“Let’s see exactly how experts’ thinking has shifted – and what’s caused the change.”

Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall.

So, let’s see exactly how experts’ thinking has shifted – and what’s caused the change.

2024 Home Price Forecasts: Then and Now

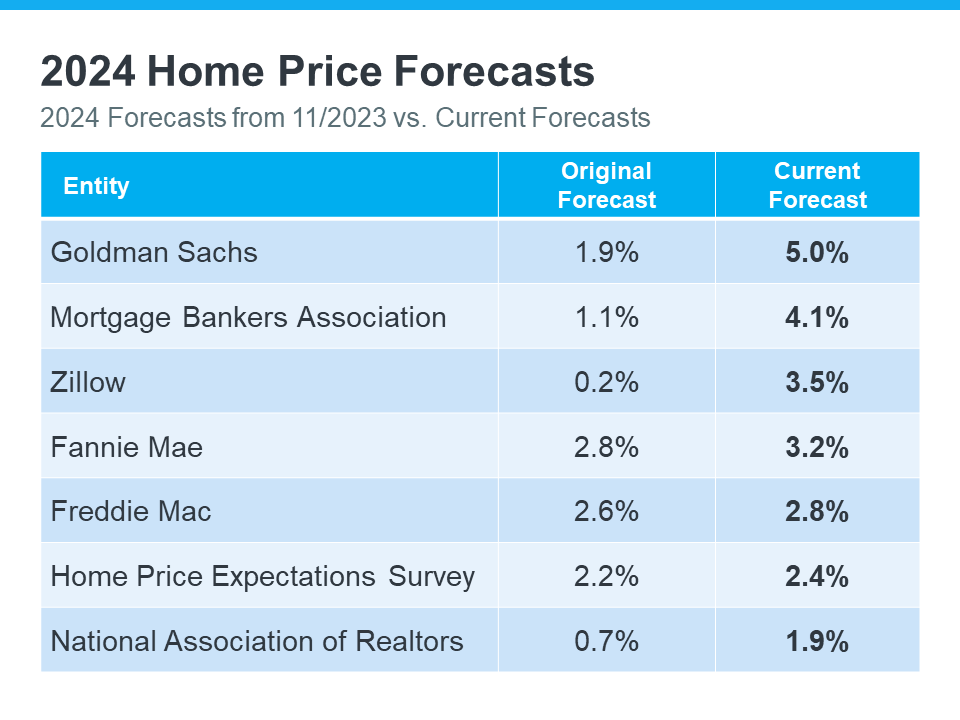

The chart below shows what seven expert organizations think will happen to home prices in 2024. It compares their first 2024 home price forecasts (made at the end of 2023) with their newest projections:

The middle column shows that, at first, these experts thought home prices would only go up a little this year. But if you look at the column on the right, you’ll see they’ve all updated their forecasts and now think prices will go up more than they originally thought. And some of the differences are major.

There are two big factors keeping such strong upward pressure on home prices. The first is how few homes are for sale right now. According to Business Insider:

“Low home inventory is a chronic problem in the US. This has generally kept home prices up . . .”

A lack of housing inventory has been pushing prices up for a long time now – and that’s not expected to change dramatically this year. But what has changed a bit is mortgage rates.

Late last year when most housing market experts were calling for home prices to rise only a little bit in 2024, mortgage rates were up and buyer demand was more moderate.

Now that rates have come down from their peak last October, and with further declines expected over the course of the year, buyer demand has picked up. That increase in demand, along with an ongoing lack of inventory, is what’s caused the experts to feel the upward pressure on prices will be stronger than they expected a couple months ago.

A Look Forward To Get Ahead of the Next Forecast Revisions

Real estate experts regularly revise their home price forecasts as the housing market shifts. It’s a normal part of their job that ensures their projections are always up-to-date and factor in the latest changes in the housing market.

That means they’ll continue to revise their projections as the housing market changes, just as they’ve always done. How those forecasts change next is anyone’s guess, but pay attention to mortgage rates.

If they trend down as the year goes on, as they’re expected to do, that could lead to more buyer demand and even higher home price forecasts.

Basically, it’s all about supply and demand. With supply still so limited, anything that causes demand to go up will likely cause prices to go up, too.

Bottom Line

At first, experts believed home prices would only go up a little this year. But now, they’ve changed their minds and forecast prices will grow even more than they originally thought. Let’s connect so you know what to expect with prices in our area.

To view original article, visit Keeping Current Matters.

What Mortgage Rate Are You Waiting For?

If you’ve been holding out and waiting for rates to come down, know that it’s already happening.

Today’s Biggest Housing Market Myths

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts and sort out the misconceptions.

How To Choose a Great Local Real Estate Agent

The right agent should be someone you trust to guide you through one of the most significant transactions of your life.

How Mortgage Rate Changes Impact Your Homebuying Power

Real estate agents have the expertise to help you understand what’s happening and what it means for you.

What Credit Score Do You Really Need to Buy a House?

While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy.

Is Affordability Starting to Improve?

While affordability is still tight, there are signs it’s getting a little better and might keep improving throughout the rest of the year. Here’s a look at the latest data.

.jpg )