“Nationally, there are 36.6% more homes actively for sale now compared to the same time last year. “

One of the biggest bright spots in today’s housing market is how much the supply of homes for sale has grown since the beginning of this year.

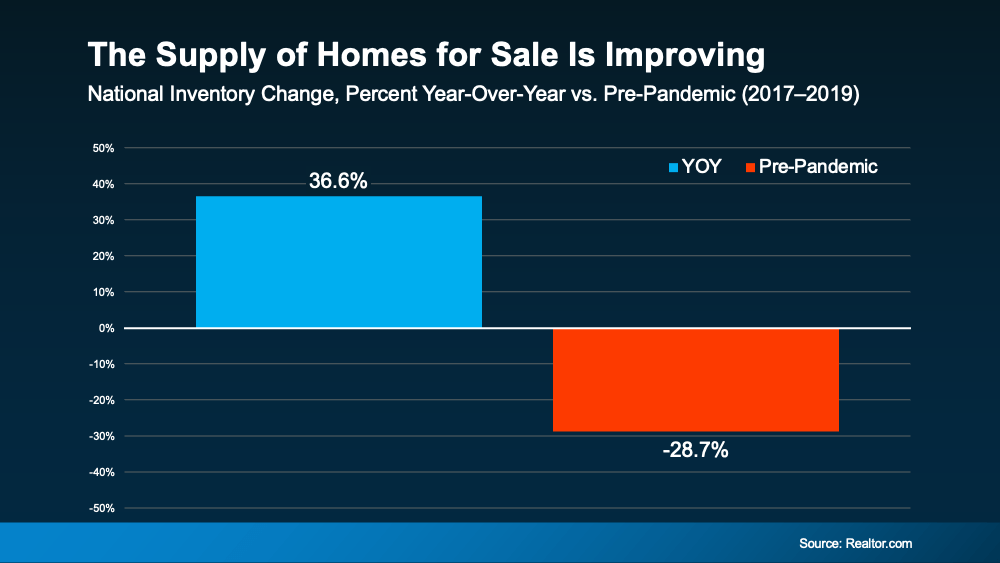

Recent data from Realtor.com shows that nationally, there are 36.6% more homes actively for sale now compared to the same time last year. That’s a significant improvement. It gives you far more options for your move than you would’ve had just a year ago. And with supply improving, you’re also regaining a bit of negotiation power. So, if you’re someone who thought about buying a home over the last few years but was discouraged by how limited inventory was, this should be welcome news.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.”

But just so you have perspective, even though inventory has grown, that doesn’t mean we’ve suddenly flipped to an oversupply of homes on the market. There are nowhere near enough homes for sale to make prices crash. If you compare today’s inventory levels to more normal, pre-pandemic numbers (2017–2019), there are still roughly 29% fewer homes actively for sale now (see graph below):

So, while we’re up by almost 37% year-over-year, we’re still not back to how much inventory there’d be in a normal market.

So, while we’re up by almost 37% year-over-year, we’re still not back to how much inventory there’d be in a normal market.

As Bill McBride, Housing Analyst for Calculated Risk, explains:

“ . . . currently inventory is increasing year-over-year but is still well below pre-pandemic levels.”

But that’s okay. It’s to be expected. As a country, it’ll take a while to get back to the typical level of homes for sale. And the good news for buyers is, in some select markets, it’s closer to being a reality.

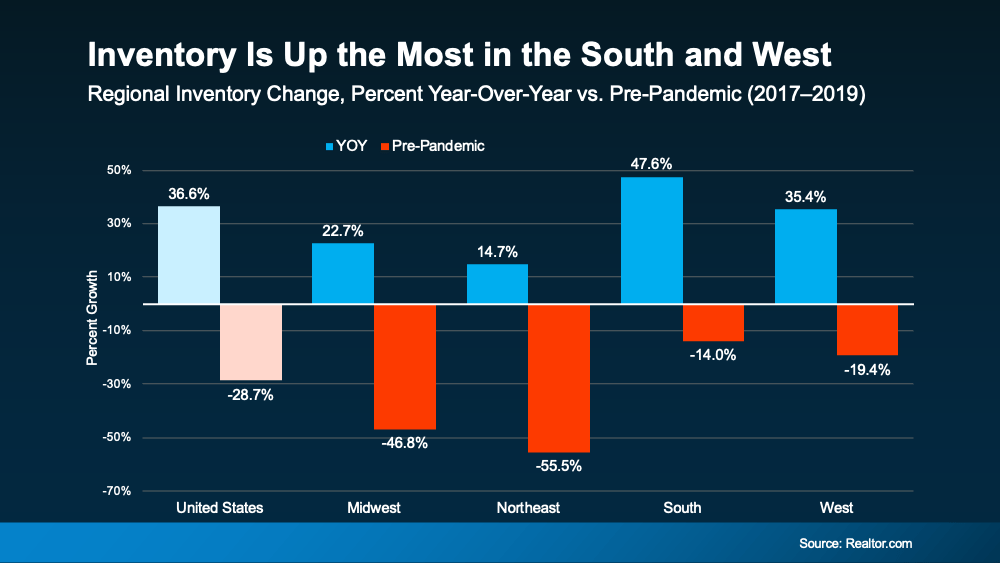

Here’s a rundown of what today’s inventory growth looks like by region (see graph below):

Real estate will always be hyper-local. If you want to find out what inventory numbers look like where you live, reach out to a local agent. They’ll be able to tell you what they’re seeing and how it stacks up to the national market. You may find you have even more opportunity to move where you are.

Real estate will always be hyper-local. If you want to find out what inventory numbers look like where you live, reach out to a local agent. They’ll be able to tell you what they’re seeing and how it stacks up to the national market. You may find you have even more opportunity to move where you are.

Bottom Line

The supply of homes across the country is improving in a big way. As a buyer, that gives you more options for your home search, and ultimately, a better chance of finding what you like.

So, what are you looking for in a home? And what’s your budget? Let’s go over that together to find the options that may be right for you.

To view original article, visit Keeping Current Matters.

2 of the Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Ever wonder why they change?

Will a Silver Tsunami Change the 2024 Housing Market?

The thought is that as baby boomers grow older, a significant number will start downsizing their homes, but will it happen this year?

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.

.jpg )