“Here’s the latest data on 3 factors affecting mortgage rates.”

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what’s ahead.

One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t directly control mortgage rates, they do control the Federal Funds Rate.

The relationship between the two is why people have been watching closely to see when the Fed might lower the Federal Funds Rate. Whenever they do, that’ll put downward pressure on mortgage rates. The Fed meets next week, and three of the most important metrics they’ll look at as they make their decision are:

- The Rate of Inflation

- How Many Jobs the Economy Is Adding

- The Unemployment Rate

Here’s the latest data on all three.

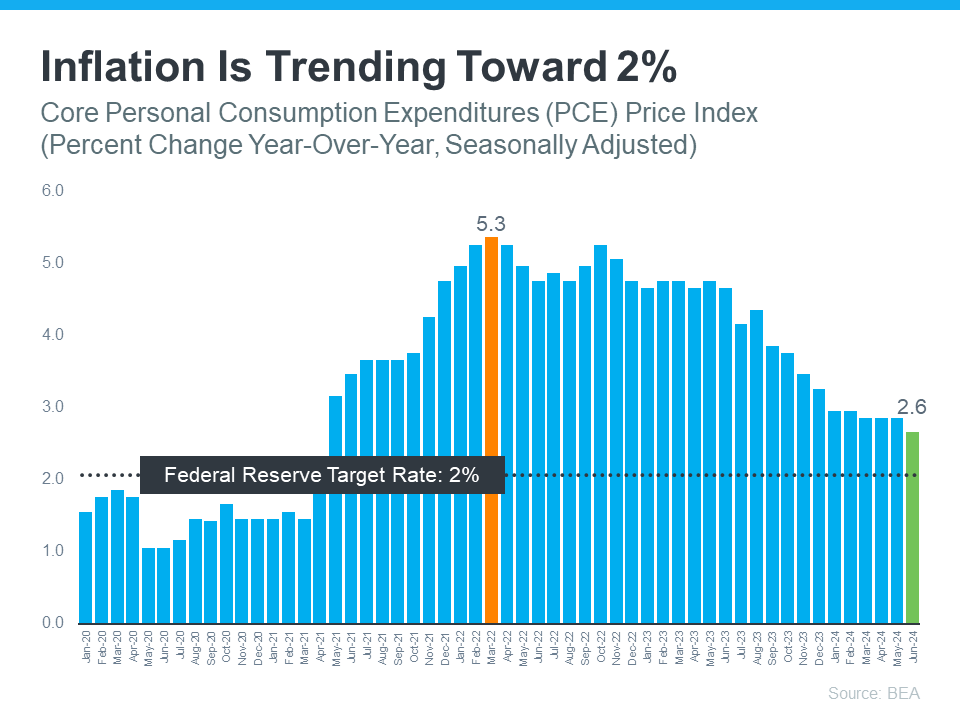

1. The Rate of Inflation

You’ve probably heard a lot about inflation over the past year or two – and you’ve likely felt it whenever you’ve gone to buy just about anything. That’s because high inflation means prices have been going up quickly.

The Fed has stated its goal is to get the rate of inflation back down to 2%. Right now, it’s still higher than that, but moving in the right direction (see graph below):

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding

The Fed is also watching how many new jobs are created each month. They want to see job growth slow down consistently before taking any action on the Federal Funds Rate. If fewer jobs are created, it means the economy is still strong but cooling a bit – which is their goal. That appears to be exactly what’s happening now. Inman says:

“. . . the Bureau of Labor Statistics reported that employers added fewer jobs in April and May than previously thought and that hiring by private companies was sluggish in June.”

So, while employers are still adding jobs, they’re not adding as many as before. That’s an indicator the economy is slowing down after being overheated for quite some time. This is an encouraging trend for the Fed to see.

3. The Unemployment Rate

The unemployment rate is the percentage of people who want to work but can’t find jobs. So, a low rate means a lot of Americans are employed. That’s a good thing for many people.

But it can also lead to higher inflation because more people working means more spending – which drives up prices. Right now, the unemployment rate is low, but it’s been rising slowly over the past few months (see graph below):

What Does This Mean Moving Forward?

While mortgage rates are going to continue to be volatile in the days and months ahead, these are signs the economy is headed in the direction the Fed wants to see. But even with that, it’s unlikely they’ll cut the Federal Funds Rate when they meet next week. Jerome Powell, Chair of the Federal Reserve, recently said:

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

Basically, we’re seeing the first signs now, but they need more data and more time to feel confident that this is a consistent trend. Assuming that direction continues, according to the CME FedWatch Tool, experts say there’s a projected 96.1% chance the Fed will lower the Federal Funds Rate at their September meeting.

Remember, the Fed doesn’t directly set mortgage rates. It’s just that whenever they decide to cut the Federal Funds Rate, mortgage rates should respond.

Of course, the timing of when the Fed takes action could change because of new economic reports, world events, and other factors. That’s why it’s usually not a good idea to try to time the market.

Bottom Line

Recent economic data may signal that hope is on the horizon for mortgage rates. Let’s connect so you have an expert to keep you up to date on the latest trends and what they mean for you.

To view original article, visit Keeping Current Matters.

5 Reasons You Should Sell This Summer

“These buyers are ready, willing and able to purchase.”

Real Estate Mogul: Here’s Why You Should Buy

Real Estate mogul, Sean Conlon, host of The Deed: Chicago on CNBC, was recently asked the question, should you buy? Or should you rent a house? Conlon responded: “I am a true believer that you save every penny and you buy your first house… and that is still the...

Green Matters in Real Estate!

Your clients want to hear more about green real estate and why it matters, surveys show. Whether they're first-time buyers or existing homeowners, consumers are showing more desire to learn more about environmental matters in housing. Indeed, 61 percent of homeowners...

The Importance of Using a Professional to Sell Your Home

When a homeowner decides to sell their house, they obviously want the best possible price for it with the least amount of hassles along the way. However, for the vast majority of sellers, the most important result is actually getting their homes sold. In order to...

Measuring Your Ability to Achieve the American Dream

Forbes.com recently released the results of their new American Dream Index, in which they measure “the prosperity of the middle class, and…examine which states best support the American Dream.” The monthly index measures several different economic factors, including...

US Housing Market Continues the Move into ‘Buy Territory’!

According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment. The BH&J Index is a...

.jpg )