“The average homeowner’s net worth is almost 40X greater than a renter’s.”

If you’re weighing your options to decide whether it makes more sense to rent or buy a home today, here’s one key data point that could help you feel more confident in making your decision. Every three years, the Federal Reserve Board releases the Survey of Consumer Finances (SCF). That report covers the difference in net worth for both homeowners and renters. Spoiler alert: the gap between the two is significant.

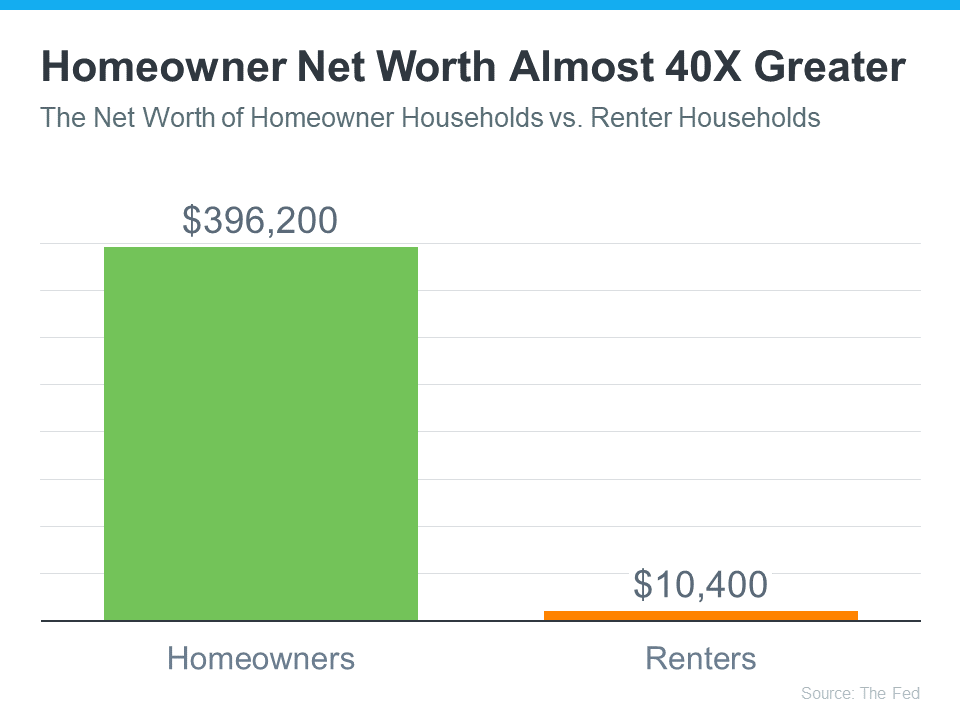

The average homeowner’s net worth is almost 40X greater than a renter’s. And here’s the data to prove it (see graph below):

The Big Reason Homeowner Net Worth Is So High

In the previous version of that report, the net worth of the average homeowner was roughly $255,000 and that of the average renter was $6,300. But in the release that just came out this year, the gap widened as homeowner net worth climbed dramatically. As the Survey of Consumer Finances (SCF) report says:

“. . . the 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.”

One of the biggest reasons homeowner net worth skyrocketed is home equity.

Over the last few years, known as the ‘unicorn’ years for housing, home prices went through the roof. That’s because there weren’t enough homes for sale, and there was a big influx of buyers rushing to buy them and take advantage of the then record-low mortgage rates. That imbalance of supply and demand pushed prices higher and higher. As a result, most homeowners who had a home during that time saw their equity grow a lot.

If you’re still in the middle of making your decision on whether to rent or buy, you may wonder if you missed the boat on the big net worth boost. But here’s what you need to realize. As a recent article in The Ascent explains:

“Whether your net worth increased in recent years or not, there are steps you can take to boost that number in the coming years. . . buying a home can be a great way to grow your net worth, since home values have a tendency to rise over time.”

Historically, home prices climb over time. Even now that mortgage rates are closer to 7-8%, prices are still rising in many areas of the country because supply is still low compared to demand. That’s why expert forecasts for the next few years call for ongoing appreciation – just at a pace that’s more typical for the housing market.

While it likely won’t be the record ramp-up that happened over the last few years, people who buy now should continue to grow equity in the years ahead. That means, if you’re ready and able to buy a home today, you’ll be making an investment that’ll help build your net worth in the long run.

As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“. . . when deciding to rent vs buy, one must calculate the total cost of homeownership (maintenance, utilities, commuting, etc.) and the total financial benefit. Based on new Fed data . . . the median net worth of homeowners was $396,200 vs renters at $10,400. There is no question about the wealth gains that homeownership provides.”

Bottom Line

If you’re on the fence about whether to rent or buy a home, remember that homeownership can give your net worth a big boost over time. If you want to learn more about this or the many other benefits of owning a home, let’s connect.

To view original article, visit Keeping Current Matters.

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Best Week To List Your House Is Almost Here – Are You Ready?

A seller listing a well-priced, move-in ready home is likely to find success.

.jpg )