” Let’s dive into why buying a fixer upper could be your ticket to homeownership and how you can make it work.”

Looking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when affordability seems like a huge roadblock – and it might be with a fixer upper. Let’s dive into why buying a fixer upper could be your ticket to homeownership and how you can make it work.

What Is a Fixer Upper?

A fixer upper is a home that’s in livable condition but needs some work. The amount of work varies by home – some may need cosmetic updates like wallpaper removal and new flooring, while others might require more extensive repairs like replacing a roof or updating plumbing.

Because they need some elbow grease, these homes typically have a lower price point, based on local market value. In fact, a survey from StorageCafe explains that fixer uppers generally cost about 29% less than move-in-ready homes.

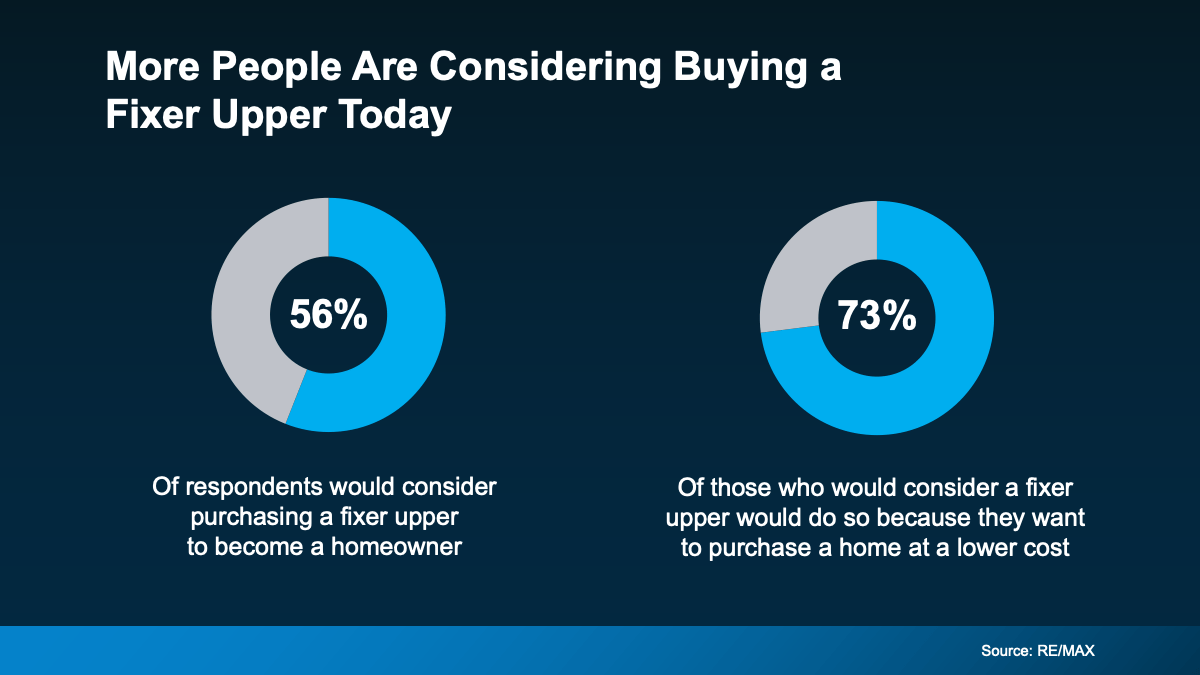

And that’s why, according to a recent survey, more buyers are considering homes that need a little extra work right now (see below):

If you’re looking for an option to get your foot in the door, and you’re willing to roll up your sleeves and do a bit of work, a house with untapped potential may be a good option.

If you’re looking for an option to get your foot in the door, and you’re willing to roll up your sleeves and do a bit of work, a house with untapped potential may be a good option.

Tips for Buying a Home That Needs Some Work

Before you buy a home that may need a makeover, here are a few things to keep in mind:

- Choose a Good Location: You can repair a house, but you can’t change where it is. Make sure the home is in a neighborhood you like or one with increasing property values and a growing number of local amenities. This way, even after you spend money fixing it up, the house will be worth more later.

- Budget for Surprises: Fixing up a house can take more time and money than you might think. Make sure you save room in your budget for unexpected repairs or other unknowns that might come up while you’re working on the house.

- Get a Home Inspection: Before you buy, hire an inspector to check out the house. They’ll help you determine the necessary repairs, so you don’t end up with expensive surprises later.

- Plan Your Priorities: When deciding what to tackle first, it helps to categorize your goals. Think of your home in three ways: the must-haves (essential repairs), the nice-to-haves (upgrades that would make life easier), and the dream-state features (luxuries you can add later). This will help you prioritize and stick to your budget.

Remember, the perfect home is the one you perfect after buying it. By starting with a fixer upper, you have the opportunity to customize a home to your liking while saving money on the initial purchase price. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home.

Real estate agents are great at finding homes with potential. They know the local market and can guide you to homes where smart upgrades can add value. With their help, you’re more likely to find a house that fits your total budget and has room for worthwhile improvements.

Bottom Line

In today’s market, where the cost of homeownership can be intimidating, finding a move-in-ready home that fits your budget can feel like a real challenge. But if you’re open to putting in a little work, you can transform a fixer upper into your ideal home over time. Let’s explore what’s possible and find a place that’ll work for you.

To view original article, visit Keeping Current Matters.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

.jpg )