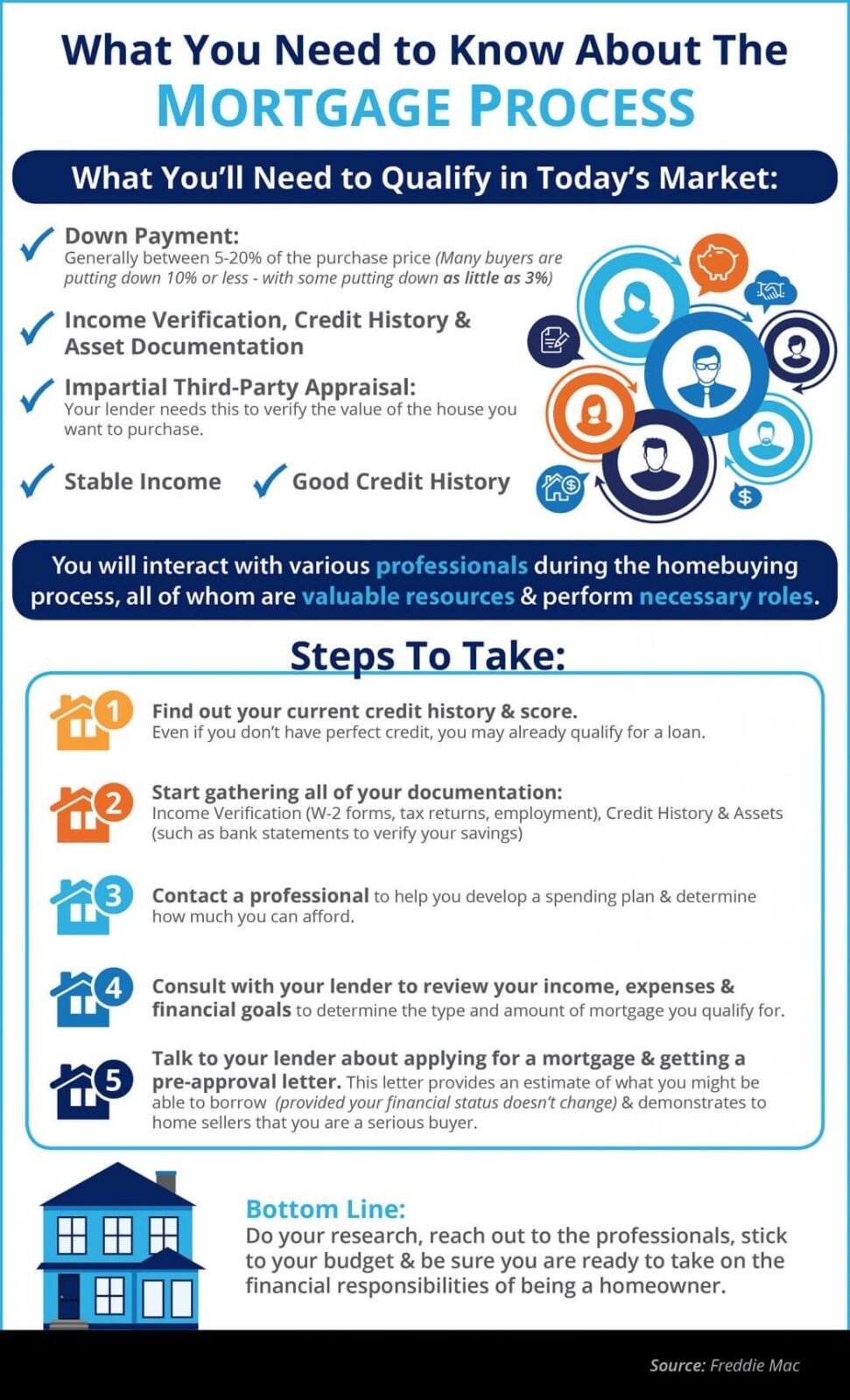

The Mortgage Process: What You Need to Know

Some Highlights:

-

Many buyers are purchasing a home with a down payment as little as 3%.

-

You may already qualify for a loan, even if you don’t have perfect credit.

-

Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

To see original article please visit Keeping Current Matters.

Is Renting Right for Me?

With rent costs rising annually and many helpful down payment assistance programs available, homeownership may be closer than you realize.

The Cost of Waiting: Interest Rates Edition

Rates are still low right now – don’t wait until they hit 5% to start searching for your dream home!

What a Difference a Year Makes for Sellers

What a difference we’ve seen over the course of this year! If you’re thinking of selling, now is the time as inventory is on the rise.

The Surprising Profile of the Real Estate Investor

If you are investing in real estate as either a landlord or someone who fixes-up and flips the house, let’s chat.

Should I Refinance My Home?

With recent lower interest rates, many homeowners are wondering if they should refinance their home. Are you? Start by asking yourself these 3 questions.

Home Price Appreciation Forecast

Questions continue to come up about where home prices will head throughout the rest of this year. We have projections from the industry’s leading experts!!

How Long Until Sellers Seriously Consider a Price Cut?

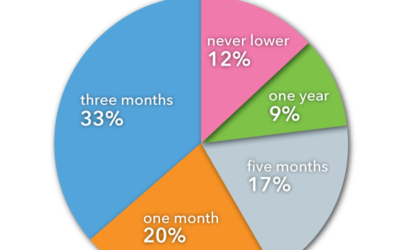

A lingering listing with no takers … how long does it take until the home seller is willing to accept that a price reduction is needed?

Just Listed! 1 Newpoint Lane, East Moriches

Spacious 4 bedroom, 2.5 bath colonial in Newport Beach with deeded beach and boating rights! Call us today to schedule a showing!

How to Know if a Home Buyer is Serious

Not sure how to tell if a homebuyer is serious about purchasing your home? Fortunately, there are usually quite a few clues that can help you gauge a home buyer’s interest and intent.

Is Your First Home Now Within Your Grasp?

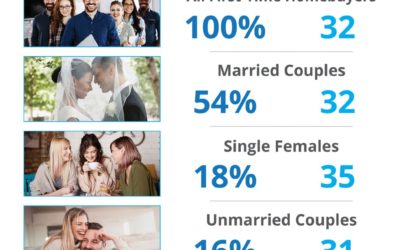

For the longest time, many experts doubted whether Millennials (ages 18-36) valued homeownership as part of their American Dream.