“Experts say a flood of foreclosures isn’t coming.”

The rising cost of just about everything from groceries to gas right now is leading to speculation that more people won’t be able to afford their mortgage payments. And that’s creating concern that a lot of foreclosures are on the horizon. While it’s true that foreclosure filings have gone up a bit compared to last year, experts say a flood of foreclosures isn’t coming.

Take it from Bill McBride of Calculated Risk. McBride is an expert on the housing market, and after closely following the data and market environment leading up to the crash, he was able to see the foreclosures coming in 2008. With the same careful eye and analysis, he has a different take on what’s ahead in the current market:

“There will not be a foreclosure crisis this time.”

Let’s look at why another flood is so unlikely.

There Aren’t Many Homeowners Who Are Seriously Behind on Their Mortgage Payments

One of the main reasons there were so many foreclosures during the last housing crash was because relaxed lending standards made it easy for people to take out mortgages, even if they couldn’t show that they’d be able to pay them back. At that time, lenders weren’t being very strict when assessing applicant credit scores, income levels, employment status, and debt-to-income ratio.

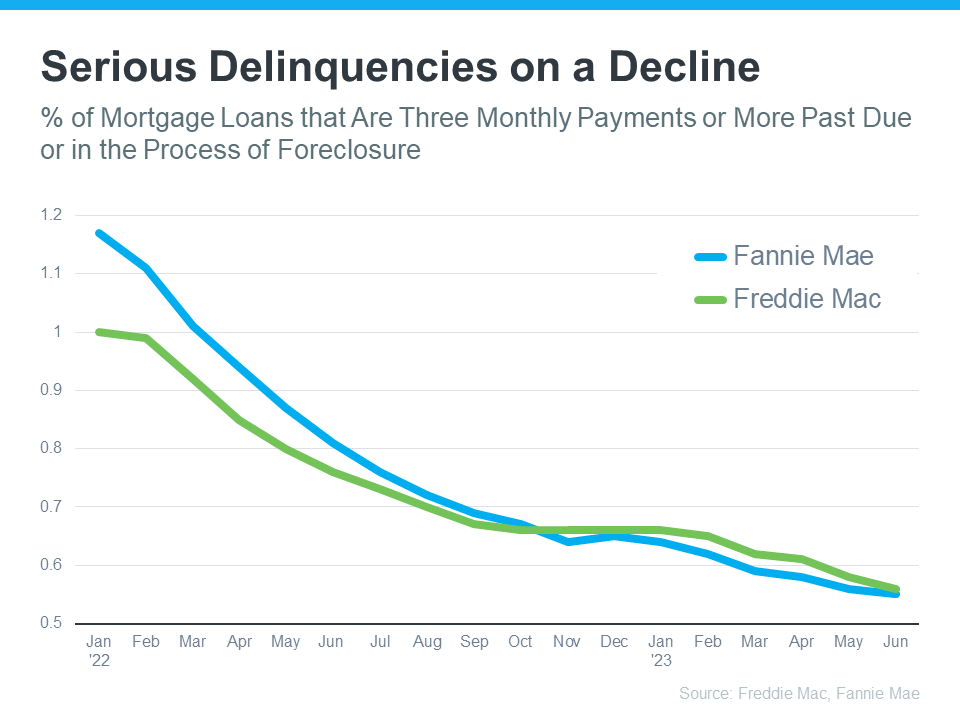

But now, lending standards have tightened, leading to more qualified buyers who can afford to make their mortgage payments. And data from Freddie Mac and Fannie Mae shows the number of homeowners who are seriously behind on their mortgage payments is declining (see graph below):

Molly Boese, Principal Economist at CoreLogic, explains just how few homeowners are struggling to make their mortgage payments:

Molly Boese, Principal Economist at CoreLogic, explains just how few homeowners are struggling to make their mortgage payments:

“May’s overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit. Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020.”

Before there can be a significant rise in foreclosures, the number of people who can’t make their mortgage payments would need to rise. Since so many buyers are making their payments today, a wave of foreclosures isn’t likely.

Bottom Line

If you’re worried about a potential flood of foreclosures, know there’s nothing in the data today to suggest that’ll happen. In fact, qualified buyers are making their mortgage payments at a very high rate.

To view original article, visit Keeping Current Matters.

If Your House’s Price Is Not Compelling, It’s Not Selling

Work with a local real estate agent who’s going to be honest with you about how you should price your house.

Why More People Are Buying Multi-Generational Homes Today

According to the latest data from NAR, cost savings are the main reason more people are choosing to live with family today.

When Is the Perfect Time To Move?

No matter when you buy, there’s always some benefit and some sort of trade-off – and that’s not a bad thing.

That’s just the reality of it.

One Homebuying Step You Don’t Want To Skip: Pre-Approval

A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.

The Truth About Credit Scores and Buying a Home

You don’t need perfect credit to buy a home, but your score can have an impact on your loan options and the terms you’re able to get.

What To Save for When Buying a Home

Planning ahead and understanding the costs you may encounter upfront can make buying a home less intimidating and allow you to take control of the process.

.jpg )