“Here are some options you should consider if you want to take advantage of today’s current low rates before they rise.”

In today’s real estate market, mortgage interest rates are near record lows. If you’ve been in your current home for several years and haven’t refinanced lately, there’s a good chance you have a mortgage with an interest rate higher than today’s average. Here are some options you should consider if you want to take advantage of today’s current low rates before they rise.

Sell and Move Up (or Downsize)

Many of today’s homeowners are rethinking what they need in a home and redefining what their dream home means. For some, continued remote work is bringing about the need for additional space. For others, moving to a lower cost-of-living area or downsizing may be great options. If you’re considering either of these, there may not be a better time to move. Here’s why.

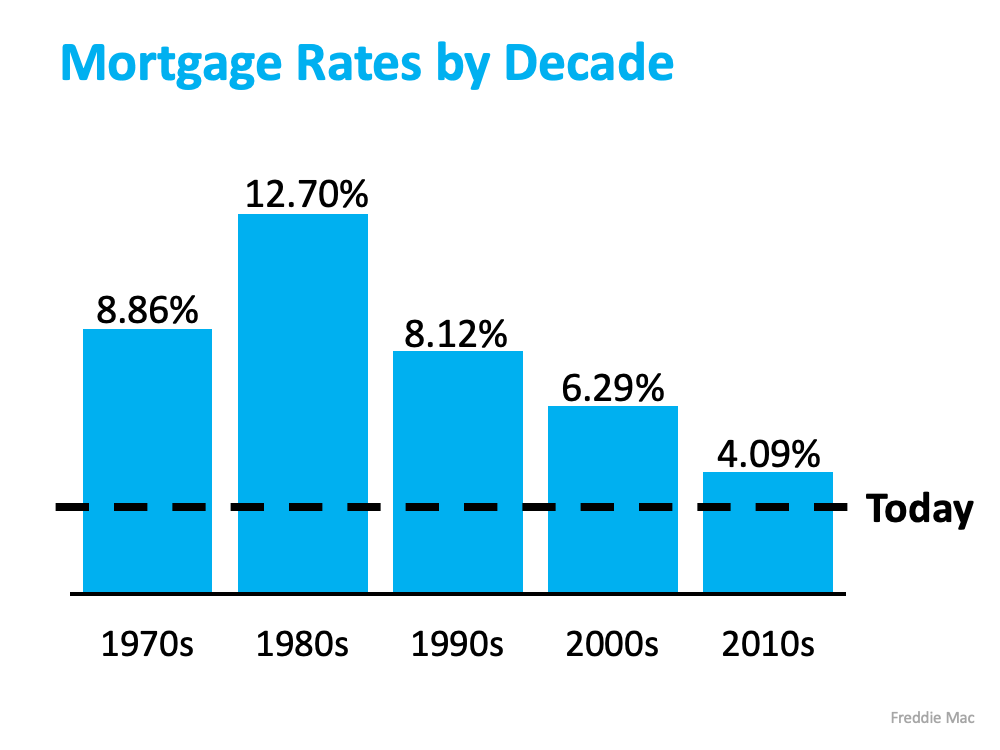

The chart below shows average mortgage rates by decade compared to where they are today: Today’s rates are below 3%, but experts forecast rates to rise over the next few years.

Today’s rates are below 3%, but experts forecast rates to rise over the next few years.

If the interest rate on your current mortgage is higher than today’s average, take advantage of this opportunity by making a move and securing a lower rate. Lower rates mean you may be able to get more house for your money and still have a lower monthly mortgage payment than you might expect.

