“Price is not the only market factor that impacts affordability.”

Home buying activity (demand) is up, and the number of available listings (supply) is down. When demand outpaces supply, prices appreciate. That’s why firms are beginning to increase their projections for home price appreciation going forward. As an example, CoreLogic increased their 12-month projection for home values from 4.5% to 5.6% over the last few months.

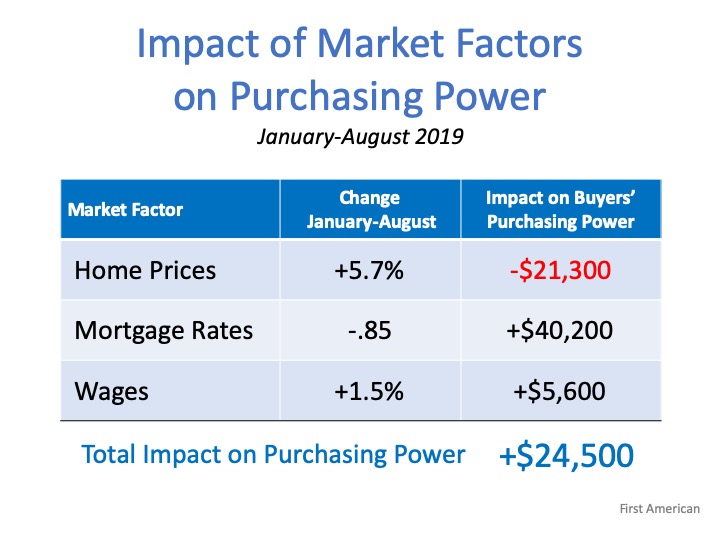

The reacceleration of home values will cause some to again voice concerns about affordability. Just last week, however, First American came out with a data analysis that explains how price is not the only market factor that impacts affordability. They studied prices, mortgage rates, and wages from January through August of this year. Here are their findings:

Home Prices

“In January 2019, a family with the median household income in the U.S. could afford to buy a $373,900 house. By August, that home had appreciated to $395,000, an increase of $21,100.”

Mortgage Interest Rates

“The 0.85 percentage point drop in mortgage rates from January 2019 through August 2019 increased affordability by 9.7%. That translates to a $40,200 improvement in house-buying power in just eight months.”

Wage Growth

“As rates have fallen in 2019, the economy has continued to perform well also, resulting in a tight labor market and wage growth. Wage growth pushes household incomes upward, which were 1.5% higher in August compared with January. The growth in household income increased consumer house-buying power by 1.5%, pushing house-buying power up an additional $5,600.”

When all three market factors are combined, purchasing power increased by $24,500, thus making home buying more affordable, not less affordable. Here is a table that simply shows the data:

Bottom Line

In the article, Mark Fleming, Chief Economist at First American, explained it best:

“Focusing on nominal house price changes alone as an indication of changing affordability, or even the relationship between nominal house price growth and income growth, overlooks what matters more to potential buyers – surging house-buying power driven by the dynamic duo of mortgage rates and income growth. And, we all know from experience, you buy what you can afford to pay per month.”

To view original article, visit Keeping Current Matters.

Worried about Home Maintenance Costs? Consider This

If you’re worried about home maintenance, here’s some information you may find interesting.

What’s Next for Home Prices and Mortgage Rates?

If you’re ready, willing, and able to afford a home right now, partner with a trusted real estate advisor to decide what’s right for you.

The Number of Homes for Sale Is Increasing

In today’s homebuying market, it’s more important than ever to find a real estate agent who really knows your local area.

Thinking of Selling? You Want an Agent with These Skills

A great agent will be very good at explaining what’s happening in the housing market in a way that’s easy to understand.

Home Prices Are Climbing in These Top Cities

Persistent demand coupled with limited housing supply are key drivers pushing home values upward.

How Buying or Selling a Home Benefits Your Community

It makes sense that housing creates a lot of jobs because so many different kinds of work are involved in the industry.

.jpg )