“For a detailed look at real estate conditions in your area, connect with a local real estate agent.”

As you’re getting ready to sell your house, one of the first questions you’re probably asking is, “how long is this going to take?” And that makes sense—you want to know what to expect.

While every market is different, understanding what’s happening nationally can give you a good baseline. But for an even more detailed look at real estate conditions in your area, connect with a local real estate agent. They know your local market best and can explain what’s happening near you and how it compares to national trends.

Here’s a look at some of the things a great agent will walk you through during that conversation.

More Homes Are on the Market, and That’s Affecting How Long They Take To Sell

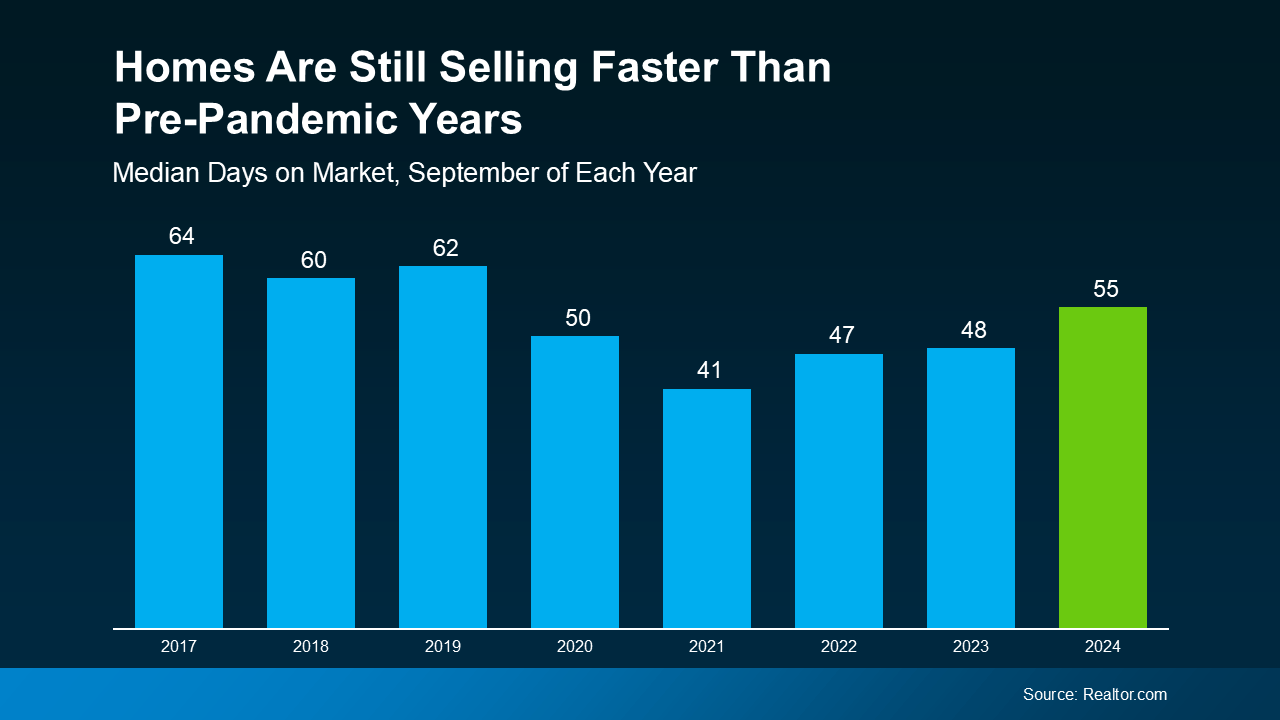

According to Realtor.com, the number of homes for sale has been going up this year. That means there are more options for buyers, which is great news for anyone looking to buy a home. But as a seller, it also means homes are staying on the market a bit longer now that buyers have more options to choose from (see graph below):

One of the big reasons homes sold so fast in recent years is because there were so few of them for sale. And now that there are more houses on the market, it makes sense that they aren’t selling at quite the same pace. Right now, according to Realtor.com, it takes 55 days from the time a house is listed for it to be officially sold and closed on.

One of the big reasons homes sold so fast in recent years is because there were so few of them for sale. And now that there are more houses on the market, it makes sense that they aren’t selling at quite the same pace. Right now, according to Realtor.com, it takes 55 days from the time a house is listed for it to be officially sold and closed on.

But keep this in mind. While homes might not be selling as quickly as they did last year at this time, they’re still selling faster than they did in more normal years in the housing market, before the pandemic.

If you look back at 2017-2019 in the graph above, you’ll see that it was typical for a house to take 60 days or more to sell. So, today’s process is still faster than the norm.

That’s because, even with more homes for sale, there are still more buyers than homes for sale. So, homes that show well and are priced right are selling fast. As NerdWallet explains:

“Overall, though, demand still outpaces supply. This is hardly a mellow market: Good homes sell quickly . . .”

Your Agent Can Help Your Home Stand Out

If you’re looking for ways to make your move happen as quickly as possible, partnering with a great local agent is the key. Your real estate agent will help you with everything from setting the right price to staging your home so it looks its best. They’ll even create a marketing plan that grabs buyers’ attention and will give you key insights about what’s happening in your specific area, so you can plan accordingly and make the process go as smoothly as possible.

So, while homes might be on the market a little longer than before, they’re still selling faster than the norm. If you have the right agent and the right strategy in place, your house may even sell faster than you’d expect.

Bottom Line

If you’re planning to sell your house, knowing how long it might take is a big part of planning your next steps. Let’s connect so you’ll be able to price, market, and sell your home with confidence.

To view original article, visit Keeping Current Matters.

Sell Your House Before the Holidays

A trusted real estate advisor can help you determine how much home equity you have and how you can use it to achieve your goal of making a move.

3 Trends That Are Good News for Today’s Homebuyers

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too.

Taking the Fear out of Saving for a Home

If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first but a trusted real estate professional can help.

What’s Ahead for Home Prices?

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted professional to help you make an informed decisions about what’s happening in our market.

The Emotional and Non-financial Benefits of Homeownership

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you.

The Cost of Waiting for Mortgage Rates to Go Down

As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can afford.

.jpg )