purchase loans that are likely to default – that is, go unpaid for more than 90 days past their due date. A lower HCAI Indicated that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates…it is easier to get a loan.”

Here is a graph showing their findings:

Again, today’s lending standards are nowhere near the levels of the boom years. As a matter of fact, they are more stringent than they were even before the boom.

Bottom Line

It is getting easier to gain financing for a home purchase. However, we are not seeing the irresponsible lending that caused the housing crisis.

To view original article, please visit Keeping Current Matters.

The #1 Thing You Can Do to Position Yourself to Buy a Home This Year

Pre-approval is the best thing you can do right now to be in a stronger position to buy a home. Let’s connect today to get the process started.

The Economic Impact of Buying a Home

While we all wait patiently for the current pandemic to pass, there are a lot of things you can do in the meantime to keep your home search on track.

The Best Advice Does Not Mean Perfect Advice

If you’re thinking of buying or selling, contact a local real estate professional to make sure you get the best advice possible.

What You Can Do to Keep Your Dream of Homeownership Moving Forward

There are things you can do right now, from your home, to keep moving forward with your home search.

Should We Be Showing Homes Right Now?

The Coronavirus pandemic has changed the world. With all that we are hearing , should we be showing homes right now?

Economic Slowdown: What the Experts Are Saying

More and more economists are predicting a recession is imminent as the result of the pullback in the economy caused by COVID-19.

Three Reasons Why This Is Not a Housing Crisis

In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data.

5 Simple Graphs Proving This Is NOT Like the Last Time

There are many reasons indicating this real estate market is nothing like 2008. Take a look at 5 graphs that show the dramatic differences.

Buying a Home: Do You Know the Lingo?

To point you in the right direction, here’s a list of some of the most common language you’ll hear throughout the home buying process.

Yes, You Can Still Afford a Home

Since wages have increased and mortgage rates have dropped to historically low levels, this is a great time to buy your first home or move up to the home of your dreams.