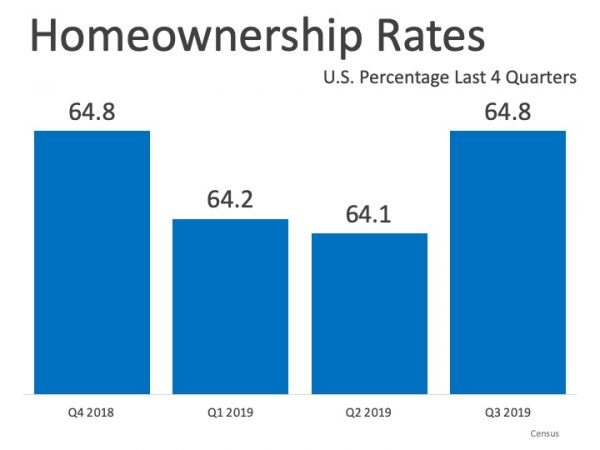

“U.S. homeownership rose again in the 3rd quarter. “

In the third quarter of 2019, the U.S. homeownership rate rose again, signaling another strong indicator of the current housing market.

The U.S. Census Bureau announced,

“The homeownership rate of 64.8 percent was not statistically different from the rate in the third quarter 2018 (64.4 percent), but was 0.7 percentage points higher than the rate in the second quarter 2019 (64.1 percent).”

Today there is still a lack of inventory, particularly at the entry and middle-level segments of the market, but that is not stopping buyers from making every effort to pursue homeownership. The many financial and non-financial benefits continue to drive the American Dream and will likely do so for generations to come.

Today there is still a lack of inventory, particularly at the entry and middle-level segments of the market, but that is not stopping buyers from making every effort to pursue homeownership. The many financial and non-financial benefits continue to drive the American Dream and will likely do so for generations to come.

Bottom Line

If you’re thinking of buying a home, let’s get together to make your dream a reality.

To view original article, visit Keeping Current Matters.

What Homebuyers Need To Know About Credit Scores

Your credit score is one of the most important factors lenders consider when you apply for a mortgage.

Why the Median Home Price Is Meaningless in Today’s Market

Using the median home price as a gauge of what’s happening with home values isn’t worthwhile right now.

Saving for a Down Payment? Here’s What You Need To Know.

One of the biggest misconceptions among housing consumers is what the typical down payment is.

Why Buying or Selling a Home Helps the Economy and Your Community

If you’re thinking about buying or selling a house, it’s important to know that it doesn’t just affect your life, but also your community.

Your Needs Matter More Than Today’s Mortgage Rates

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed.

Are Home Prices Going Up or Down? That Depends…

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year.