“Unlike 2008, homeowners have a comfortable level of mortgage debt and are sitting on massive amounts of home equity.”

The housing crisis of the last decade was partially caused by unhealthy levels of mortgage debt. Homeowners were using their homes as ATMs by refinancing and swapping their equity for cash.

When prices started to fall, many homeowners found themselves in a negative equity situation (where their mortgage was higher than the value of their home). As a result, they walked away. This caused prices to fall even further.

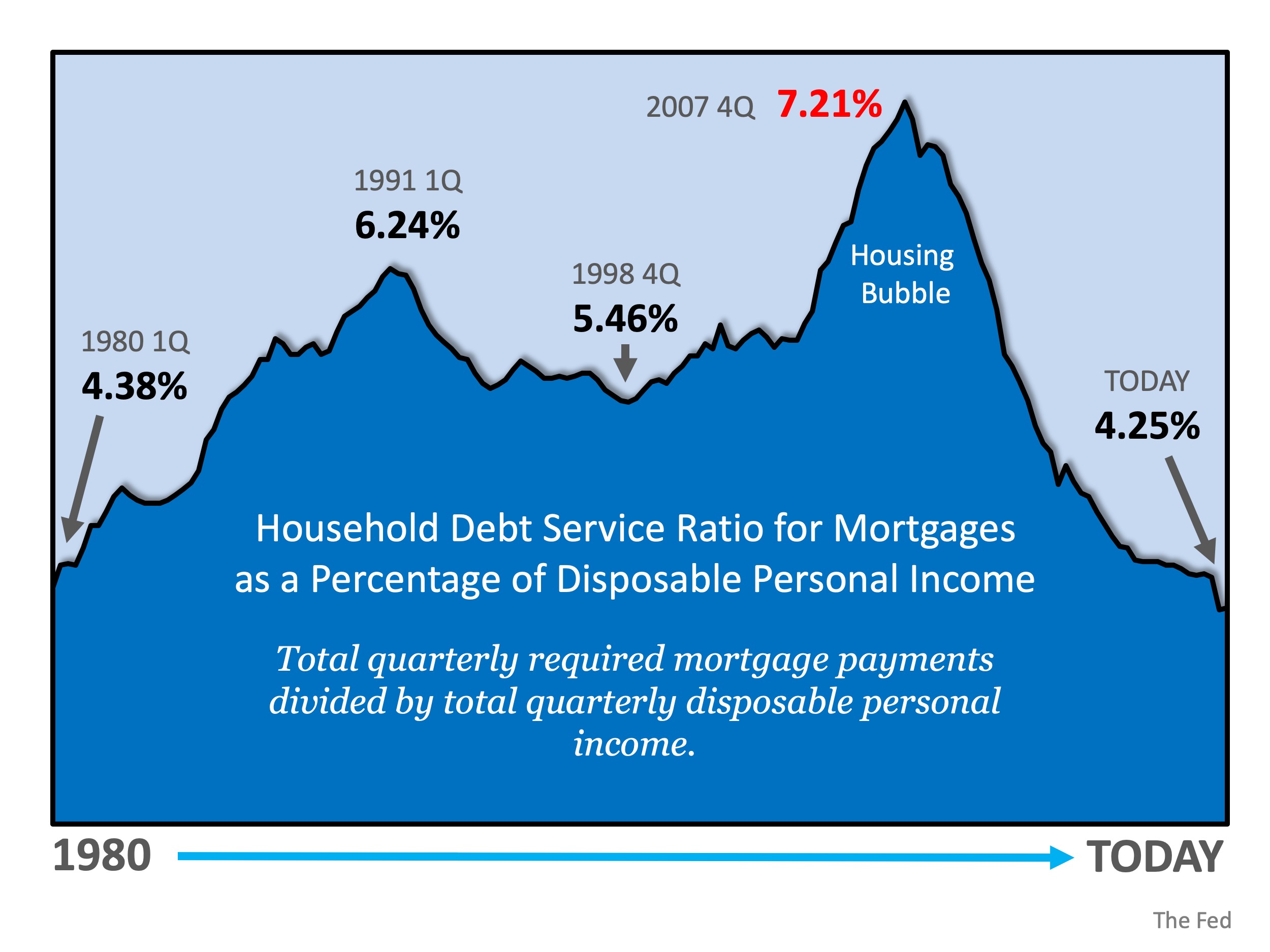

Headlines are again talking about record levels of mortgage debt, making the comparison to the challenges that preceded the housing crash. However, cumulative debt is not an important data point. If we look at the debt as a percentage of disposable personal income, we are at an all-time low.

Here’s a visual representation of mortgage debt as a percent of income: Furthermore, according to a new report from ATTOM Data Solutions, more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains:

Furthermore, according to a new report from ATTOM Data Solutions, more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains:

“[O]ver 14.5 million U.S. properties were equity rich — where the combined estimated amount of loans secured by the property was 50 percent or less of the property’s estimated market value — up by more than 834,000 from a year ago to a new high as far back as data is available, Q4 2013.”

Bottom Line

Unlike 2008, homeowners have a comfortable level of mortgage debt and are sitting on massive amounts of home equity. They will not be walking away from their homes if the housing market begins to soften.

To view original article, visit Keeping Current Matters.

What To Do When Your House Didn’t Sell

If you want an expert’s advice on why your home didn’t sell, rely on a trusted real estate agent.

Do Elections Impact the Housing Market?

While Presidential elections do have some impact on the housing market, the effects are usually small and temporary. For help navigating the market, election year or not, let’s connect.

How Long Will It Take To Sell My House?

You may be wondering how long the whole process is going to take. One way to get your answer? Work with a local real estate agent.

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Here’s what experts say you should expect for home prices, mortgage rates, and home sales.

Why a Vacation Home Is the Ultimate Summer Upgrade

If you’re excited about getting away and having some fun in the sun, it might make sense to own your own vacation home.

What You Need To Know About Today’s Down Payment Programs

If you want more information on down payment programs, the best place to start is by contacting a trusted real estate professional.

.jpg )