“Home prices will appreciate by 5.4% over the next 12 months.”

Some Highlights:

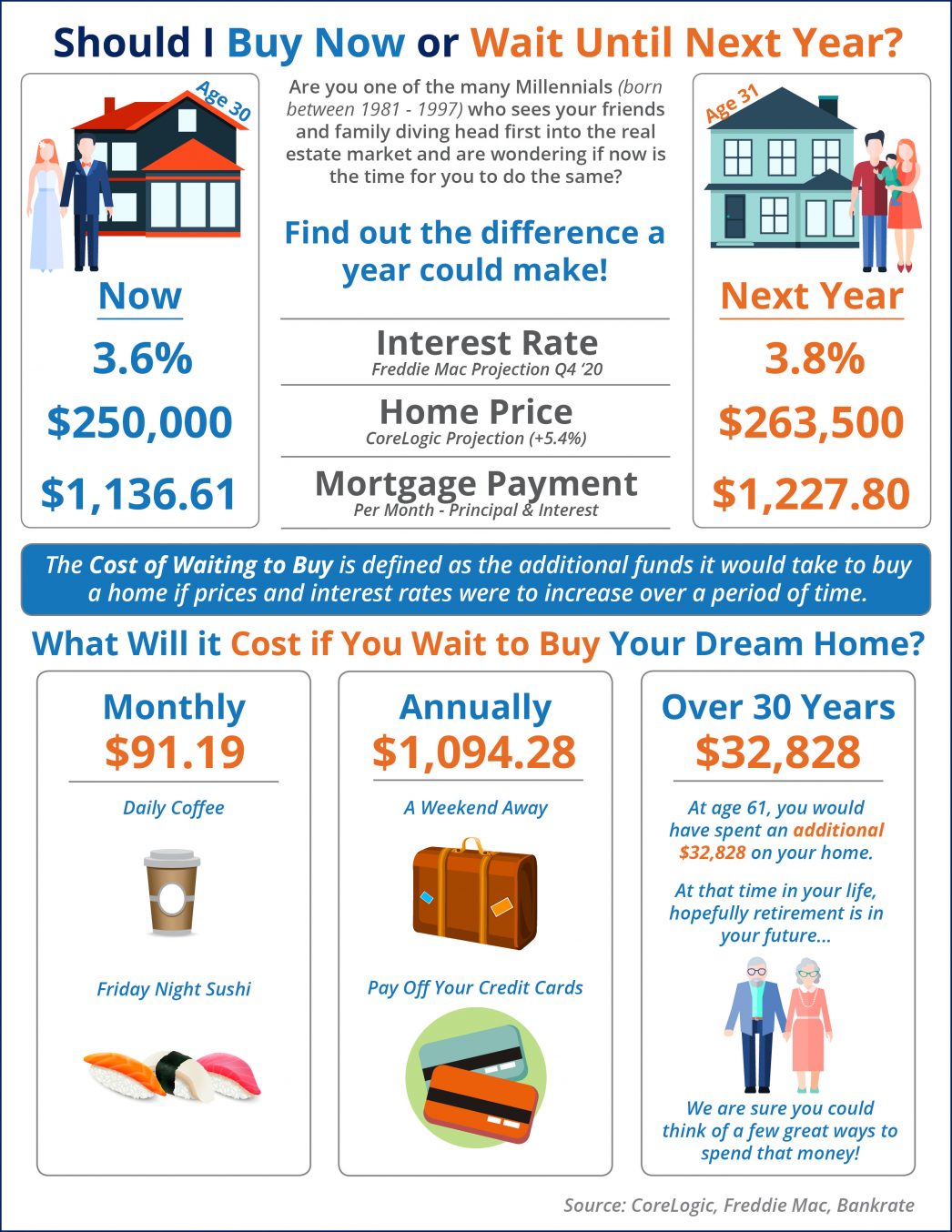

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates will rise to 3.8% by Q4 2020.

- CoreLogic predicts home prices will appreciate by 5.4% over the next 12 months.

- If you’re ready and willing to buy your dream home, now is a great time to buy.

To view original article, visit Keeping Current Matters.

What Will It Take for Prices To Come Down?

It’s crucial to work with a local real estate expert who understands your market and can explain what’s going on where you live.

Sell Your House During the Winter Sweet Spot

While inventory is higher this year than the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot.

Why More Sellers Are Hiring Real Estate Agents

Selling your home is a big deal, and while FSBO might seem like a way to save time or money, it comes with a lot of responsibilities.

Should You Sell Your House As-Is or Make Repairs?

So, how do you make sure you’re making the right decision for your move? The key is working with a pro.

Why Owning a Home Is Worth It in the Long Run

Increased home values are a major reason so many homeowners are still happy with their decision today!

How Co-Buying a Home Helps with Affordability Today

If you are an aspiring homeowner, buying a home with your family or friends could be an option.

.jpg )