“Here’s a breakdown of what you need to know.”

If you’ve been keeping an eye on the housing market over the past couple of years, you know sellers have had the upper hand. But is that going to shift now that inventory is growing? Here’s a breakdown of what you need to know.

What Is a Balanced Market?

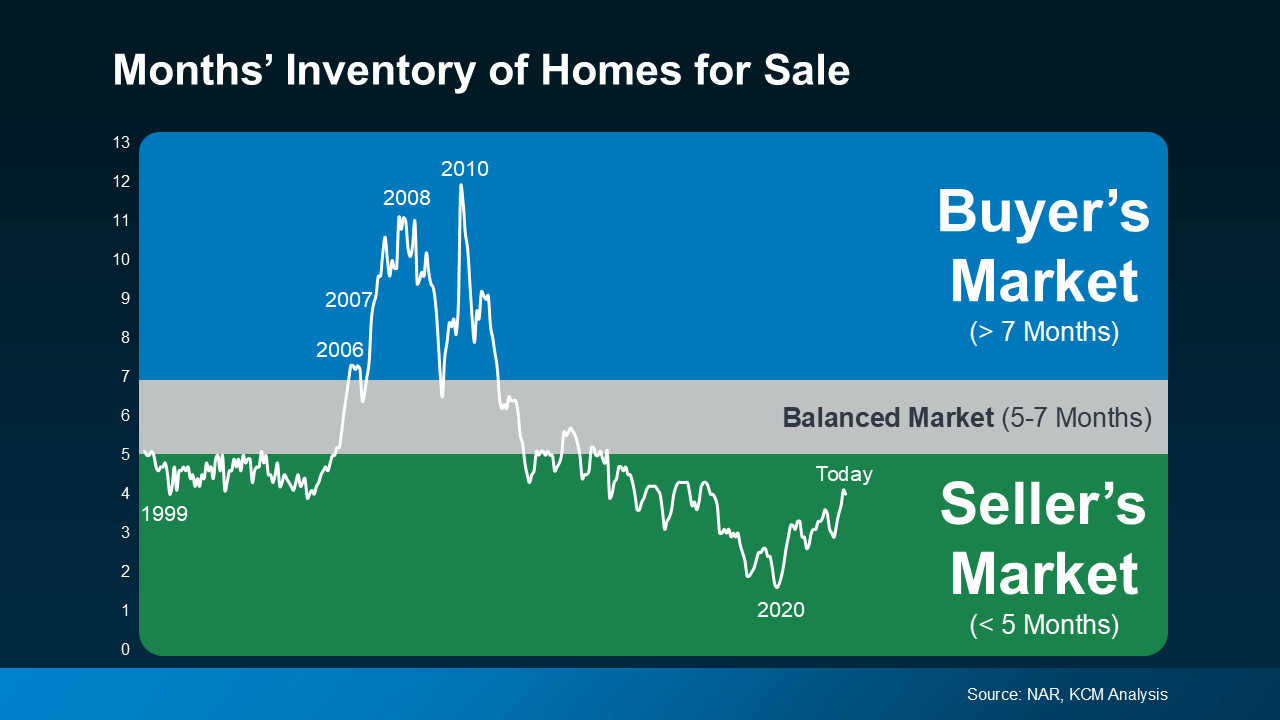

A balanced market is generally defined as a market with about a five-to-seven-month supply of homes available for sale. In this type of market, neither buyers nor sellers have a clear advantage. Prices tend to stabilize, and there’s a healthier number of homes to choose from. And after many years when sellers had all the leverage, a more balanced market would be a welcome sight for people looking to move. The question is – is that really where the market is headed?

After starting the year with a three-month supply of homes nationally, inventory has increased to four months. That may not sound like a lot, but it means the market is getting closer to balanced – even though it’s not quite there yet. It’s important to note this increase in inventory is not leading to an oversupply that would cause a crash. Even with the growth lately, there’s still nowhere near enough supply for that to happen.

The graph below uses data from the National Association of Realtors (NAR) to give you an idea of where inventory has been in the past, and where it’s at today:

For now, this is still seller’s market territory – it’s just not as frenzied of a seller’s market as it’s been over the past few years. As Mark Fleming, Chief Economist at First American, says:

For now, this is still seller’s market territory – it’s just not as frenzied of a seller’s market as it’s been over the past few years. As Mark Fleming, Chief Economist at First American, says:

“The faster housing supply increases, the more affordability improves and the strength of a seller’s market wanes.”

