“With rent costs rising annually and many helpful down payment assistance programs available, homeownership may be closer than you realize.”

If you’re currently renting and have dreams of owning your own home, it may be a good time to think about your next move. With rent costs rising annually and many helpful down payment assistance programs available, homeownership may be closer than you realize.

According to the 2018 Bank of America Homebuyer Insights Report, 74% of renters plan on buying within the next 5 years, and 38% are planning to buy within the next 2 years.

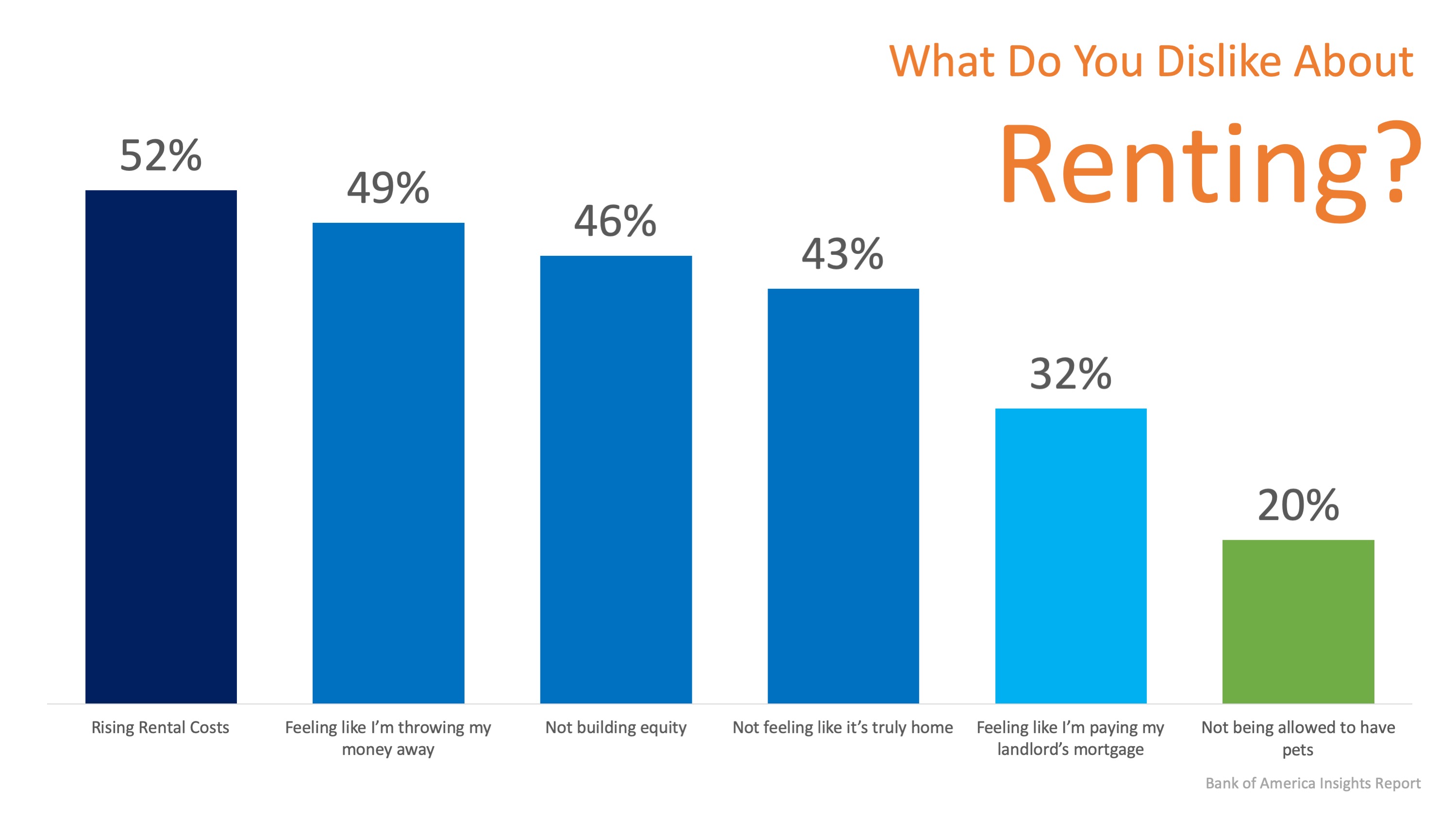

When those same renters were asked why they disliked renting, 52% said rising rental costs were their top reason. The results of the survey can be seen here:It’s no wonder rising rental costs came in as the top answer. The median asking rent price has risen steadily over the last 30 years, as you can see below.

