The Truth About Homeowner Equity

A recent article from a reputable news source was titled: Here’s why some homeowners still can’t sell. In the opening bullets of the article, the author claimed, “Negative equity is one of the main reasons why there are so few homes for sale.” The article then goes on to soften that stance but we want to bring better clarity to the equity situation.

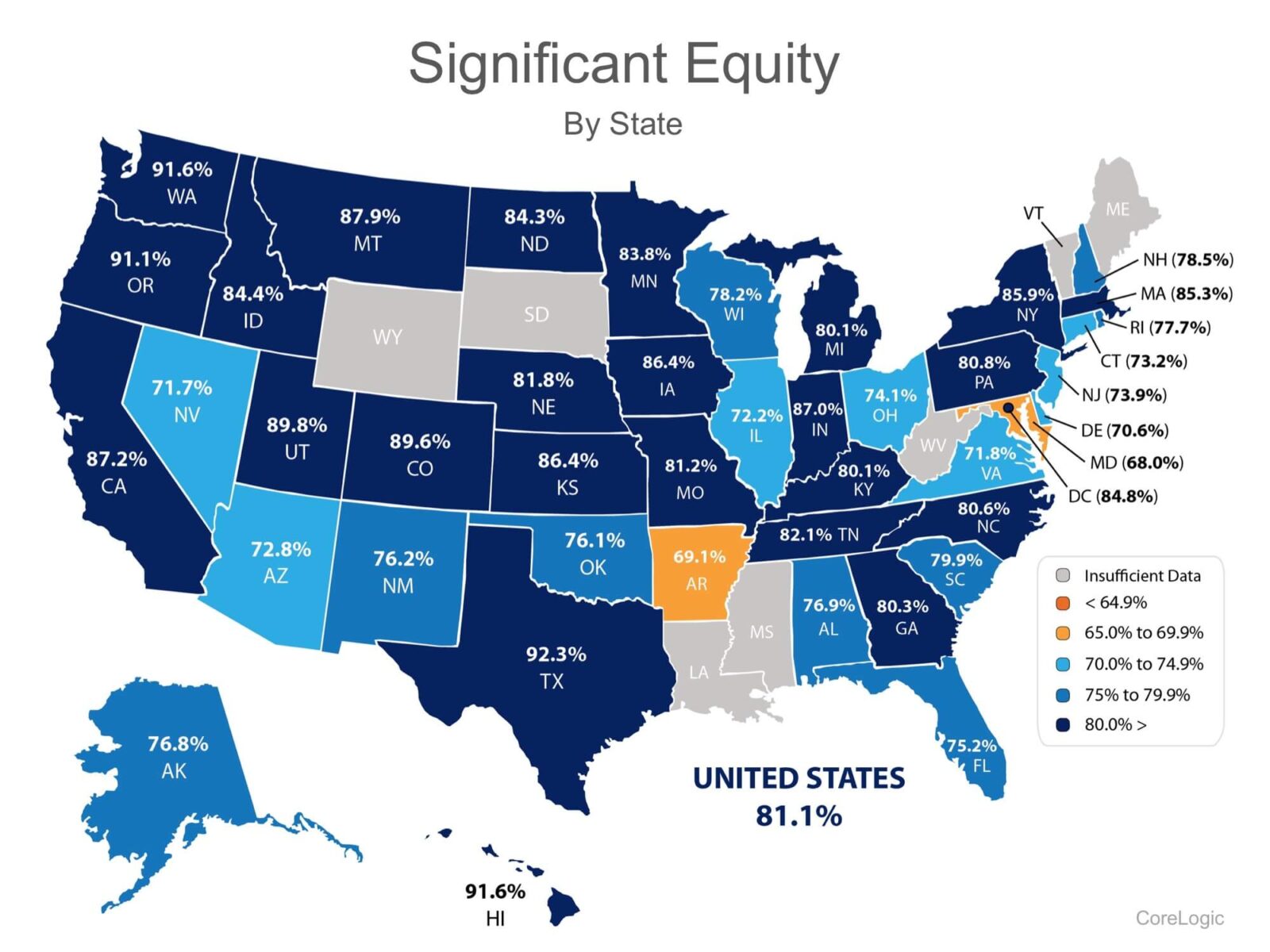

A recent report from CoreLogic (which was quoted in the article) revealed that over 80% of all homes now have “significant equity,” which means the home has over 20% equity. That level of equity allows the homeowner to sell their home if they so desire. (There was no reference to significant equity in the article.)

If eight out of ten homeowners now have significant equity in their homes, it is hard to make the claim that lack of equity is “one of the main reasons why there are so few homes for sale.”

Here is a map showing the percentage of homes in each state which currently have significant equity:

Bottom Line

If you are one of many homeowners who is debating selling your home and are wondering how much equity you have accumulated, let’s get together to determine if now is the time to list.

To see original article please visit Keeping Current Matters.

Why Buyers Need an Expert Agent by Their Side

Advice and guidance from a professional real estate agent can be invaluable, particularly amid a hot or unpredictable housing market.

What You Need To Know About Home Price News

More ‘less-expensive’ houses are selling right now, and that’s causing the median price to decline.

The Worst Home Price Declines Are Behind Us

If we take a yearly view, home prices stayed positive – they just appreciated more slowly than they did at the peak of the pandemic.

Homeowners Have Incredible Equity To Leverage Right Now

A real estate professional can help you understand the value of your home, so you’ll get a clearer picture of how much equity you have.

It May Be Time To Consider a Newly Built Home

When housing inventory is as low as it is right now, it can feel like a bit of an uphill battle to find the perfect home.

Why Buying a Home Makes More Sense Than Renting Today

With rents much higher now than they were in more normal, pre-pandemic years, owning your home may be a better option.

Why Today’s Foreclosure Numbers Are Nothing Like 2008

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was during the housing crisis.

What Are the Experts Saying About the Spring Housing Market?

Buyers are going to see more competition than they might expect because there are not many homes on the market.

The Power of Pre-Approval

Pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow.

What’s the Difference Between a Home Inspection and an Appraisal?

Your trusted real estate professional will help you navigate both the inspection as well as any issues that arise during the buying process.