“Expert forecasts lean towards a moderation in home price growth over the next five years.”

Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking at what a correction means.

Here’s what Danielle Hale, Chief Economist at Realtor.com, says:

“In stock market terms, a correction is generally referred to as a 10 to 20% drop in prices . . . We don’t have the same established definitions in the housing market.”

In the context of today’s housing market, it doesn’t mean home prices are going to fall dramatically. It only means prices, which have been increasing rapidly over the last couple years, are normalizing a bit. In other words, they’re now growing at a slower pace. Prices vary a lot by local market, but rest assured, a big drop off isn’t what’s happening at a national level.

The Real Estate Market Is Normalizing

From 2020 to 2022, home prices skyrocketed. That rapid increase was due to high demand, low interest rates, and a shortage of homes for sale. But, that kind of aggressive growth couldn’t continue forever.

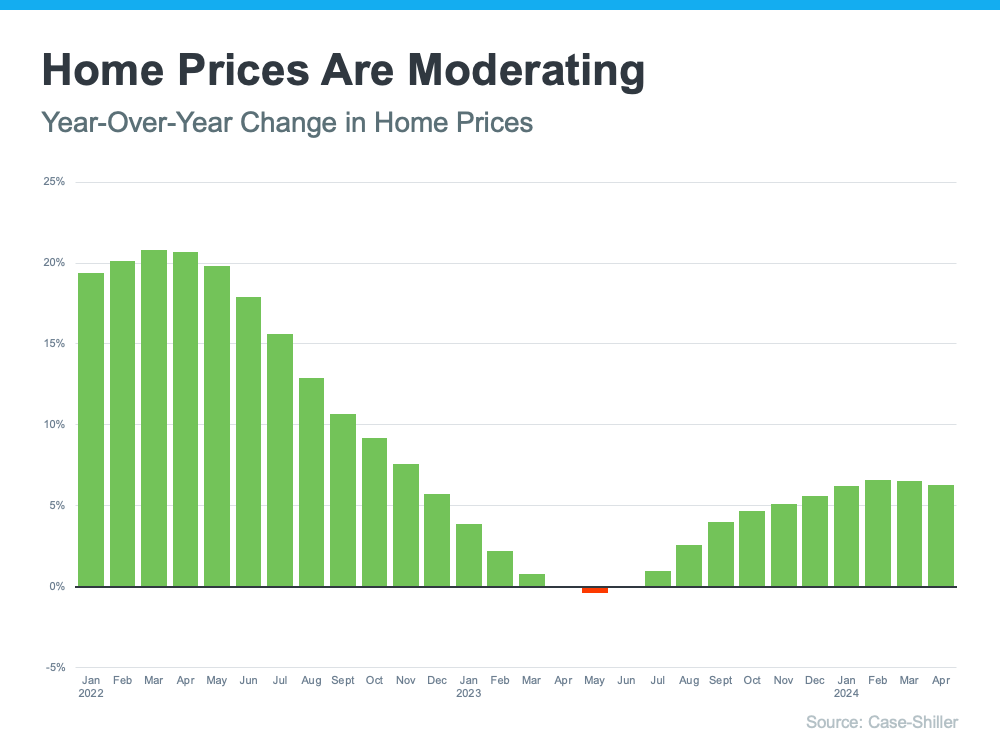

Today, price growth has started to slow down, which is a sign the market is beginning to normalize. The most recent data from Case-Shiller shows that after being basically flat for a couple of months last year, prices are going up at a national level – just not as quickly as before (see graph below):

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

Of course, that’s what’s happening now, but you may be wondering what’s next for prices. Marco Santarelli, the Founder of Norada Real Estate Investments, says:

“Expert forecasts lean towards a moderation in home price growth over the next five years. This translates to a slower and more sustainable pace of appreciation compared to the breakneck speed witnessed in recent years, rather than a freefall in prices.”

It’s all about supply and demand. Increasing inventory plus limited buyer demand, due to relatively high mortgage rates, will continue to ease some of the upward pressure on prices.

What This Means for You

If you’re thinking about buying a home, slowing price growth is welcome news. Skyrocketing home prices during the pandemic left many would-be homebuyers feeling priced-out.

While it’s still a good thing to know the value of the home you buy will likely continue to go up once you own it, slowing price gains are making things feel more manageable. Odeta Kushi, Deputy Chief Economist at First American, says:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help — so the dream of homeownership isn’t boarded up just yet.”

Bottom Line

At the national level, home prices are not going down. And most experts forecast they’ll continue growing moderately moving forward. But prices vary a lot by local market. That’s where a trusted real estate agent comes into play. If you have questions about what’s happening with prices in our area, reach out.

To view original article, visit Keeping Current Matters.

Time in the Market Beats Timing the Market

If you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it.

New Year, New Home: How to Make It Happen in 2025

Buying or selling is a big milestone and a great goal for this year. With the right expert, you’ll feel confident and ready to take on the market.

Simple Steps To Help You Save for Your First Home

Reaching your savings goal doesn’t mean making huge sacrifices overnight – small, consistent steps can get you there over time.

How Eco-Friendly Features Can Boost Your Home’s Value

Not sure which upgrades to prioritize? That’s where a local real estate agent comes in.

The Biggest Perks of Buying a Home This Winter

Since homes generally take longer to sell during the winter, sellers are often more motivated to close a deal.

How Home Equity May Help You Buy Your Next Home in Cash

Building equity in your house is one of the biggest financial advantages of homeownership.

.jpg )