Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

Should We Be Showing Homes Right Now?

The Coronavirus pandemic has changed the world. With all that we are hearing , should we be showing homes right now?

Economic Slowdown: What the Experts Are Saying

More and more economists are predicting a recession is imminent as the result of the pullback in the economy caused by COVID-19.

Three Reasons Why This Is Not a Housing Crisis

In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data.

5 Simple Graphs Proving This Is NOT Like the Last Time

There are many reasons indicating this real estate market is nothing like 2008. Take a look at 5 graphs that show the dramatic differences.

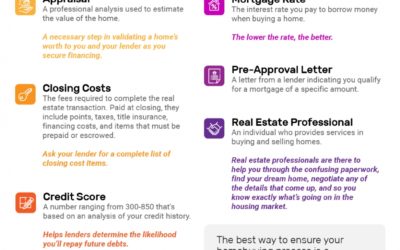

Buying a Home: Do You Know the Lingo?

To point you in the right direction, here’s a list of some of the most common language you’ll hear throughout the home buying process.

Yes, You Can Still Afford a Home

Since wages have increased and mortgage rates have dropped to historically low levels, this is a great time to buy your first home or move up to the home of your dreams.

Confidence is the Key to Success for Young Home Buyers

For those in younger generations who aspire to buy, here are three things to consider sooner rather than later…

Equity Gain Growing in Nearly Every State

Today, the number of homeowners that currently have significant equity in their homes is growing. This year may be your year to sell!

New Homes Coming to the Housing Market This Year

New inventory means more options. More inventory means more competition. What does all this mean to you?

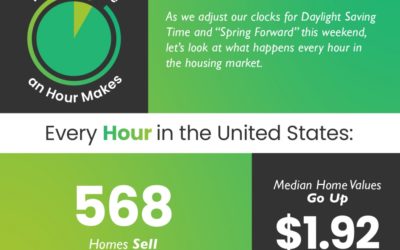

The Difference an Hour Makes

Don’t forget to set your clocks forward this Sunday, March 8 at 2:00 AM EST in observance of Daylight Saving Time, unless you’re a resident of Arizona or Hawaii!