“A lingering listing with no takers…”

A lingering listing with no takers … how long does it take until the home seller to accept that a price reduction is needed? The most common answer was three months, if there have been zero offers, according to a new survey by ShelterZoom, a blockchain-based real estate platform.

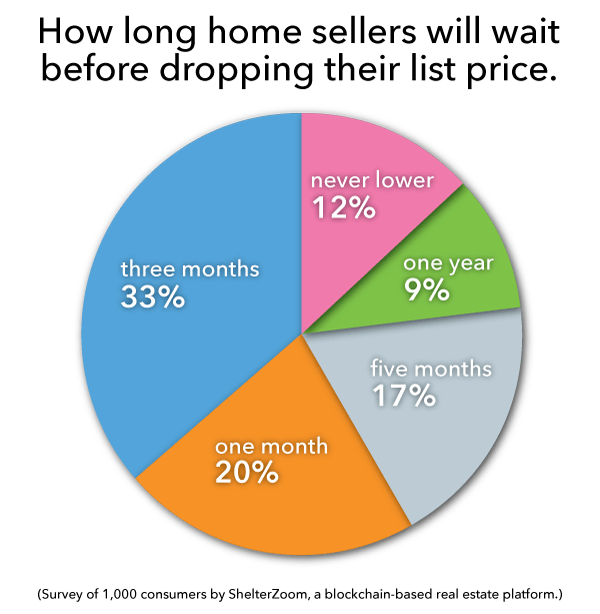

Thirty-three percent of 1,000 consumers surveyed say they would opt for a price cut after three months, the most common choice. Slightly under 20% say they would wait just one month; 17% would wait five months; and 9% say they’d wait an entire year before they’d consider reducing their asking price. The remainder say they would never lower their asking price.

But waiting for and receiving an offer can be stressful. Home sellers said they’d like some extra assurance when offers are presented to buyers. Forty-eight percent of respondents said they’d like to ensure that their offer was presented to the seller and to track it every step of the way.

And when an offer does come, home sellers wish the process would speed up. Forty-eight percent of consumers surveyed said they think it takes too long to get a mortgage approved. Thirty-six percent say it takes too long for contracts to be signed and 34% believe too many people are involved in the process.

“When you consider how fast everything moves these days, thanks in large part to technology, and how short attention spans and expectation spans have gotten as a result, the home buying and selling processes are even more of an anachronism than they were just a few years ago,” says Allen Alishahi, co-founder of ShelterZoom.

To view original article, visit REALTOR Magazine.

Renting vs. Buying: The Net Worth Gap You Need To See

If you’re on the fence, it may be helpful to speak with a local real estate agent. They can help you weigh your options.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Understanding what’s happening will help you make the right decisions, whether that’s buying or selling.

Is a Fixer Upper Right for You?

The perfect home is the one you perfect after buying it. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home.

How Real Estate Agents Take the Fear Out of Moving

Real estate agents are trusted guides to help you navigate the complexities of the housing market with confidence and ease.

Why Home Sales Bounce Back After Presidential Elections

As has been the case before, once the election uncertainty passes, buyers and sellers will return to the market.

Why Your House Will Shine in Today’s Market

If you’re thinking about selling, the shortage of homes for sale means your house is likely to get some serious attention from buyers.

.jpg )