No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

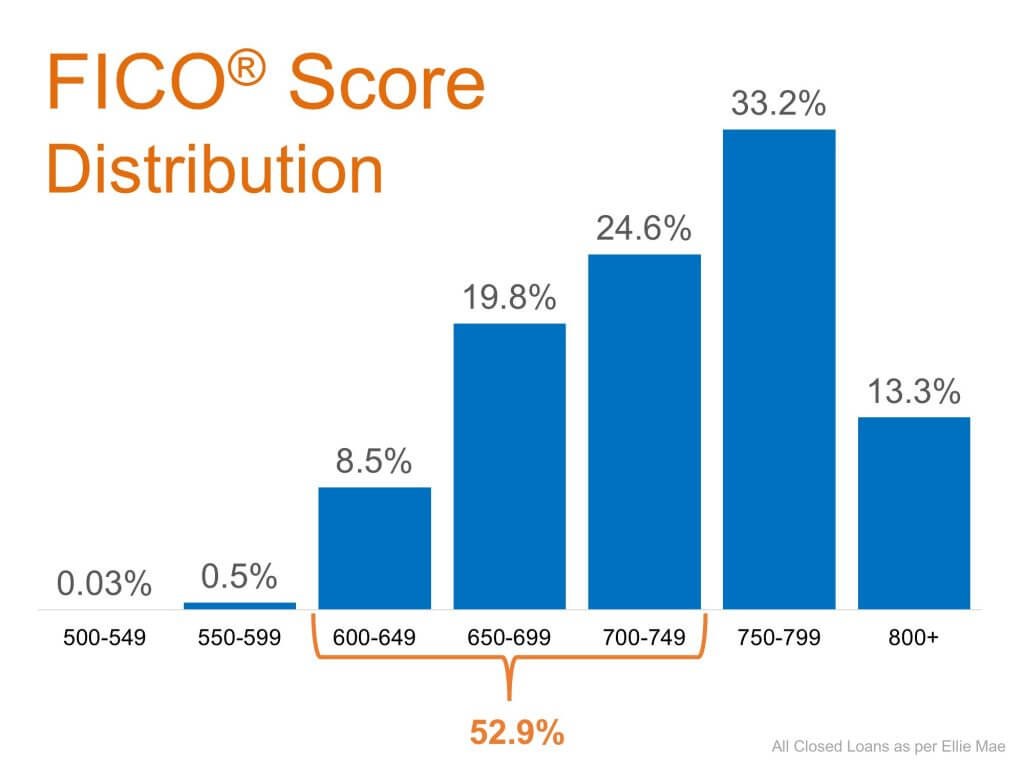

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

The #1 Thing You Can Do to Position Yourself to Buy a Home This Year

Pre-approval is the best thing you can do right now to be in a stronger position to buy a home. Let’s connect today to get the process started.

The Economic Impact of Buying a Home

While we all wait patiently for the current pandemic to pass, there are a lot of things you can do in the meantime to keep your home search on track.

The Best Advice Does Not Mean Perfect Advice

If you’re thinking of buying or selling, contact a local real estate professional to make sure you get the best advice possible.

What You Can Do to Keep Your Dream of Homeownership Moving Forward

There are things you can do right now, from your home, to keep moving forward with your home search.

Should We Be Showing Homes Right Now?

The Coronavirus pandemic has changed the world. With all that we are hearing , should we be showing homes right now?

Economic Slowdown: What the Experts Are Saying

More and more economists are predicting a recession is imminent as the result of the pullback in the economy caused by COVID-19.

Three Reasons Why This Is Not a Housing Crisis

In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data.

5 Simple Graphs Proving This Is NOT Like the Last Time

There are many reasons indicating this real estate market is nothing like 2008. Take a look at 5 graphs that show the dramatic differences.

Buying a Home: Do You Know the Lingo?

To point you in the right direction, here’s a list of some of the most common language you’ll hear throughout the home buying process.

Yes, You Can Still Afford a Home

Since wages have increased and mortgage rates have dropped to historically low levels, this is a great time to buy your first home or move up to the home of your dreams.