What is the Cost of Waiting Until Next Year to Buy?

We recently shared that over the course of the last 12 months, home prices have appreciated by 7.0%. Over the same amount of time, interest rates have remained historically low which has allowed many buyers to enter the market.

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

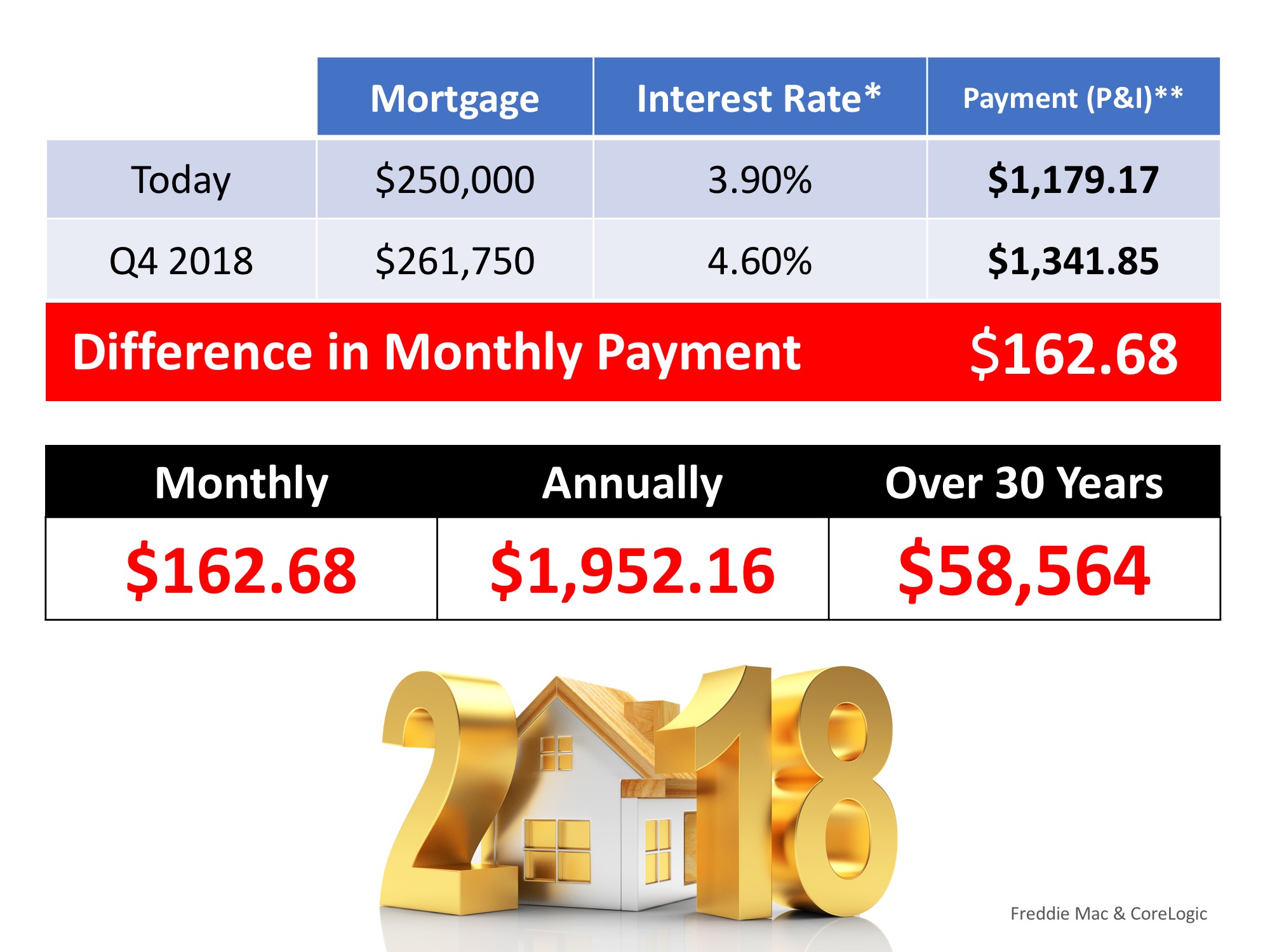

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Index Report, home prices will appreciate by 4.7% over the next 12 months.

What Does This mean as a Buyer?

If home prices appreciate by 4.7% over the next twelve months as predicted by CoreLogic, here is a simple demonstration of the impact that an increase in interest rate would have on the mortgage payment of a home selling for approximately $250,000 today:

Bottom Line

If buying a home is in your plan for 2018, doing it sooner rather than later could save you thousands of dollars over the terms of your loan.

To view original article, please visit Keeping Current Matters.

Homeownership Rate on the Rise to a 6-Year High

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high.

How Pricing Your Home Right Makes a Big Difference

Pricing your home correctly will increase the visibility of your listing and drive more buyers your way.

The Top States Americans Moved To Last Year

Idaho held on to the top spot of ‘high inbound’ states for the second time since 2017, followed by Washington State.

Great News for Renters Who Want to Buy a Home

Rental expenses are beginning to moderate and average wages are increasing, allowing renters to save towards a down payment.

Does “Aging in Place” Make the Most Sense?

Making a move to a smaller home in the neighborhood might make the most sense.

How to Avoid a Gender Gap When Investing in the Housing Market

Our agents are ready to make sure that you’re prepped and ready to enter the housing market, regardless of gender.

3 Reasons Why Pre-Approval Is the First Step in the Homebuying Journey

Our agents at BrookHampton Realty have relationships with lenders who can help you through the pre-approval process.

5 Reasons Homeowners Throw Better Parties During the Big Game

There’s more room to entertain a big crowd.

The kitchen is big enough to whip up endless appetizers – yum!

Strength of the Economy Is Surprising the Experts

There probably won’t be a recession this year. That’s good news for you, whether you’re looking to buy or sell a home.

Where Have All the Houses Disappeared To?

The supply of homes for sale is at a historic low. Buyer demand is surprisingly strong. Now would be a great time to sell.