“Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?“

If you’re thinking about buying a home, you may find yourself interested in the latest real estate headlines so you can have a pulse on all of the things that could impact your decision. If that’s the case, you’ve probably heard mention of investors, and wondered how they’re impacting the housing market right now. That could leave you asking yourself questions like:

- How many homes do investors own?

- Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

To answer those questions, here’s the real story of what’s happening based on the data.

Let’s start with establishing how many single-family homes (SFHs) there are and what portion of those are rentals owned by investors. According to SFR Investor, which studies the single-family rental market in the United States, there are eighty-two million single-family homes in this country. But how many of them are actually rentals?

According to data shared in a recent post, sixty-eight million (82.93%) of those homes are owner-occupied – meaning the person who owns the home lives in it. If you subtract that sixty-eight million from the total number of single-family homes (82 million), that leaves just about fourteen million homes left that are single-family rentals (SFRs).

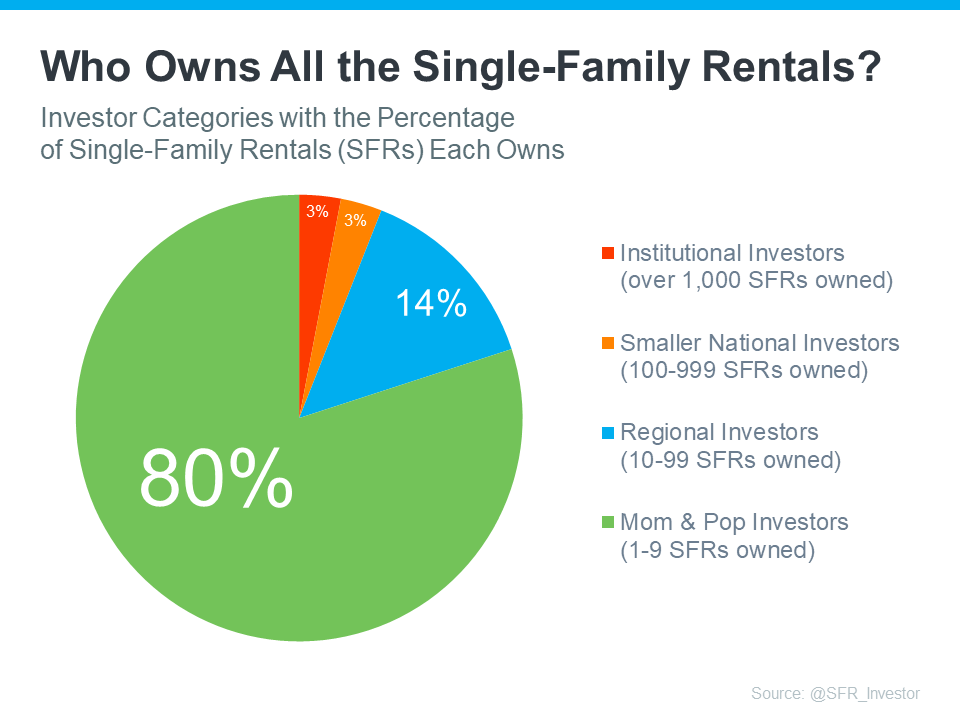

Do institutional investors own all of those remaining fourteen million homes? Not even close. Let’s take it one step further. There are four categories of investors:

- The mom & pop investor who owns between 1-9 SFRs

- The regional investor who owns between 10-99 SFRs

- Smaller national investor who owns between 100-999 SFRs

- The institutional investor who owns over 1,000 SFRs

These categories show that not all investors are large institutional investors. To help convey that even more clearly, here are the percentages of rental homes owned by each type of investor (see chart below):

As you can see in the chart, despite what the news and social media would have you believe, the green shows the vast majority are not owned by large institutional investors. Instead, most are owned by small mom & pop investors, like your friends and neighbors.

What’s actually happening is, that there are people out there, just like you, who believe in homeownership, and they view buying a home (or a second home) as an investment. Maybe they saw an opportunity to buy a second home over the last few years to use it as a rental and generate additional income. Or maybe they just decided to keep their first house rather than sell it when they moved up.

So, don’t believe everything you read or hear about institutional investors. They aren’t buying up all the homes and making it impossible for the average person to buy. That’s just not what the numbers show. Institutional investors are actually the smallest piece of the pie chart.

Bottom Line

While it’s true that institutional investors are a player in the single-family rental marketplace, they’re not buying up all of the houses on the market. If you have other questions about things you’re hearing about the housing market, let’s connect so you have an expert to give you the context you need.

To view original article, visit Keeping Current Matters.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

.jpg )