“If you’re wondering what’s going on with home prices, here’s the scoop.”

Thinking about buying a home or selling your current one to find a better fit? If so, you might be wondering what’s going on with home prices these days. Here’s the scoop.

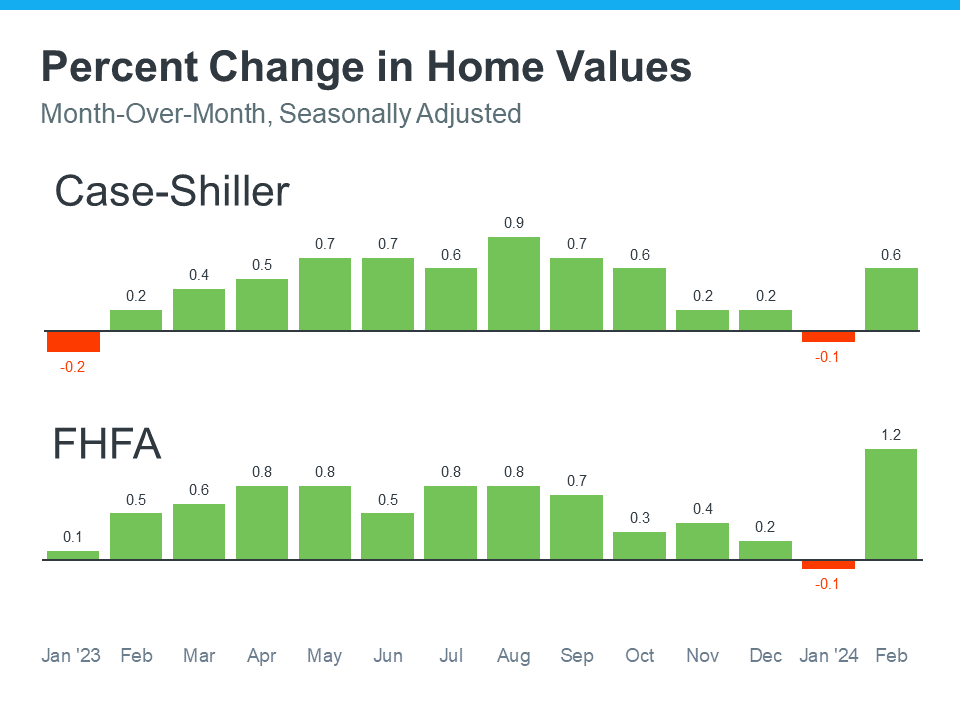

The latest national data from Case-Shiller and the Federal Housing Finance Agency (FHFA) shows they’re going up (see graphs below):

As you can see, home prices were rising for most of 2023. But over the course of December and January, they were virtually flat – which is pretty normal for that time of year.

But here’s what you need to know now. As of February, when the spring market kicked off, prices were on the rise again.

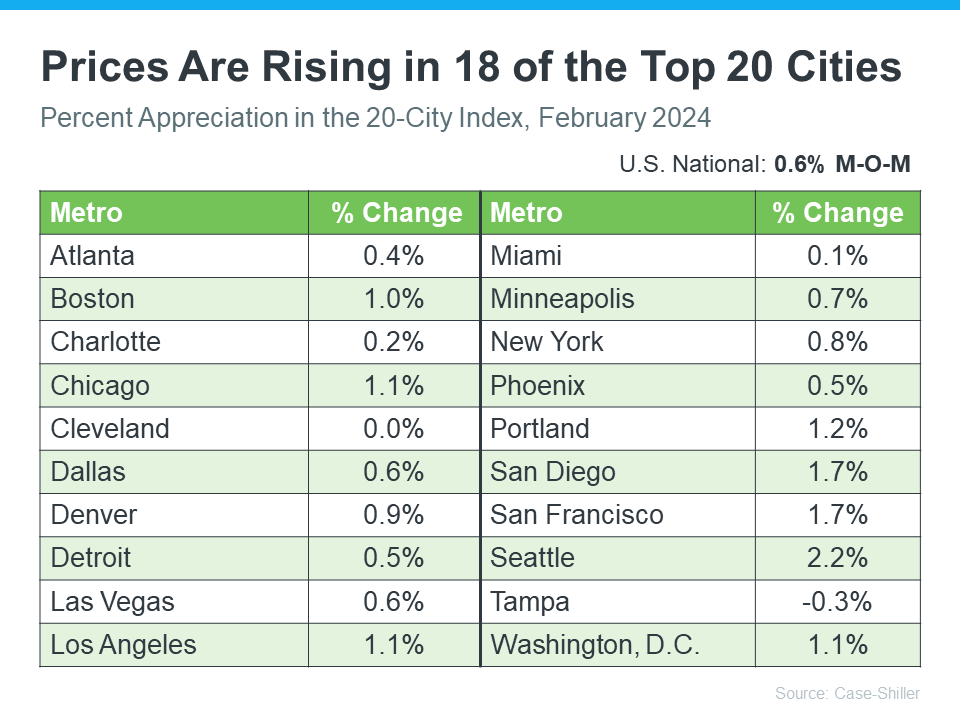

Home Prices Are Going Up in Most of America’s Top Cities

After seeing a jump in home prices nationally in February, you might be wondering if they’re going up in your area, too. While it depends on where you live, prices are rising in 18 of the top 20 cities Case-Shiller reports on in the monthly price index (see chart below):

Most experts also think home prices will keep rising and end the year on a high note. Forbes explains why:

“Even as mortgage rates have reached their highest level since November, persistent demand coupled with limited housing supply are key drivers pushing home values upward.”

How This Impacts You

- For Buyers: If you’re ready, willing, and able to buy a home, purchasing before prices go up even more might be a smart choice, since home values are expected to keep climbing.

- For Sellers: Prices are going up because there still aren’t enough homes available for sale right now compared to today’s buyer demand. So, if you work with an agent to price your house right, you might receive multiple offers and sell quickly.

Bottom Line

The data shows home prices are increasing nationally. Let’s chat to see exactly what’s going on with prices in our neighborhood.

To view original article, visit Keeping Current Matters.

Key Skills You Need Your Listing Agent To Have

A listing agent, also known as a seller’s agent, helps market and sell your house while advocating for you every step of the way.

Are You a Homebuyer Worried About Climate Risks?

Homebuyers are interested in finding out if the house they want will be exposed to things like floods, extreme heat, and wildfires.

Home Prices Are Not Falling

Don’t fall for the negative headlines and become part of this statistic. Remember, data from a number of sources shows home prices aren’t falling anymore.

Unpacking the Long-Term Benefits of Homeownership

Higher mortgage rates, rising home prices, and ongoing affordability concerns may make you wonder if you should buy a home right now.

Why Your House Didn’t Sell

For insight on why your home didn’t sell, rely on a trusted real estate agent. A great agent will offer expert advice on relisting your house with effective strategies to get it sold.

The Return of Normal Seasonality for Home Price Appreciation

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear.

.jpg )