“Here’s the latest data on 3 factors affecting mortgage rates.”

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what’s ahead.

One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t directly control mortgage rates, they do control the Federal Funds Rate.

The relationship between the two is why people have been watching closely to see when the Fed might lower the Federal Funds Rate. Whenever they do, that’ll put downward pressure on mortgage rates. The Fed meets next week, and three of the most important metrics they’ll look at as they make their decision are:

- The Rate of Inflation

- How Many Jobs the Economy Is Adding

- The Unemployment Rate

Here’s the latest data on all three.

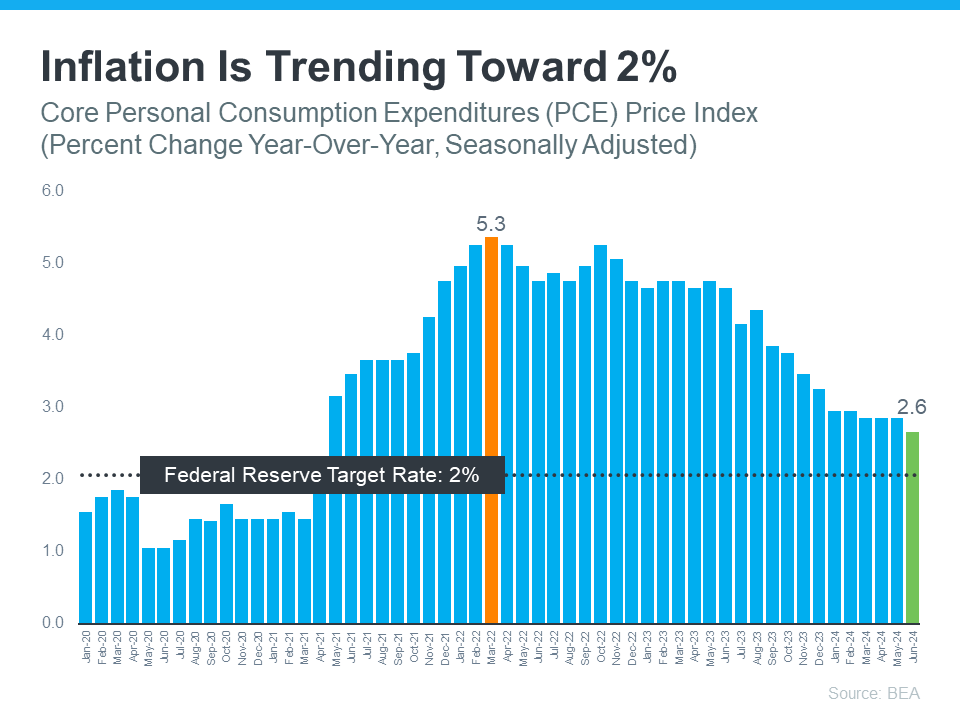

1. The Rate of Inflation

You’ve probably heard a lot about inflation over the past year or two – and you’ve likely felt it whenever you’ve gone to buy just about anything. That’s because high inflation means prices have been going up quickly.

The Fed has stated its goal is to get the rate of inflation back down to 2%. Right now, it’s still higher than that, but moving in the right direction (see graph below):

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding

The Fed is also watching how many new jobs are created each month. They want to see job growth slow down consistently before taking any action on the Federal Funds Rate. If fewer jobs are created, it means the economy is still strong but cooling a bit – which is their goal. That appears to be exactly what’s happening now. Inman says:

“. . . the Bureau of Labor Statistics reported that employers added fewer jobs in April and May than previously thought and that hiring by private companies was sluggish in June.”

So, while employers are still adding jobs, they’re not adding as many as before. That’s an indicator the economy is slowing down after being overheated for quite some time. This is an encouraging trend for the Fed to see.

3. The Unemployment Rate

The unemployment rate is the percentage of people who want to work but can’t find jobs. So, a low rate means a lot of Americans are employed. That’s a good thing for many people.

But it can also lead to higher inflation because more people working means more spending – which drives up prices. Right now, the unemployment rate is low, but it’s been rising slowly over the past few months (see graph below):

What Does This Mean Moving Forward?

While mortgage rates are going to continue to be volatile in the days and months ahead, these are signs the economy is headed in the direction the Fed wants to see. But even with that, it’s unlikely they’ll cut the Federal Funds Rate when they meet next week. Jerome Powell, Chair of the Federal Reserve, recently said:

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

Basically, we’re seeing the first signs now, but they need more data and more time to feel confident that this is a consistent trend. Assuming that direction continues, according to the CME FedWatch Tool, experts say there’s a projected 96.1% chance the Fed will lower the Federal Funds Rate at their September meeting.

Remember, the Fed doesn’t directly set mortgage rates. It’s just that whenever they decide to cut the Federal Funds Rate, mortgage rates should respond.

Of course, the timing of when the Fed takes action could change because of new economic reports, world events, and other factors. That’s why it’s usually not a good idea to try to time the market.

Bottom Line

Recent economic data may signal that hope is on the horizon for mortgage rates. Let’s connect so you have an expert to keep you up to date on the latest trends and what they mean for you.

To view original article, visit Keeping Current Matters.

More Than a House: The Emotional Benefits of Homeownership

Here’s a look at just a few of those more emotional or lifestyle perks, to help anchor you to why homeownership is one of your goals.

The Biggest Mistakes Buyers Are Making Today

There’s one way to avoid getting tripped up – and that’s leaning on a real estate agent for the best possible advice.

How Do Climate Risks Affect Your Next Home?

How can you be sure your investment is safe from the elements? Work with a local real estate agent!

Questions You May Have About Selling Your House

If you’ve been considering selling your house, and have some questions, call us today for some clarity.

Worried about Home Maintenance Costs? Consider This

If you’re worried about home maintenance, here’s some information you may find interesting.

What’s Next for Home Prices and Mortgage Rates?

If you’re ready, willing, and able to afford a home right now, partner with a trusted real estate advisor to decide what’s right for you.

.jpg )