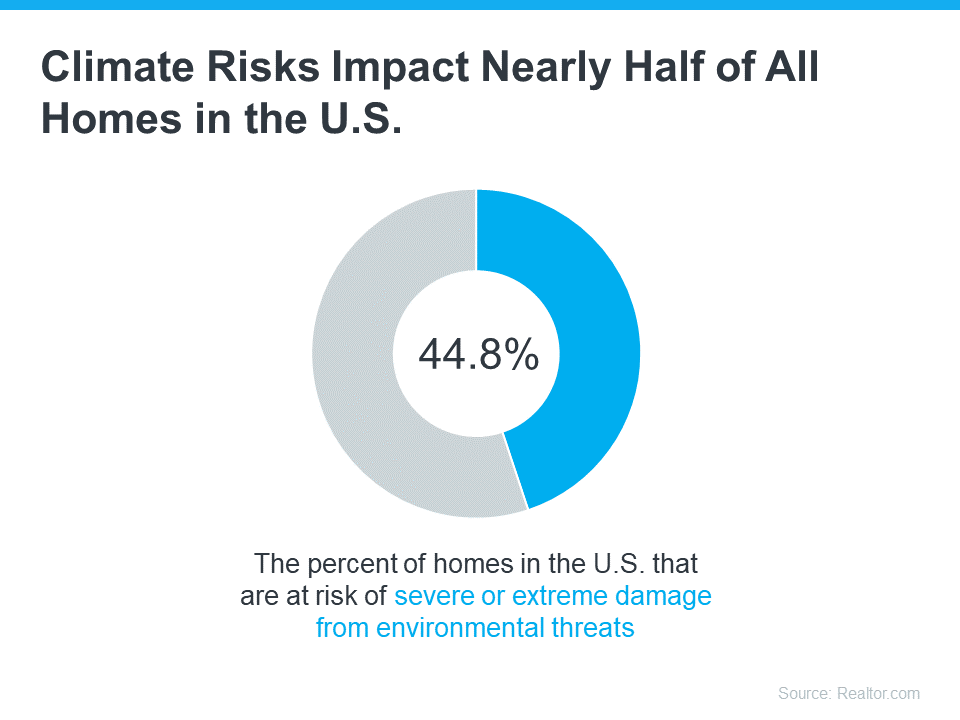

“Climate risks impact nearly half of all homes in the U.S.”

Climate change is impacting where people buy homes. As the experts at the National Association of Realtors (NAR) explain:

“Sixty-three percent of people who have moved since the pandemic began say they believe climate change is—or will be—an issue in the place they currently live.”

If you’re planning to move, climate change is something you might want to consider, no matter where you are. A recent study from Realtor.com helps put the growing impact climate change is having on real estate into perspective (see below):

So, how can you be sure your investment is safe from the elements?

For starters, work with a local real estate agent to understand the likelihood of your future home being exposed to hazards like wind, floods, and wildfires. Your agent will know the area and be able to tell you about the risks you’ll most likely face.

Beyond that, there are two important factors to think about: the quality of the home you want to buy and the insurance you’ll need to protect it.

A Home Built to Last

If you’re planning to be in your home for many years, you want to know it’s going to last. One way to think ahead is to work with your real estate agent to ensure the home you buy can withstand environmental hazards. They’re up to date on the most common building and remodeling techniques—like a secondary water barrier on the roof or noncombustible, fire-resistant exterior walls—used to protect homes from the effects of climate change.

And if the home you’re interested in doesn’t have the features you’re looking for, they can help you determine what you may be able to negotiate in the contract or what work it might require in the future.

Insurance To Protect It

Once you’re confident the home you’re looking at is well built, the next step is finding out what it’s going to take to insure it. As Selma Hepp, Chief Economist at CoreLogic, says:

“. . . homeowners are going to become increasingly more aware of risks of living in some areas as it becomes prohibitively expensive or very difficult to obtain hazard insurance.”

In areas where climate risks are having a bigger impact, the right home insurance can make a big difference. And the price of that insurance is an important factor when thinking about your budget and the true cost of buying and protecting your home. Get an insurance quote early in the process because you may want to compare multiple quotes and it can take several weeks to get them.

While this may feel like a lot to consider, don’t worry. An agent can help. Your real estate agent will be your go-to resource on the homebuying process, what to look for and consider, and how climate change may affect your next home. With the right planning and an agent’s expert advice, you can make this happen. Homeownership is worth it. And with a great agent by your side, you can make sure the home you find is the right fit.

Bottom Line

Climate change is an important factor to think about when buying a home. After all, your home is a huge investment, and you want to be ready for anything that might affect it. Let’s chat so you can find the perfect home.

To view original article, visit Keeping Current Matters.

With Mortgage Rates Climbing, Now’s the Time to Act

Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades.

Why Inflation Shouldn’t Stop You from Buying a Home in 2022

Housing is commonly looked at as a good inflation hedge, especially with interest rates so low.

Real Estate Professionals Are Experts at Keeping You Safe When You Sell

Real estate professionals have learned new technologies plus safety and sanitation measures.

There Won’t Be a Wave of Foreclosures in the Housing Market

Most homeowners exited their forbearance plan either fully caught up or with a plan from the bank to start making payments again.

Avoid the Rental Trap in 2022

Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.

How Much Do You Need for Your Down Payment?

Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process.

.jpg )