Homeownership: “The Reports of My Death Have Been Greatly Exaggerated.”

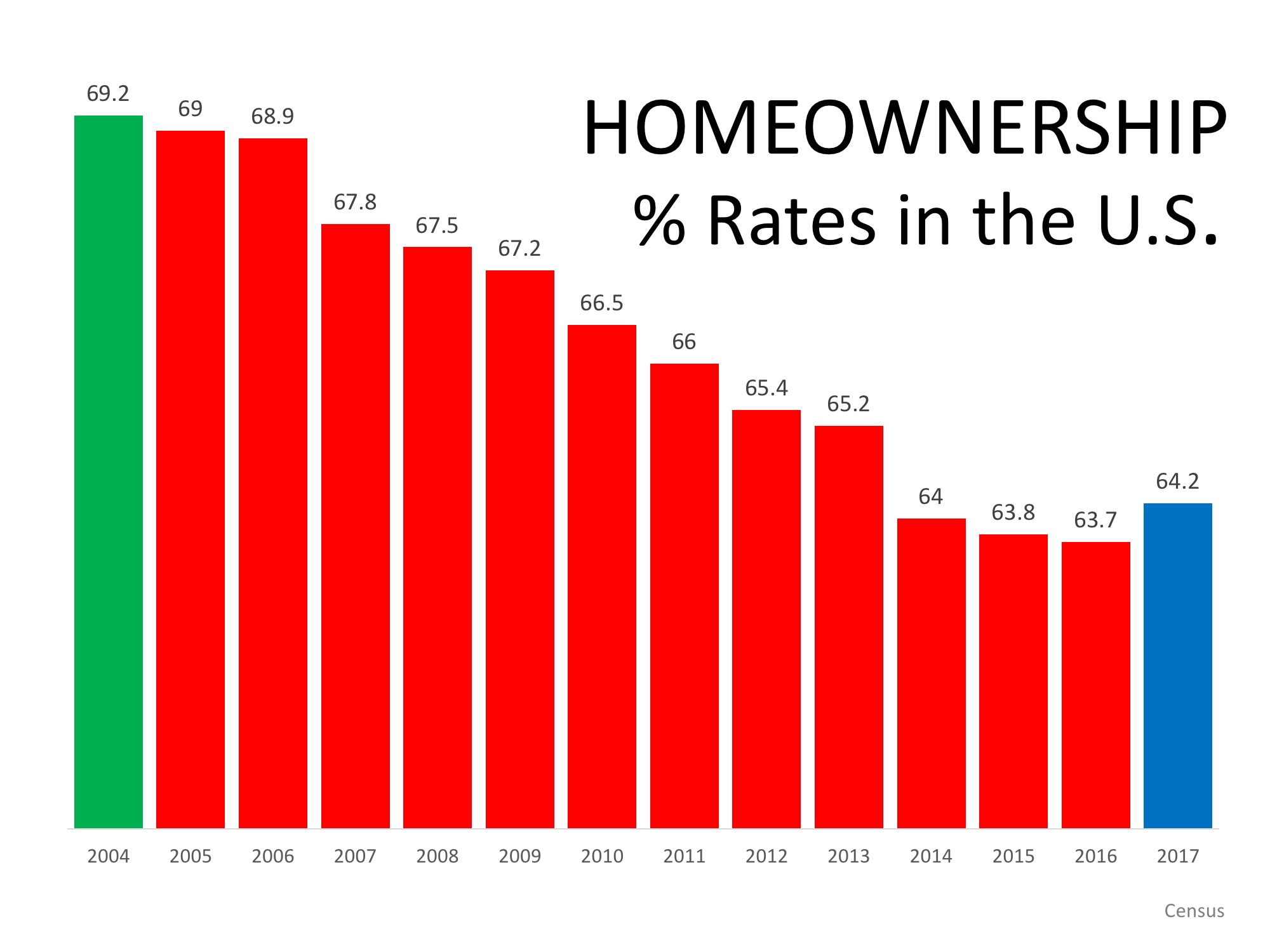

The famous quote by Mark Twain in the title of this article can be used to describe homeownership in America today. Last week, the Census revealed that the percentage of homeowners in the country increased for the first time in thirteen years.

A story in the Wall Street Journal gave these new homeownership numbers some context:

“The annual increase marks a crucial turning point because it comes after the federal government reined in bubble-era policies that encouraged banks to ease lending standards to boost homeownership. This time, what’s driving the market is a shift in favor of owning rather than renting.

‘This is market, market and market…There’s no government incentive program in sight that is having this effect,’ said Susan Wachter, a professor of real estate and finance at the Wharton School at the University of Pennsylvania, ‘This is back to basics.’”

In a separate report comparing the rental population in America to the homeowner population, RentCafé also concluded that the gap is now shrinking.

“Undoubtedly, the recession had a great impact on homeownership…However, it looks like it takes more to discourage Americans from buying a house than that.

As the years go by, it seems more and more certain that the fact that renting has seen a sudden gain in popularity is more a reaction to the economic crisis than a paradigm shift in the Americans’ attitude toward housing.”

America’s belief in homeownership was also evidenced in a recent survey by Pew Research. They asked consumers “How important is homeownership to achieving the American Dream?”

The results:

- 43% said homeownership was essential to the American Dream

- 48% said homeownership was important to the American Dream

- Only 9% said it was not importantBottom Line: Homeownership has been, is and will always be a crucial element of the American Dream.

The True Cost of Selling Your House on Your Own

When it comes to selling your most valuable asset, consider the invaluable support that a real estate agent can provide.

What Homebuyers Need To Know About Credit Scores

Your credit score is one of the most important factors lenders consider when you apply for a mortgage.

Why the Median Home Price Is Meaningless in Today’s Market

Using the median home price as a gauge of what’s happening with home values isn’t worthwhile right now.

Saving for a Down Payment? Here’s What You Need To Know.

One of the biggest misconceptions among housing consumers is what the typical down payment is.

Why Buying or Selling a Home Helps the Economy and Your Community

If you’re thinking about buying or selling a house, it’s important to know that it doesn’t just affect your life, but also your community.

Your Needs Matter More Than Today’s Mortgage Rates

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed.

Are Home Prices Going Up or Down? That Depends…

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year.

This Real Estate Market Is the Strongest of Our Lifetime

This is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime.

Real Estate Is Still Considered the Best Long-Term Investment

Real estate was voted the best long-term investment for the 11th consecutive year, beating gold, stocks, and bonds.

Oops! Home Prices Didn’t Crash After All

Home prices didn’t come crashing down and may already rebounding from the minimal depreciation experienced over the last few months.