Thinking About Buying? Know Your Credit Score

Knowing your credit score or getting a recent copy of your credit report is one of the first steps that you can take toward knowing how ready you are to start the home buying process.

Make sure all the information listed on your report is accurate and work to correct any mistakes. The higher your credit score, the more likely you will be to receive a better interest rate for your mortgage, which will translate into more ‘home for your money.’

Many potential buyers believe that they need a 750 FICO® Score or higher to be able to purchase a home. The truth is that according to Ellie Mae’s Origination Report, over 53% of loans were approved with a FICO® score under 750 last month!

Here are some tips for improving your credit score:

-

Make payments, including rent, credit cards, and car loans, on time.

-

Keep your spending to no more than 30% of your limit on credit cards.

-

Pay down high-balance credit cards to lower balances, and consider balance transfers to free up credit.

-

Check for errors on your credit report and work toward fixing them.

-

Shop for mortgage rates within a 30-day period – too many spread-out inquiries can lower your score.

-

Work with a credit counselor or a lender to improve your score.

Once you know your score, your next step will be finding a lender and getting pre-approved for a mortgage. Doing this will ensure that you know your budget before you start looking for your dream home.

To view original article, please visit Keeping Current Matters.

Are You Aware of How Much Equity You Have in Your Home? You May Be Surprised!

Many homeowners are not aware that they have regained equity in their homes as their investment has increased in value.

Homeownership: “The Reports of My Death Have Been Greatly Exaggerated.”

Homeownership has been, is and will always be a crucial element of the American Dream.

Calm Down! The Real Estate Market is NOT Falling Apart

Speculation has driven certain markets over the last year. However, it has not been speculation, but instead people’s desire for homeownership, that has driven the real estate market.

The #1 Reason to Sell Now Before Spring

Buyers in the market during the winter months are truly motivated purchasers. They want to buy now.

Where Are Mortgage Interest Rates Headed In 2018?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search.

Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

Millionaire to Millennials: Don’t Rent a Home… Buy!

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.”

Housing Prices are Not Heading for Another Crash

Prices are appreciating at levels greater than historic norms. However, we are not at the levels that led to the housing bubble and bust.

Top 5 Benefits of Hiring a Real Estate Agent

If your plans for 2018 include putchasing your dream home, let’s get together to discuss your options and to help you make the most powerful and confident decisions for you and your family.

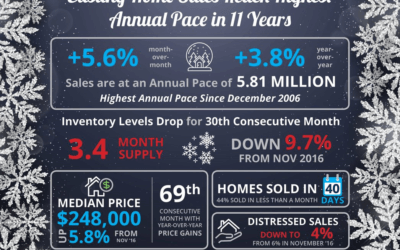

Existing Home Sales Reach Highest Annual Pace in 11 Years

Existing home sales are currently at an annual pace of 5.81 million, the highest pace since December 2006.