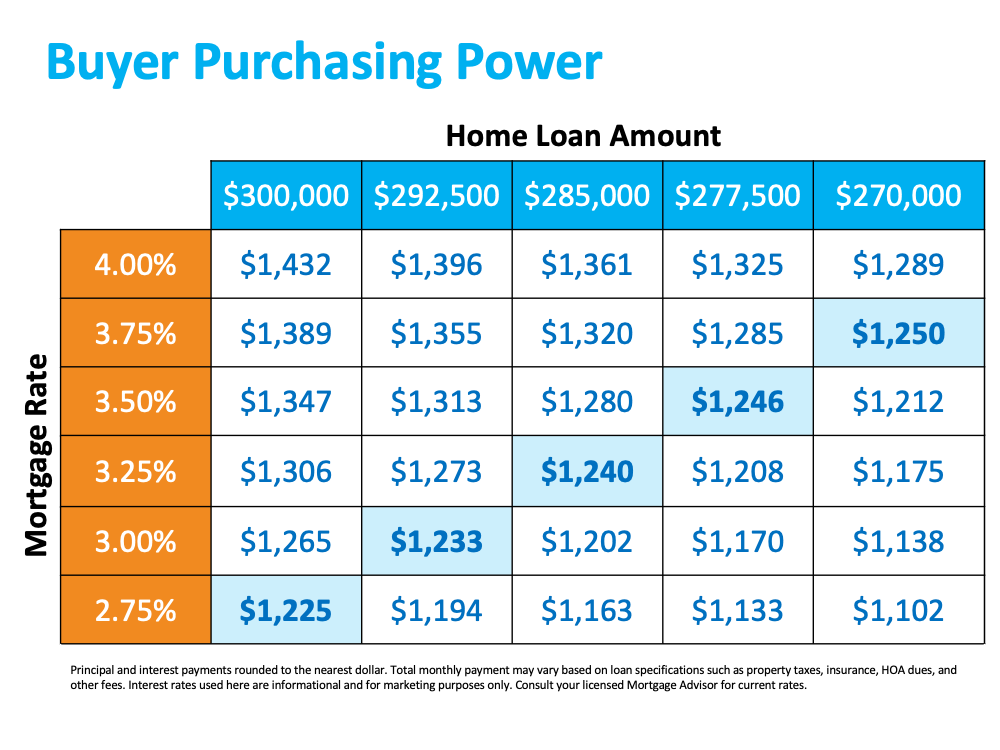

Waiting, however, might mean you miss out on this historic opportunity. Below is a chart showing how your monthly payment will change if you buy a home as mortgage rates increase:

Breaking It All Down:

Using the chart above, let’s look at the breakdown of a $300,000 mortgage:

- When mortgage rates rise, so does the monthly payment you can secure.

- Even the smallest increase in rates can make a difference in your monthly mortgage payment.

- As interest rates rise, you’ll need to look at a lower-priced home to try and keep the same target monthly payment, meaning you may end up with less home for your money.

No matter what, whether you’re looking to make a move up or downsize to a home that better suits your needs, now is the time. Even a small change in interest rates can have a big impact on your purchasing power.

Refinance

If making a move right now still doesn’t feel right for you, consider refinancing. With the current low mortgage rates, refinancing is a great option if you’re looking to lower your monthly payments and stay in your current home.

Bottom Line

Take advantage of today’s low rates before they begin to rise. Whether you’re thinking about moving up, downsizing, or refinancing, let’s connect today to discuss which option is best for you.

To view original article, visit Keeping Current Matters.

Saving for a Down Payment? Here’s What You Need To Know.

One of the biggest misconceptions among housing consumers is what the typical down payment is.

Why Buying or Selling a Home Helps the Economy and Your Community

If you’re thinking about buying or selling a house, it’s important to know that it doesn’t just affect your life, but also your community.

Your Needs Matter More Than Today’s Mortgage Rates

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed.

Are Home Prices Going Up or Down? That Depends…

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year.

This Real Estate Market Is the Strongest of Our Lifetime

This is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime.

Real Estate Is Still Considered the Best Long-Term Investment

Real estate was voted the best long-term investment for the 11th consecutive year, beating gold, stocks, and bonds.