“A lingering listing with no takers…”

A lingering listing with no takers … how long does it take until the home seller to accept that a price reduction is needed? The most common answer was three months, if there have been zero offers, according to a new survey by ShelterZoom, a blockchain-based real estate platform.

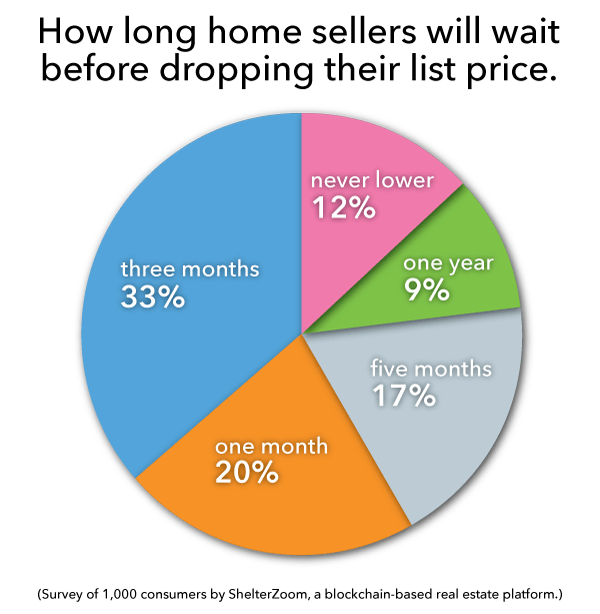

Thirty-three percent of 1,000 consumers surveyed say they would opt for a price cut after three months, the most common choice. Slightly under 20% say they would wait just one month; 17% would wait five months; and 9% say they’d wait an entire year before they’d consider reducing their asking price. The remainder say they would never lower their asking price.

But waiting for and receiving an offer can be stressful. Home sellers said they’d like some extra assurance when offers are presented to buyers. Forty-eight percent of respondents said they’d like to ensure that their offer was presented to the seller and to track it every step of the way.

And when an offer does come, home sellers wish the process would speed up. Forty-eight percent of consumers surveyed said they think it takes too long to get a mortgage approved. Thirty-six percent say it takes too long for contracts to be signed and 34% believe too many people are involved in the process.

“When you consider how fast everything moves these days, thanks in large part to technology, and how short attention spans and expectation spans have gotten as a result, the home buying and selling processes are even more of an anachronism than they were just a few years ago,” says Allen Alishahi, co-founder of ShelterZoom.

To view original article, visit REALTOR Magazine.

Why There Won’t Be a Recession That Tanks the Housing Market

The fundamentals of the economy, despite some hiccups, are doing pretty good.

What To Know About Credit Scores Before Buying a Home

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan.

Why You Want an Agent’s Advice for Your Move

A real estate advisor can anticipate what could happen next and work with you to put together a solid plan.

Why Today’s Housing Supply Is a Sweet Spot for Sellers

The number of homes for sale and new listing activity continues to improve compared to last year.

The Truth About Down Payments

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

Expert Home Price Forecasts for 2024 Revised Up

Now that rates have come down from their peak, and with further declines expected this year, buyer demand has picked up.

.jpg )