“Over the past year, mortgage rates have fallen more than a full percentage point.”

Over the past year, mortgage rates have fallen more than a full percentage point. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them:

- Refinance: If you already own a home, you may want to decide if you’re going to refinance. It’s one way to lock in a lower monthly payment and save substantially over time, but it also means paying upfront closing costs too. You have to answer the question: Should I refinance my home?

- Move-up or Downsize: Another option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that’s truly a perfect fit for your family.

- Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it. Just take a look at the cost of renting vs. buying

Why 2019 Was a Great Year for Homeownership

Last year at this time, mortgage rates were 4.63% (substantially higher than they are today). If you’re one who waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates combined with increasing wages are making homes much more affordable than they were just one year ago, so it’s a great time to get more for your money and consider a new home.

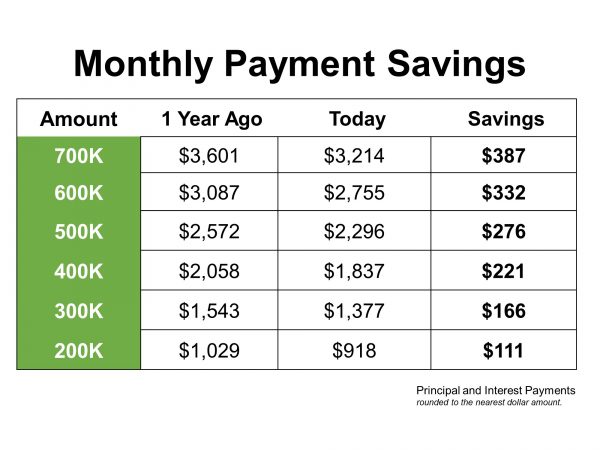

The chart below shows how much you would save based on today’s rates, compared to what you would have paid if you purchased a house exactly one year ago, depending on how much you finance. Bottom Line

Bottom Line

If you’ve been waiting since last year to make your move into homeownership, or to find a house that better meets your needs, today’s low mortgage rates may be just what you need to get the process going. Let’s get together to discuss how you can benefit from the current rates.

To view original article, visit Keeping Current Matters.

Real Estate Voted the Best Investment Eight Years in a Row

As a homeowner, your house is an asset that typically increases in value over time, even during inflation.

4 Simple Graphs Showing Why This Is Not a Housing Bubble

This market is very different than it was during the housing crash 15 years ago.

What Every Seller Needs to Know About Renovating This Year

Speak with a real estate professional to confirm which improvements aren’t deal-breakers for buyers.

Are You Ready To Fall in Love with Homeownership?

Buying a home is not just a financial decision. It’s also a lifestyle decision. Are you ready?

Want Top Dollar for Your House? Now’s the Time to List It.

If you’re thinking of selling your house this year, here are two reasons why now’s the time to list.

Don’t Let Student Loans Delay Your Homeownership Dreams

The key takeaway is, for many people, homeownership is achievable even with student loans.

.jpg )