Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

The Surprising Profile of the Real Estate Investor

If you are investing in real estate as either a landlord or someone who fixes-up and flips the house, let’s chat.

Should I Refinance My Home?

With recent lower interest rates, many homeowners are wondering if they should refinance their home. Are you? Start by asking yourself these 3 questions.

Home Price Appreciation Forecast

Questions continue to come up about where home prices will head throughout the rest of this year. We have projections from the industry’s leading experts!!

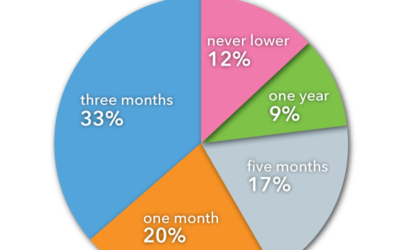

How Long Until Sellers Seriously Consider a Price Cut?

A lingering listing with no takers … how long does it take until the home seller is willing to accept that a price reduction is needed?

Just Listed! 1 Newpoint Lane, East Moriches

Spacious 4 bedroom, 2.5 bath colonial in Newport Beach with deeded beach and boating rights! Call us today to schedule a showing!

How to Know if a Home Buyer is Serious

Not sure how to tell if a homebuyer is serious about purchasing your home? Fortunately, there are usually quite a few clues that can help you gauge a home buyer’s interest and intent.

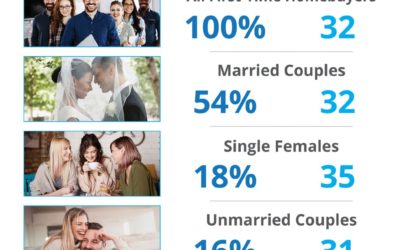

Is Your First Home Now Within Your Grasp?

For the longest time, many experts doubted whether Millennials (ages 18-36) valued homeownership as part of their American Dream.

Americans’ Powerful Belief in Homeownership as an Investment

Real estate the number one choice of Americans for the best long-term investment when compared to stocks, savings accounts or gold.

4 Tips to Sell Your Home Faster

One of the top four elements when selling your home is access! If your home is available anytime, that opens up more opportunity to find a buyer right away. So be sure to give buyers full access to your home!

5 Powerful Reasons to Own Instead of Rent

From a financial standpoint, owning a home has always been and will always be better than renting.