“This is the first time since 2020 that we’ve seen an uptick in new listings this time of year.”

If you’re looking to buy a home, the recent downward trend in mortgage rates is good news because it helps with affordability. But there’s another way this benefits you – it may inspire more homeowners to put their houses up for sale.

The Mortgage Rate Lock-In Effect

Over the past year, one factor that’s really limited the options for your move is how few homes were on the market. That’s because many homeowners chose to delay their plans to sell once mortgage rates went up. An article from Freddie Mac explains:

“The lack of housing supply was partly driven by the rate lock-in effect. . . . With higher rates, the incentive for existing homeowners to list their property and move to a new house has greatly diminished, leaving them rate locked.”

These homeowners decided to stay put and keep their current lower mortgage rate, rather than move and take on a higher one on their next home.

Early Signs Show Those Homeowners Are Ready To Move Again

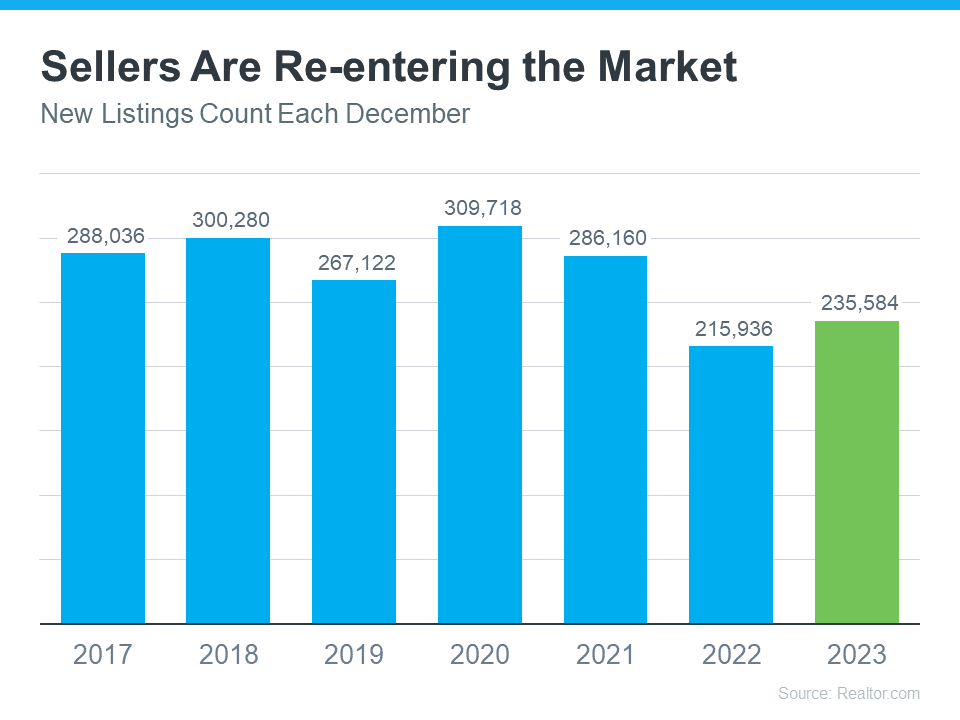

According to the latest data from Realtor.com, there were more homeowners putting their houses up for sale, known in the industry as new listings, in December 2023 compared to December 2022 (see graph below):

Here’s why this is so significant. Typically, activity in the housing market cools down in the later months of the year as some sellers choose to delay their moves until January rolls around.

This is the first time since 2020 that we’ve seen an uptick in new listings this time of year. This could be a signal that the rate lock-in effect is easing a bit in response to lower rates.

What This Means for You

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list. According to a recent article from the Joint Center for Housing Studies (JCHS):

“A reduction in interest rates could alleviate the lock-in effect and help lift homeowner mobility. Indeed, interest rates have recently declined, falling by a full percentage point from October to November 2023 . . . Further decreases would reduce the barrier to moving and give homeowners looking to sell a newfound sense of urgency . . .”

And that means you may see more homes come onto the market to give you more fresh options to choose from.

Bottom Line

As mortgage rates come down, more sellers may re-enter the market – that gives you an opportunity to find the home you’re looking for. Let’s connect so you’ve got a local expert on your side who’ll help you stay on top of the latest listings in our area.

To view original article, visit Keeping Current Matters.

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Here’s what experts say you should expect for home prices, mortgage rates, and home sales.

Why a Vacation Home Is the Ultimate Summer Upgrade

If you’re excited about getting away and having some fun in the sun, it might make sense to own your own vacation home.

What You Need To Know About Today’s Down Payment Programs

If you want more information on down payment programs, the best place to start is by contacting a trusted real estate professional.

Worried About Mortgage Rates? Control the Controllables

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

Here’s what’s really happening with home prices.

Your Equity Could Make a Move Possible

Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Equity can help you make your move.

.jpg )