“Price is not the only market factor that impacts affordability.”

Home buying activity (demand) is up, and the number of available listings (supply) is down. When demand outpaces supply, prices appreciate. That’s why firms are beginning to increase their projections for home price appreciation going forward. As an example, CoreLogic increased their 12-month projection for home values from 4.5% to 5.6% over the last few months.

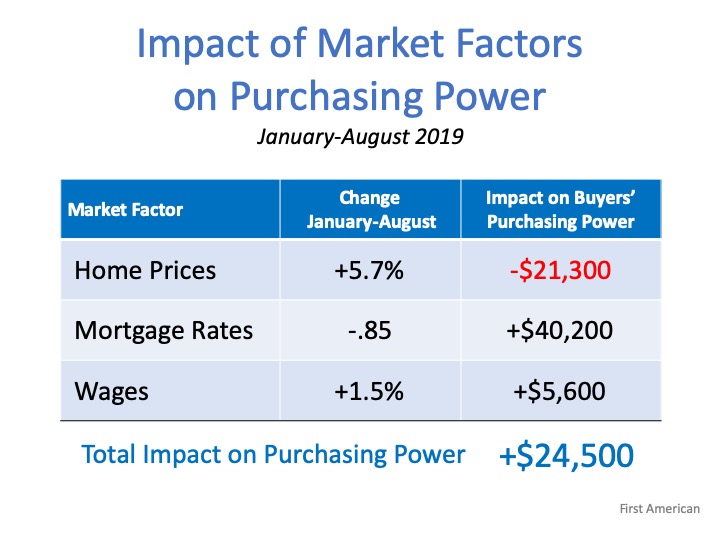

The reacceleration of home values will cause some to again voice concerns about affordability. Just last week, however, First American came out with a data analysis that explains how price is not the only market factor that impacts affordability. They studied prices, mortgage rates, and wages from January through August of this year. Here are their findings:

Home Prices

“In January 2019, a family with the median household income in the U.S. could afford to buy a $373,900 house. By August, that home had appreciated to $395,000, an increase of $21,100.”

Mortgage Interest Rates

“The 0.85 percentage point drop in mortgage rates from January 2019 through August 2019 increased affordability by 9.7%. That translates to a $40,200 improvement in house-buying power in just eight months.”

Wage Growth

“As rates have fallen in 2019, the economy has continued to perform well also, resulting in a tight labor market and wage growth. Wage growth pushes household incomes upward, which were 1.5% higher in August compared with January. The growth in household income increased consumer house-buying power by 1.5%, pushing house-buying power up an additional $5,600.”

When all three market factors are combined, purchasing power increased by $24,500, thus making home buying more affordable, not less affordable. Here is a table that simply shows the data:

Bottom Line

In the article, Mark Fleming, Chief Economist at First American, explained it best:

“Focusing on nominal house price changes alone as an indication of changing affordability, or even the relationship between nominal house price growth and income growth, overlooks what matters more to potential buyers – surging house-buying power driven by the dynamic duo of mortgage rates and income growth. And, we all know from experience, you buy what you can afford to pay per month.”

To view original article, visit Keeping Current Matters.

Houses Are Still Selling Fast

Homes are selling faster than the norm for this time of year – and your house may sell quickly too. Are you thinking about selling your house? Give us a call!

Why Having Your Own Agent Matters When Buying a New Construction Home

Having a trusted agent on your side can make a big difference when it comes to buying a newly constructed home!

Don’t Wait Until Spring To Sell Your House

While spring is usually the peak homebuying season, you don’t actually need to wait until spring to sell.

2 of the Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Ever wonder why they change?

Will a Silver Tsunami Change the 2024 Housing Market?

The thought is that as baby boomers grow older, a significant number will start downsizing their homes, but will it happen this year?

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

.jpg )