“If home price gains are about to re-accelerate, buying now rather than later makes financial sense.”

1. Affordability

Many people focus solely on price when talking about home affordability. Since home prices have appreciated throughout the past year, they assume homes are less affordable. However, affordability is determined by three components:

- Price

- Wages

- Mortgage Interest Rate

Prices are up, but so are wages – and interest rates have recently dropped dramatically (see #2 below). As a result, the National Association of Realtors’ (NAR) latest Affordability Index report revealed that homes are MORE affordable throughout the country today than they were a year ago.

“All four regions saw an increase in affordability from a year ago. The South had the biggest gain in affordability of 6.9%, followed by the West with a gain of 6.0%. The Midwest had an increase of 5.8%, followed by the Northeast with the smallest gain of 1.8%.”

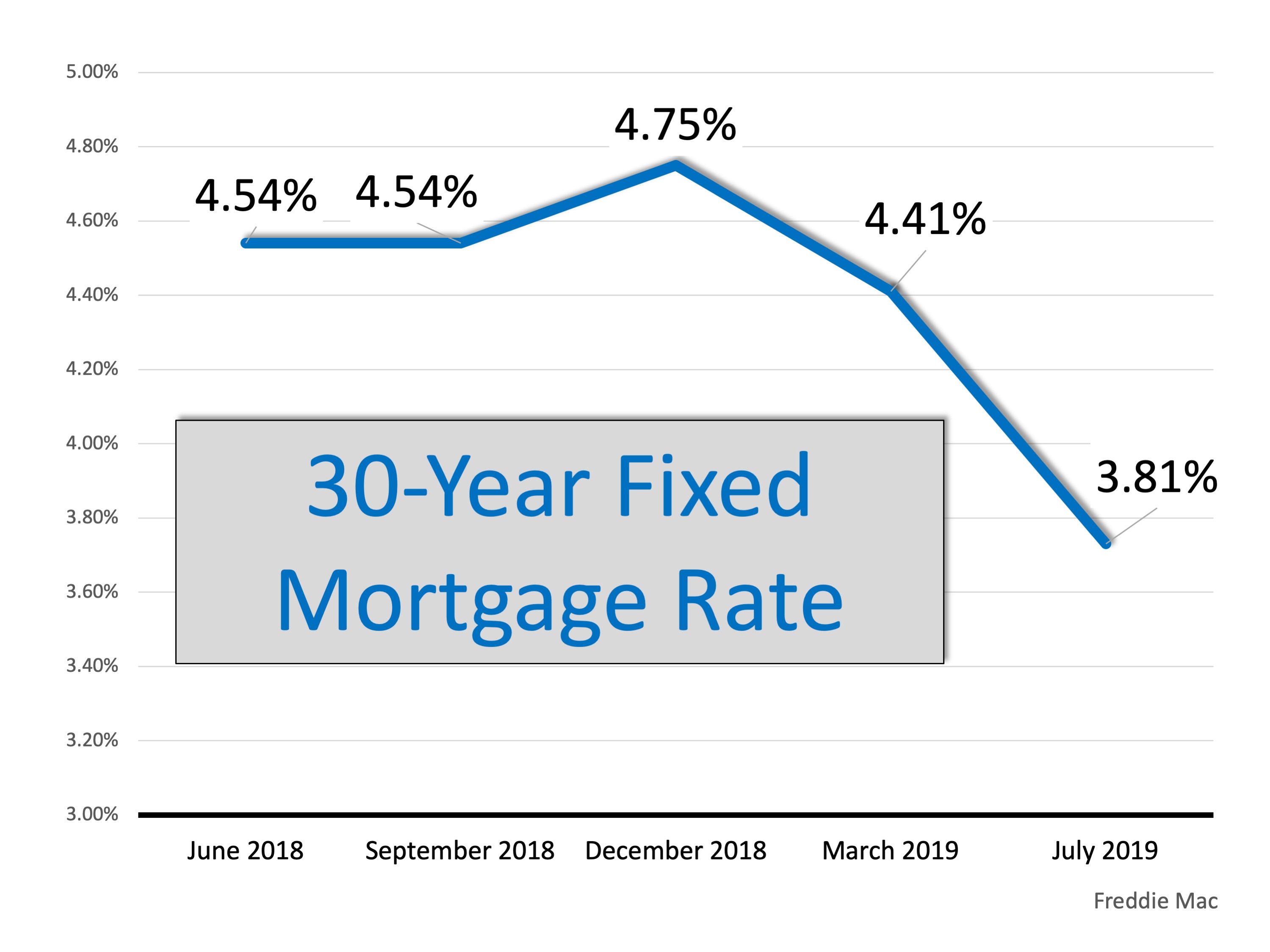

2. Mortgage Interest Rates

Mortgage rates have dropped almost a full point after heading toward 5% last fall and early winter. Currently, they are below 4%. Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

With mortgage rates remaining near historic lows, Fannie Mae and others have increased their forecasts for housing appreciation for the rest of the year. If home price gains are about to re-accelerate, buying now rather than later makes financial sense.

3. Increase Family Wealth

Homeownership has always been recognized as a sensational way to build long-term family wealth. A new report by ATTOM Data Solutions reveals:

“U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since purchase of $67,500, up from an average gain of $57,706 in Q1 2019 and up from an average gain of $60,100 in Q2 2018. The average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of original purchase price.”

The longer you delay purchasing a home, the longer you are waiting to put the power of home equity to work for you.

Bottom Line

With affordability increasing, mortgage rates decreasing, and home values about to re-accelerate, it may be time to make a move. Let’s get together to determine if buying now makes sense for your family.

To view original article, visit Keeping Current Matters.

It May Be Time To Consider a Newly Built Home

When housing inventory is as low as it is right now, it can feel like a bit of an uphill battle to find the perfect home.

Why Buying a Home Makes More Sense Than Renting Today

With rents much higher now than they were in more normal, pre-pandemic years, owning your home may be a better option.

Why Today’s Foreclosure Numbers Are Nothing Like 2008

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was during the housing crisis.

What Are the Experts Saying About the Spring Housing Market?

Buyers are going to see more competition than they might expect because there are not many homes on the market.

The Power of Pre-Approval

Pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow.

What’s the Difference Between a Home Inspection and an Appraisal?

Your trusted real estate professional will help you navigate both the inspection as well as any issues that arise during the buying process.

.jpg )