“Unlike 2008, homeowners have a comfortable level of mortgage debt and are sitting on massive amounts of home equity.”

The housing crisis of the last decade was partially caused by unhealthy levels of mortgage debt. Homeowners were using their homes as ATMs by refinancing and swapping their equity for cash.

When prices started to fall, many homeowners found themselves in a negative equity situation (where their mortgage was higher than the value of their home). As a result, they walked away. This caused prices to fall even further.

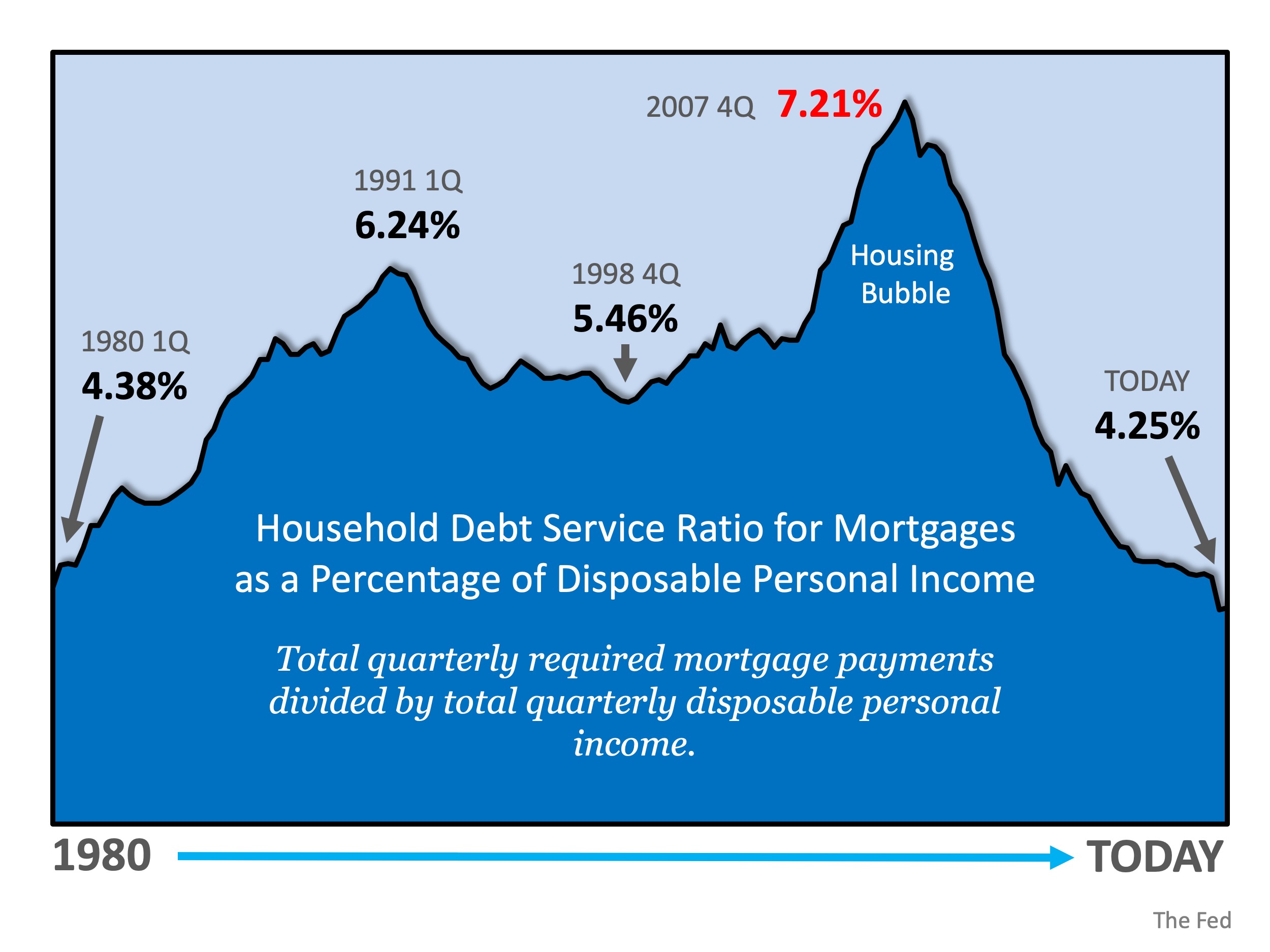

Headlines are again talking about record levels of mortgage debt, making the comparison to the challenges that preceded the housing crash. However, cumulative debt is not an important data point. If we look at the debt as a percentage of disposable personal income, we are at an all-time low.

Here’s a visual representation of mortgage debt as a percent of income: Furthermore, according to a new report from ATTOM Data Solutions, more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains:

Furthermore, according to a new report from ATTOM Data Solutions, more than 1-in-4 homes with a mortgage have at least 50% equity. The report explains:

“[O]ver 14.5 million U.S. properties were equity rich — where the combined estimated amount of loans secured by the property was 50 percent or less of the property’s estimated market value — up by more than 834,000 from a year ago to a new high as far back as data is available, Q4 2013.”

Bottom Line

Unlike 2008, homeowners have a comfortable level of mortgage debt and are sitting on massive amounts of home equity. They will not be walking away from their homes if the housing market begins to soften.

To view original article, visit Keeping Current Matters.

Tips for Younger Homebuyers: How To Make Your Dream a Reality

An agent will help you prioritize your list of home features and find houses that can deliver on the top ones.

Now’s a Great Time To Sell Your House

Late spring and early summer are generally considered the best times to sell a house as these are the seasons most people move and buyer demand grows.

What Is Going on with Mortgage Rates?

Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year.

Is a Multi-Generational Home Right for You?

Looking for the perfect multi-generational home is a bit trickier than finding a regular house. A local real estate agent can help you out.

What More Listings Mean When You Sell Your House

if you’re considering whether or not to list your house, today’s limited supply is one of the biggest advantages you have right now.

What You Really Need To Know About Home Prices

If you’re worried about if home prices will be coming down, here’s what you need to know.

.jpg )