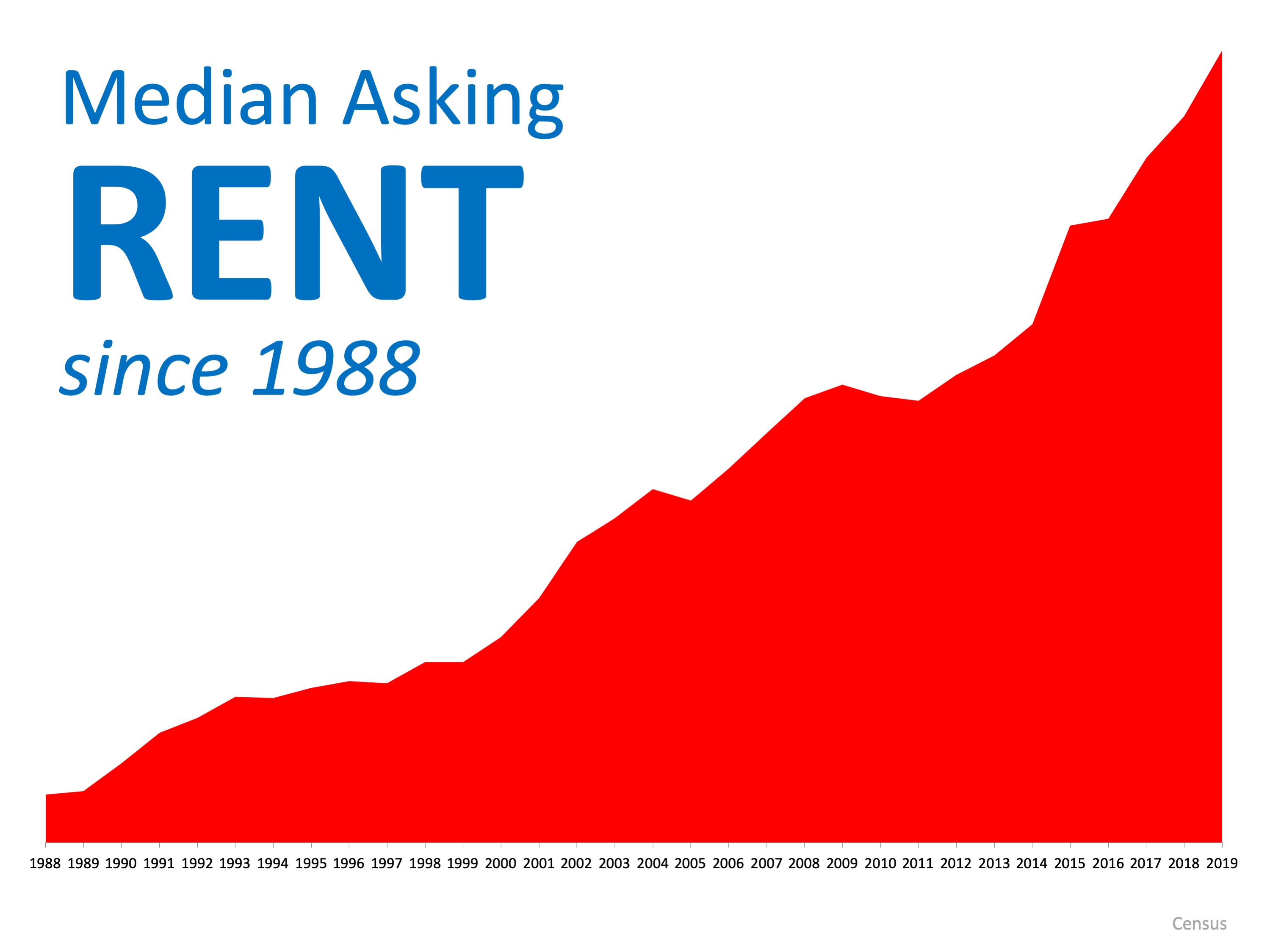

It’s no wonder rising rental costs came in as the top answer. The median asking rent price has risen steadily over the last 30 years, as you can see below. There is a long-standing rule that a household should not spend more than 28% of its income on housing expenses. With nearly half of renters (48%) surveyed already spending more than that, and with their rents likely to rise again, it’s never a bad idea to reconsider your family’s plan and ask yourself if renting is your best angle going forward. When asked why they haven’t purchased a home yet, not having enough saved for a down payment (44%) came in as the top response. The report went on to reveal that nearly half of all respondents believe that “a 20% down payment is required to buy a home.”

There is a long-standing rule that a household should not spend more than 28% of its income on housing expenses. With nearly half of renters (48%) surveyed already spending more than that, and with their rents likely to rise again, it’s never a bad idea to reconsider your family’s plan and ask yourself if renting is your best angle going forward. When asked why they haven’t purchased a home yet, not having enough saved for a down payment (44%) came in as the top response. The report went on to reveal that nearly half of all respondents believe that “a 20% down payment is required to buy a home.”

The reality is, the need to produce a 20% down payment is one of the biggest misconceptions of homeownership, especially for first-time buyers. That means a large number of renters may be able to buy now, and they don’t even know it.

Bottom Line

If you’re one of the many renters who are tired of rising rents but may be confused about what is required to buy in today’s market, let’s get together to determine your path to homeownership.

To view original article, visit Keeping Current Matters.

Why It’s Easy To Fall in Love with Homeownership

Over the last few years, we’ve fully embraced the meaning of our homes as we spent more time than ever in them.

What You Should Know About Closing Costs

Understanding what closing costs include is important, but knowing what you’ll need to budget to cover them is critical, too.

Number of Homes for Sale Up from Last Year, but Below Pre-Pandemic Years

Your house would be welcome in a market that has fewer homes for sale than it did in the years leading up to the pandemic.

How Experts Can Help Close the Gap in Today’s Homeownership Rate

Homeownership is an essential piece for building household wealth that can be passed down to future generations.

The Top Reasons for Selling Your House

If you also find yourself wanting a change in location, needing more space than your current house can provide or feel the need to downsize, it may be time to sell.

Experts Forecast a Turnaround in the Housing Market in 2023

As we move through 2023, there are signs things are finally going to turn around.

.jpg )