What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

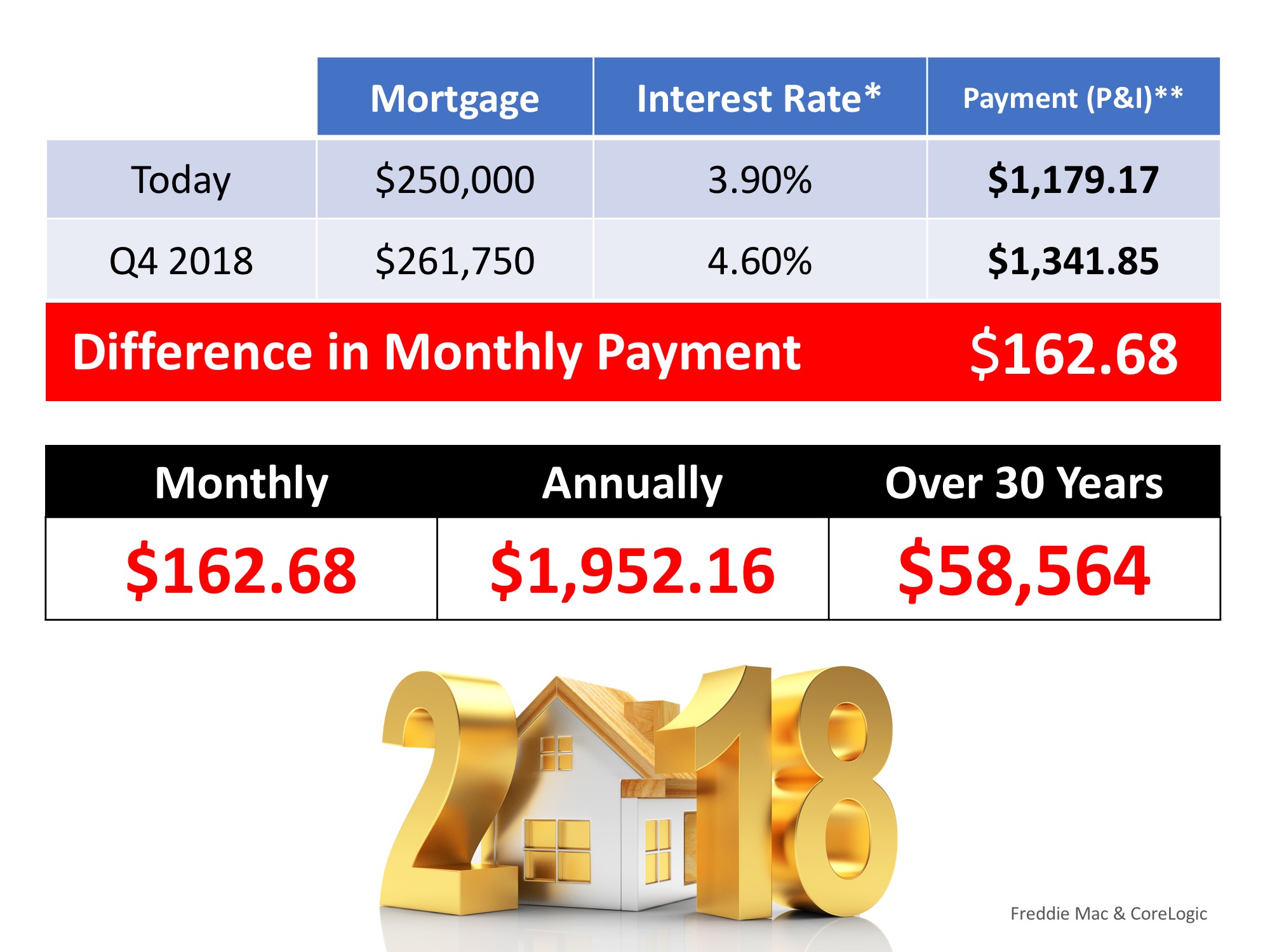

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

The #1 Thing You Can Do to Position Yourself to Buy a Home This Year

Pre-approval is the best thing you can do right now to be in a stronger position to buy a home. Let’s connect today to get the process started.

The Economic Impact of Buying a Home

While we all wait patiently for the current pandemic to pass, there are a lot of things you can do in the meantime to keep your home search on track.

The Best Advice Does Not Mean Perfect Advice

If you’re thinking of buying or selling, contact a local real estate professional to make sure you get the best advice possible.

What You Can Do to Keep Your Dream of Homeownership Moving Forward

There are things you can do right now, from your home, to keep moving forward with your home search.

Should We Be Showing Homes Right Now?

The Coronavirus pandemic has changed the world. With all that we are hearing , should we be showing homes right now?

Economic Slowdown: What the Experts Are Saying

More and more economists are predicting a recession is imminent as the result of the pullback in the economy caused by COVID-19.

Three Reasons Why This Is Not a Housing Crisis

In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data.

5 Simple Graphs Proving This Is NOT Like the Last Time

There are many reasons indicating this real estate market is nothing like 2008. Take a look at 5 graphs that show the dramatic differences.

Buying a Home: Do You Know the Lingo?

To point you in the right direction, here’s a list of some of the most common language you’ll hear throughout the home buying process.

Yes, You Can Still Afford a Home

Since wages have increased and mortgage rates have dropped to historically low levels, this is a great time to buy your first home or move up to the home of your dreams.