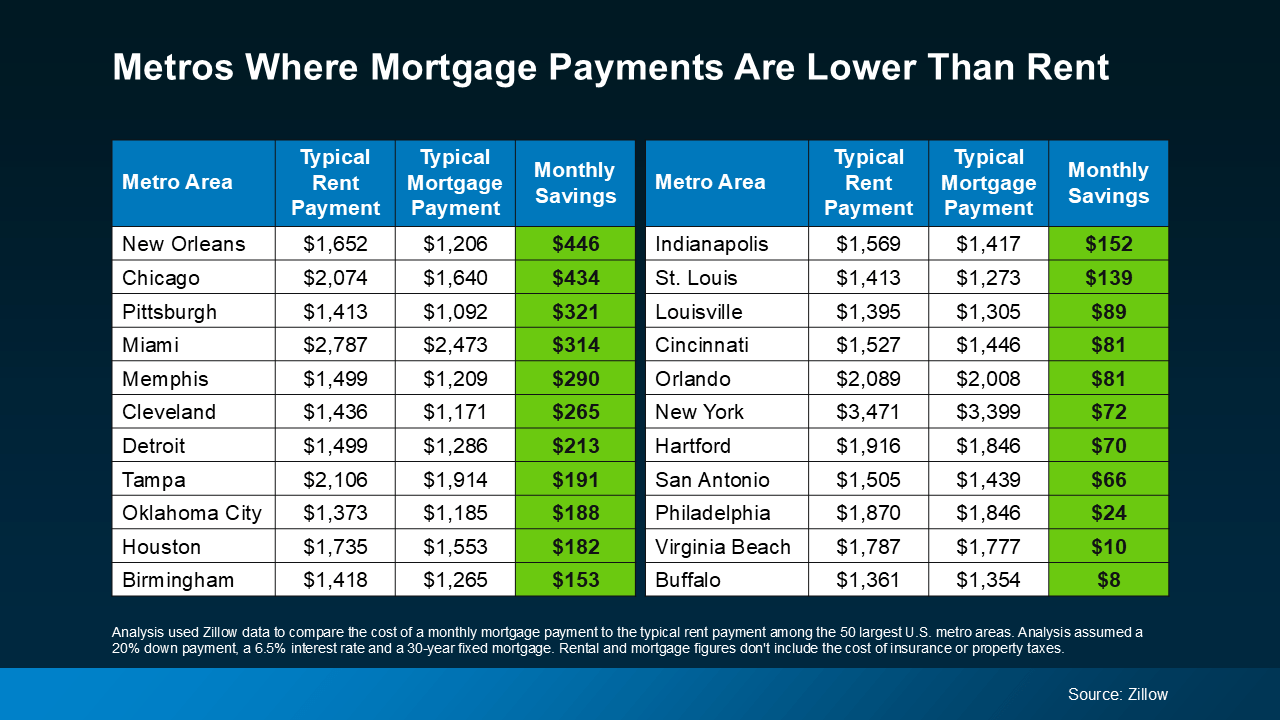

“In 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments.”

That’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below):

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of that up, it’s getting less expensive to buy a home than to rent one in many parts of the country.

This is a big deal if you’ve been renting for a while now. But if you don’t see your city on this list, don’t sweat it. Things are moving fast, and your area might be joining these top metros soon.

You see, talking with a local real estate agent about what’s happening in your market before this happens in your ideal neighborhood could really change the game for you. It’s all about being informed by a true expert, and understanding what was out of reach before might actually be getting more affordable than you think.

Now, while this study compares monthly rent to principal and interest on a mortgage payment (not the whole monthly payment), let’s think through this. As Zillow notes, what you can’t ignore when you buy a home are things like taxes, insurance, utilities, and maintenance that should also be factored into your budget and your monthly payment.

But remember – renters pay extra fees too, like renters’ insurance, utilities, parking, and more. And while doing the math may feel like a drag, this equation could be a much more exciting one to work through today.

So, grab your calculator and your agent because the big takeaway is this: it may be time to determine if you’re in a spot to afford what you couldn’t just a few months ago.

As Orphe Divounguy, Senior Economist at Zillow, says:

“… for those who can make it work, homeownership may come with lower monthly costs and the ability to build long-term wealth in the form of home equity — something you lose out on as a renter. With mortgage rates dropping, it’s a great time to see how your affordability has changed and if it makes more sense to buy than rent.”

Whether you live in one of these budget-friendly metros where the scales have already tipped in your favor, or any town in-between, it’s time to connect with a local real estate agent to get the conversation started.

With mortgage rates coming down and more homes hitting the market, you’ll want to be ready to jump back into your search – before everyone else does.

Bottom Line

If you’re tired of renting and ready to find out what it takes to purchase a home in our area now that the landscape may be shifting, let’s do the math together to see if buying a home makes sense for you now or sometime soon.

To view original article, visit Keeping Current Matters.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

.jpg )