“Depending on where you live, property taxes can have a big impact on your monthly payment.”

When buying a home, taxes are one of the expenses that can make a significant difference in your monthly payment. Do you know how much you might pay for property taxes in your state or local area?

When applying for a mortgage, you’ll see one of two acronyms in your paperwork – P&I or PITI – depending on how you’re including your taxes in your mortgage payment.

P&I stands for Principal and Interest, and both are parts of your monthly mortgage payment that go toward paying off the loan you borrow. PITI stands for Principal, Interest, Taxes, and Insurance, and they’re all important factors to calculate when you want to determine exactly what the cost of your new home will be.

TaxRates.org defines property taxes as,

“A municipal tax levied by counties, cities, or special tax districts on most types of real estate – including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.”

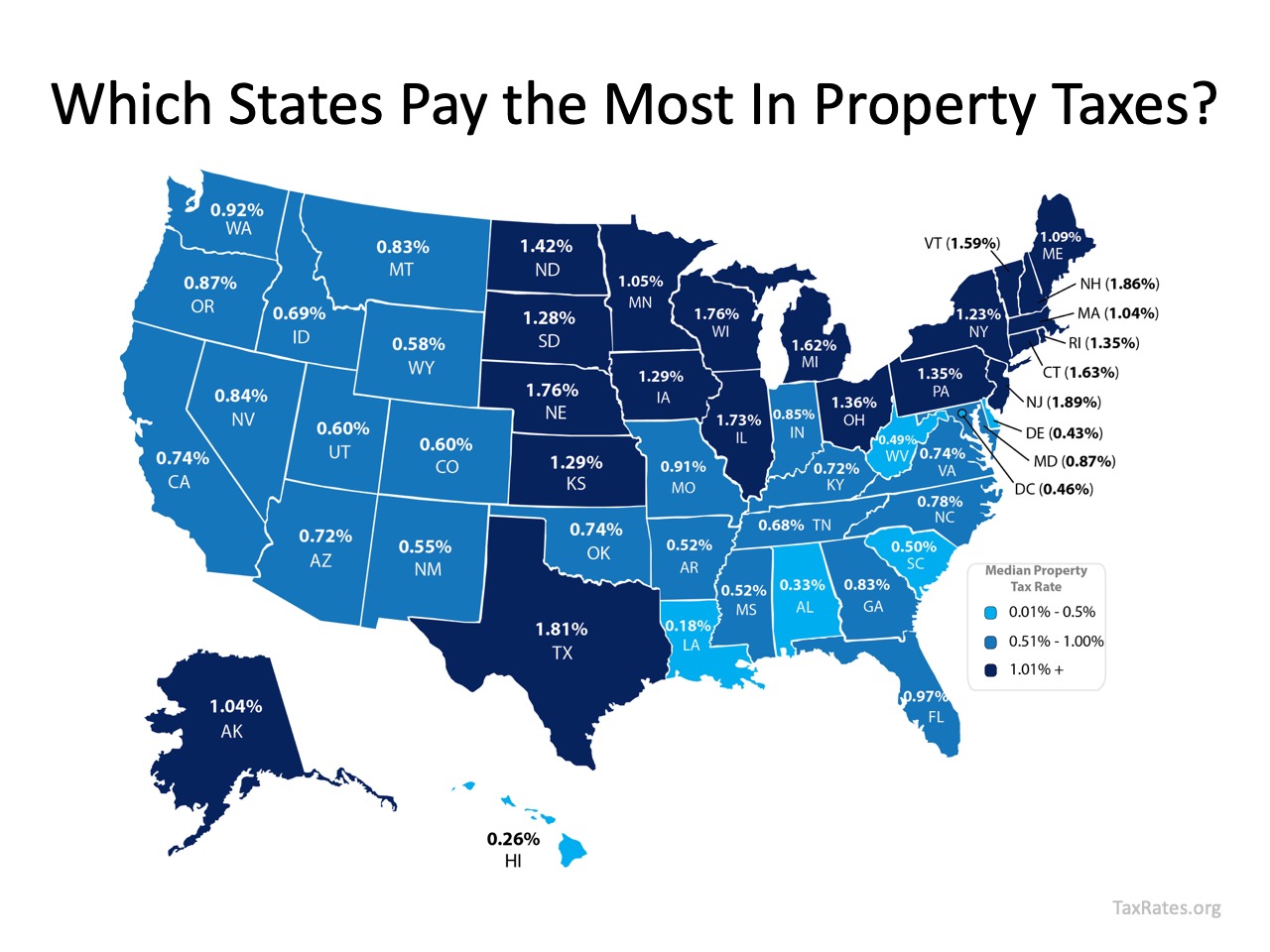

This organization also provides a map showing annual property taxes by state (including the District of Columbia), from lowest to highest, as a percentage of median home value. The top 5 states with the highest median property taxes are New Jersey, New Hampshire, Texas, Nebraska, and Wisconsin. The states with the lowest median property taxes are Louisiana, Hawaii, Alabama, and Delaware, followed by the District of Columbia.

The top 5 states with the highest median property taxes are New Jersey, New Hampshire, Texas, Nebraska, and Wisconsin. The states with the lowest median property taxes are Louisiana, Hawaii, Alabama, and Delaware, followed by the District of Columbia.

Bottom Line

Depending on where you live, property taxes can have a big impact on your monthly payment. To make sure your estimated taxes will fall within your desired budget, let’s get together today to determine how the neighborhood or area you choose can make a difference in your overall costs when buying a home.

To view original article, visit Keeping Current Matters.

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

Most homeowners today are employed and have low-interest mortgages they can afford, so they are able to make payments.

What’s Behind Today’s Mortgage Rate Volatility?

The best way to navigate this landscape is to have a team of real estate experts by your side.

Don’t Let These Two Concerns Hold You Back from Selling Your House

Working with a local real estate agent is the best way to see what inventory trends look like in your area.

More Homes, Slower Price Growth – What It Means for You as a Buyer

Having a real estate agent who knows the local area can be a big advantage when you start the buying process.

What’s Motivating Homeowners To Move Right Now

Selling your home isn’t just about market conditions or mortgage rates—it’s also about making the best decision for your lifestyle and future.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

VA home loans are designed to make homeownership a reality for those who have served our country.

.jpg )