“The current situation makes it extremely difficult to project the future of the economy. “

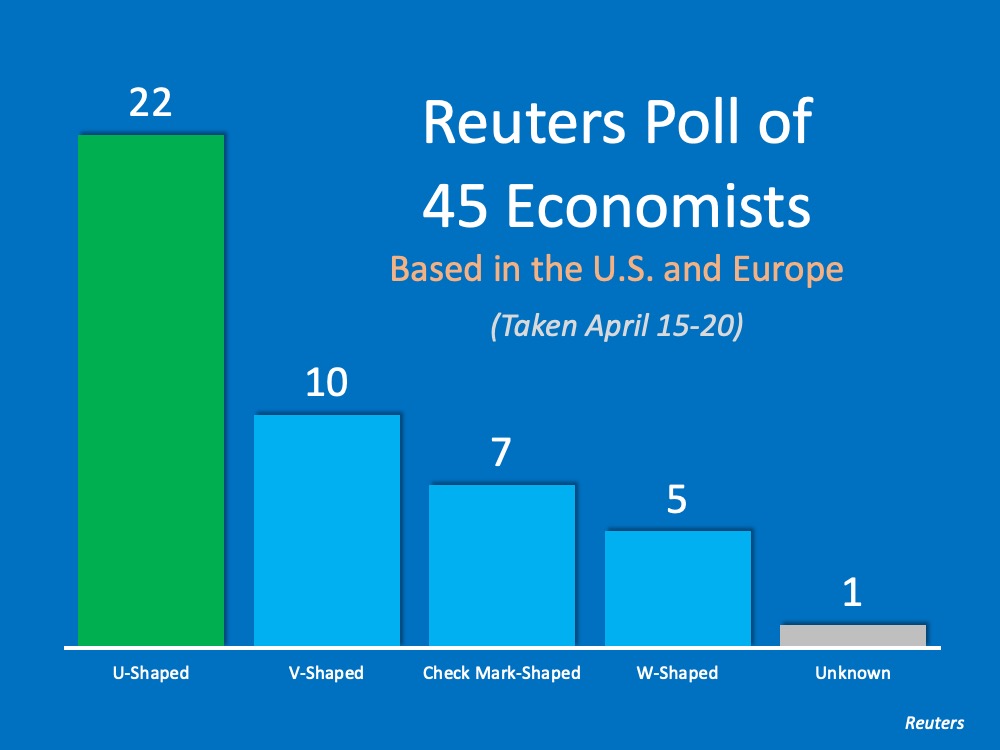

In addition, we noted how there are some in the business community who believe we may instead be headed for a U-shaped recovery, where the return to previous levels of economic success won’t occur until the middle of next year. Yesterday, Reuters released a poll of U.S. and European economists which revealed that most surveyed are now leaning more toward a U-shaped recovery.

Here are the results of that poll:

Why the disparity in thinking among different groups of economic experts?

The current situation makes it extremely difficult to project the future of the economy. Analysts normally look at economic data and compare it to previous slowdowns to create their projections. This situation, however, is anything but normal.

Today, analysts must incorporate data from three different sciences into their recovery equation:

1. Business Science – How has the economy rebounded from similar slowdowns in the past?

2. Health Science – When will COVID-19 be under control? Will there be another flareup of the virus this fall?

3. Social Science – After businesses are fully operational, how long will it take American consumers to return to normal consumption patterns? (Ex: going to the movies, attending a sporting event, or flying).

The challenge of accurately combining the three sciences into a single projection has created uncertainty, and it has led to a wide range of opinions on the timing of the recovery.

Bottom Line

Right now, the vast majority of economists and analysts believe a full recovery will take anywhere from 6-18 months. No one truly knows the exact timetable, but it will be coming.

To view original article, visit Keeping Current Matters.

Keys to Success for First-Time Homebuyers

The best way to make sure you’re set up for success, especially if you’re just starting out, is to work with a trusted real estate agent.

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

The pandemic profoundly changed real estate over the last few years. The demand for a home of our own skyrocketed, and needs changed.

The Benefits of Selling Now, According to Experts

Sellers who price and market their home competitively shouldn’t have a problem finding a buyer especially in today’s market.

Why Buyers Need an Expert Agent by Their Side

Advice and guidance from a professional real estate agent can be invaluable, particularly amid a hot or unpredictable housing market.

What You Need To Know About Home Price News

More ‘less-expensive’ houses are selling right now, and that’s causing the median price to decline.

The Worst Home Price Declines Are Behind Us

If we take a yearly view, home prices stayed positive – they just appreciated more slowly than they did at the peak of the pandemic.