“If you’re wondering whether or not you should delay your homebuying plans, here’s what you really need to know. “

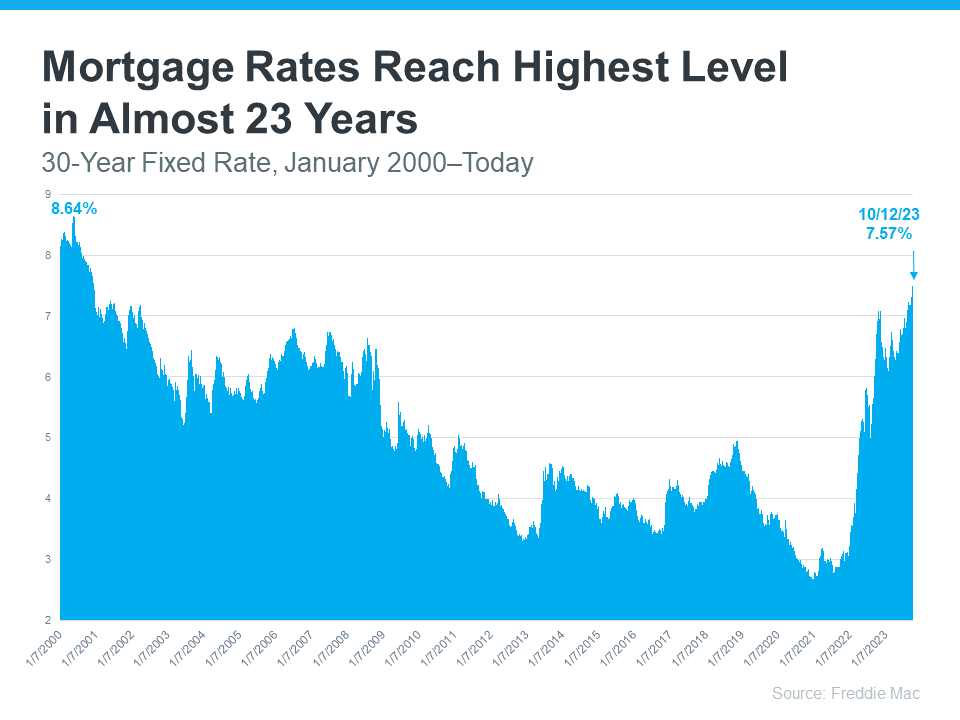

Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over two decades (see graph below):

That can feel like a little bit of a gut punch if you’re thinking about making a move. If you’re wondering whether or not you should delay your plans, here’s what you really need to know.

How Higher Mortgage Rates Impact You

There’s no denying mortgage rates are higher right now than they were in recent years. And, when rates are up, that affects overall home affordability. It works like this. The higher the rate, the more expensive it is to borrow money when you buy a home. That’s because, as rates trend up, your monthly mortgage payment for your future home loan also increases.

Urban Institute explains how this is impacting buyers and sellers right now:

“When mortgage rates go up, monthly housing payments on new purchases also increase. For potential buyers, increased monthly payments can reduce the share of available affordable homes . . . Additionally, higher interest rates mean fewer homes on the market, as existing homeowners have an incentive to hold on to their home to keep their low interest rate.”

Basically, some people are deciding to put their plans on hold because of where mortgage rates are right now. But what you want to know is: is that a good strategy?

Where Will Mortgage Rates Go from Here?

If you’re eager for mortgage rates to drop, you’re not alone. A lot of people are waiting for that to happen. But here’s the thing. No one knows when it will. Even the experts can’t say with certainty what’s going to happen next.

Forecasts project rates will fall in the months ahead, but what the latest data says is that rates have been climbing lately. This disconnect shows just how tricky mortgage rates are to project.

The best advice for your move is this: don’t try to control what you can’t control. This includes trying to time the market or guess what the future holds for mortgage rates. As CBS News states:

“If you’re in the market for a new home, experts typically recommend focusing your search on the right home purchase — not the interest rate environment.”

Instead, work on building a team of skilled professionals, including a trusted lender and real estate agent, who can explain what’s happening in the market and what it means for you. If you need to move because you’re changing jobs, want to be closer to family, or are in the middle of another big life change, the right team can help you achieve your goal, even now.

Bottom Line

The best advice for your move is: don’t try to control what you can’t control – especially mortgage rates. Even the experts can’t say for certain where they’ll go from here. Instead, focus on building a team of trusted professionals who can keep you informed. When you’re ready to get the process started, let’s connect.

To view original article, visit Keeping Current Matters.

Explaining Today’s Mortgage Rates

Factors such as inflation, other economic drivers, and the policy and decisions from the Federal Reserve are all influencing mortgage rates today.

Homebuyers Are Getting Used to the New Normal

One positive trend right now is homebuyers are adapting to today’s mortgage rates and getting used to them as the new normal.

Home Prices Are Rebounding

Experts believe one of the reasons prices didn’t crash like some expected is because there aren’t enough available homes for the number of people who want to buy them.

Momentum Is Building for New Home Construction

If you’re looking to move right now, reach out to a local real estate professional to explore the homes that were recently completed.

Reasons Your Home May Not Be Selling

If you’re thinking of selling, lean on your real estate agent for expert advice based on your unique situation and feedback you get from buyers throughout the process.

Today’s Housing Inventory Is a Sweet Spot for Sellers

Buyers have fewer choices now than they did in more normal years, and that’s continuing to impact statistics in the housing market.

.jpg )