What This Means for You and Your Move

Here’s how this shift impacts you and the market conditions you’ll face when you move. Lawrence Yun, Chief Economist at NAR, explains:

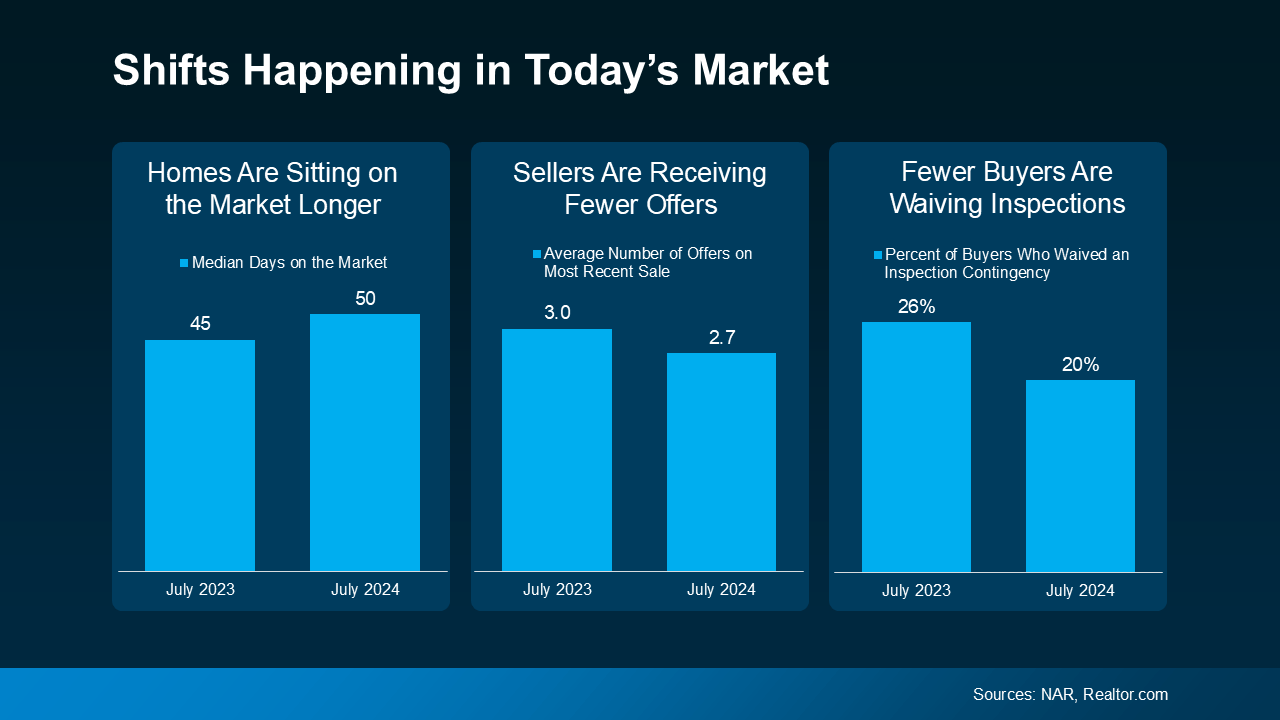

“Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis.”

The graphs below use the latest data from NAR and Realtor.com to help show examples of these changes:

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to price your house right if you want it to sell. If you don’t, buyers might choose better-priced options.

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to price your house right if you want it to sell. If you don’t, buyers might choose better-priced options.

Sellers Are Receiving Fewer Offers: As a seller, you might need to be more flexible and willing to compromise on price or terms to close the deal. For buyers, you could start to face less intense competition since you have more options to choose from.

Fewer Buyers Are Waiving Inspections: As a buyer, you have more negotiation power now. And that’s why fewer buyers are waiving inspections. For sellers, this means you need to be ready to negotiate and address repair requests to keep the sale moving forward.

How a Real Estate Agent Can Help

But this is just the national picture. The type of market you’re in is going to vary a lot based on how much inventory is available. So, lean on a local real estate agent for insight into how your area stacks up.

Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights, so you know exactly what’s happening and how to navigate it.

Bottom Line

The real estate market is always changing, and it’s important to stay informed. Whether you’re buying or selling, understanding this shift toward a balanced market can help. If you have any questions or need expert advice, don’t hesitate to reach out.

To view original article, visit Keeping Current Matters.

Why You Should Think About Listing Prices Like an Auction’s Reserve Price

Frequent and competitive bidding wars are creating an auction-like atmosphere in many real estate transactions.

Should We Fear the Surge in Cash-Out Refinances?

Today’s cash-out refinance situation bears no resemblance to the situation that preceded the housing crash.

What Credit Score Do You Need for a Mortgage?

Planning to buy a home? Speak to an expert about steps you can take to improve your credit score so you’re in the best position possible.

To Renovate or Not To Renovate Before You Sell

Spending costly time and money on renovations before you sell might just mean you’ll miss your key window of opportunity.

What Is the Strongest Tailwind to Today’s Recovering Economy?

Real estate has been a beacon of light during a very challenging time in our nation’s history.

What Is the #1 Financial Benefit of Homeownership?

The wealth-building power of homeownership shows that home is not only where your heart is, but also where your wealth is.

.jpg )