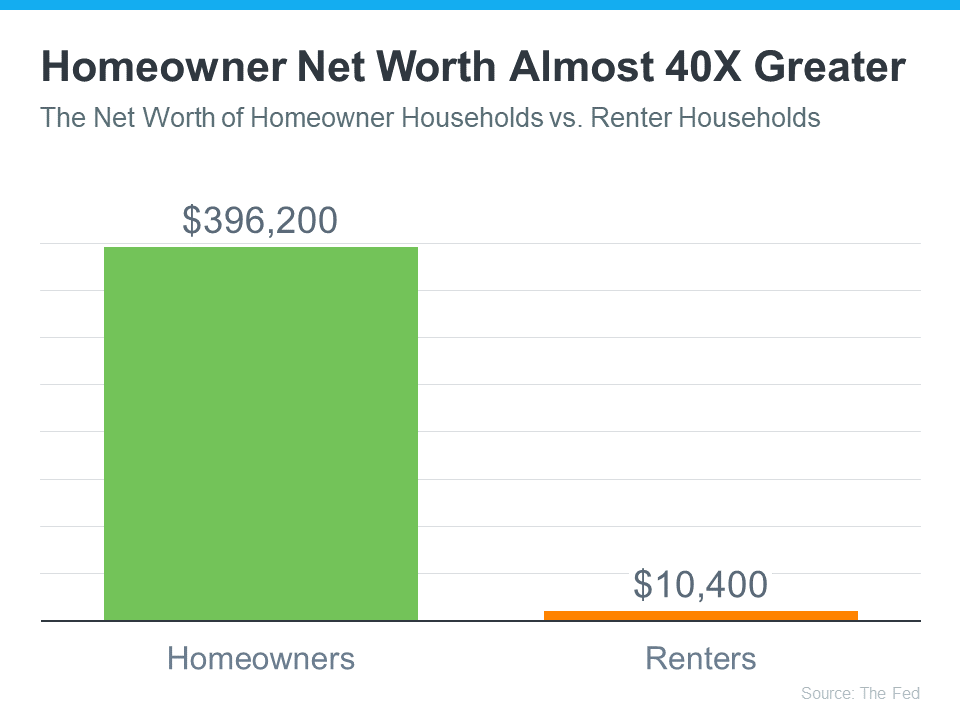

“The average homeowner’s net worth is almost 40X greater than a renter’s.”

If you’re weighing your options to decide whether it makes more sense to rent or buy a home today, here’s one key data point that could help you feel more confident in making your decision. Every three years, the Federal Reserve Board releases the Survey of Consumer Finances (SCF). That report covers the difference in net worth for both homeowners and renters. Spoiler alert: the gap between the two is significant.

The average homeowner’s net worth is almost 40X greater than a renter’s. And here’s the data to prove it (see graph below):

The Big Reason Homeowner Net Worth Is So High

In the previous version of that report, the net worth of the average homeowner was roughly $255,000 and that of the average renter was $6,300. But in the release that just came out this year, the gap widened as homeowner net worth climbed dramatically. As the Survey of Consumer Finances (SCF) report says:

“. . . the 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.”

One of the biggest reasons homeowner net worth skyrocketed is home equity.

Over the last few years, known as the ‘unicorn’ years for housing, home prices went through the roof. That’s because there weren’t enough homes for sale, and there was a big influx of buyers rushing to buy them and take advantage of the then record-low mortgage rates. That imbalance of supply and demand pushed prices higher and higher. As a result, most homeowners who had a home during that time saw their equity grow a lot.

If you’re still in the middle of making your decision on whether to rent or buy, you may wonder if you missed the boat on the big net worth boost. But here’s what you need to realize. As a recent article in The Ascent explains:

“Whether your net worth increased in recent years or not, there are steps you can take to boost that number in the coming years. . . buying a home can be a great way to grow your net worth, since home values have a tendency to rise over time.”

Historically, home prices climb over time. Even now that mortgage rates are closer to 7-8%, prices are still rising in many areas of the country because supply is still low compared to demand. That’s why expert forecasts for the next few years call for ongoing appreciation – just at a pace that’s more typical for the housing market.

While it likely won’t be the record ramp-up that happened over the last few years, people who buy now should continue to grow equity in the years ahead. That means, if you’re ready and able to buy a home today, you’ll be making an investment that’ll help build your net worth in the long run.

As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“. . . when deciding to rent vs buy, one must calculate the total cost of homeownership (maintenance, utilities, commuting, etc.) and the total financial benefit. Based on new Fed data . . . the median net worth of homeowners was $396,200 vs renters at $10,400. There is no question about the wealth gains that homeownership provides.”

Bottom Line

If you’re on the fence about whether to rent or buy a home, remember that homeownership can give your net worth a big boost over time. If you want to learn more about this or the many other benefits of owning a home, let’s connect.

To view original article, visit Keeping Current Matters.

Real Estate Mogul: Here’s Why You Should Buy

Real Estate mogul, Sean Conlon, host of The Deed: Chicago on CNBC, was recently asked the question, should you buy? Or should you rent a house? Conlon responded: “I am a true believer that you save every penny and you buy your first house… and that is still the...

Green Matters in Real Estate!

Your clients want to hear more about green real estate and why it matters, surveys show. Whether they're first-time buyers or existing homeowners, consumers are showing more desire to learn more about environmental matters in housing. Indeed, 61 percent of homeowners...

The Importance of Using a Professional to Sell Your Home

When a homeowner decides to sell their house, they obviously want the best possible price for it with the least amount of hassles along the way. However, for the vast majority of sellers, the most important result is actually getting their homes sold. In order to...

Measuring Your Ability to Achieve the American Dream

Forbes.com recently released the results of their new American Dream Index, in which they measure “the prosperity of the middle class, and…examine which states best support the American Dream.” The monthly index measures several different economic factors, including...

US Housing Market Continues the Move into ‘Buy Territory’!

According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment. The BH&J Index is a...

Is This the Best Seller’s Market Ever?

The inventory squeeze has left home buyers with fewer options on the market than they've seen in decades. While that's bad news for them, the continuously high demand means it's one of the best times to be a seller—ever. "I've been selling real estate for 25 years,...

.jpg )